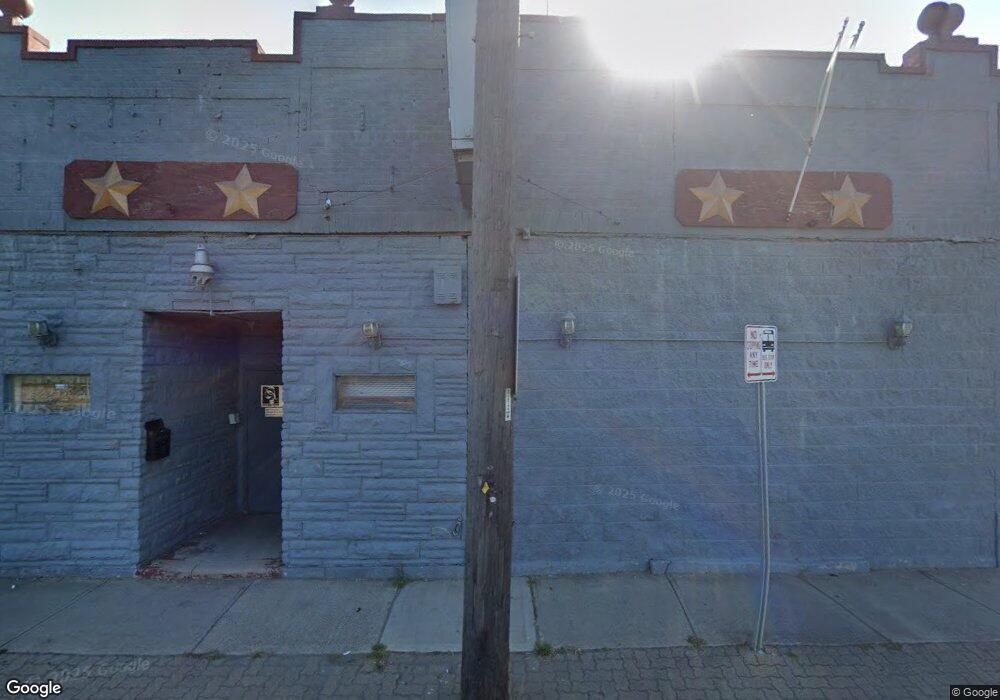

1816 Parsons Ave Columbus, OH 43207

Obetz-Lockbourne NeighborhoodEstimated Value: $87,684

--

Bed

--

Bath

3,520

Sq Ft

$25/Sq Ft

Est. Value

About This Home

This home is located at 1816 Parsons Ave, Columbus, OH 43207 and is currently priced at $87,684, approximately $24 per square foot. 1816 Parsons Ave is a home located in Franklin County with nearby schools including Lincoln Park Elementary School, South High School, and South Columbus Preparatory Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2025

Sold by

1816 Parsons Llc

Bought by

Tack Property Holdings Llc

Current Estimated Value

Purchase Details

Closed on

Aug 18, 2023

Sold by

Equity Trust Co

Bought by

1816 Parsons Llc

Purchase Details

Closed on

Aug 10, 2023

Sold by

Equity Trust Co

Bought by

1816 Parsons Llc

Purchase Details

Closed on

Feb 25, 2021

Sold by

Kac Management Llc

Bought by

Equity Trust Company and 200418440 Ira

Purchase Details

Closed on

May 31, 2019

Sold by

Ewing Glenna Hope and Little Glenna Hope

Bought by

Kac Management Llc

Purchase Details

Closed on

Mar 5, 1997

Sold by

Holland Geraldine O

Bought by

Glenna H Little

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,250

Interest Rate

7.93%

Mortgage Type

Commercial

Purchase Details

Closed on

Apr 2, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tack Property Holdings Llc | $185,000 | Great American Title | |

| 1816 Parsons Llc | $80,000 | Pm Title | |

| 1816 Parsons Llc | $80,000 | Pm Title | |

| Equity Trust Company | $50,000 | Land And Mortgage Title Agcy | |

| Kac Management Llc | $74,000 | Land And Mortgage Title Agcy | |

| Glenna H Little | $65,000 | -- | |

| -- | $15,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Glenna H Little | $55,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,385 | $41,860 | $8,890 | $32,970 |

| 2023 | $3,058 | $41,860 | $8,890 | $32,970 |

| 2022 | $2,455 | $32,730 | $6,510 | $26,220 |

| 2021 | $2,465 | $32,730 | $6,510 | $26,220 |

| 2020 | $2,448 | $32,730 | $6,510 | $26,220 |

| 2019 | $2,451 | $29,760 | $5,920 | $23,840 |

| 2018 | $2,353 | $29,760 | $5,920 | $23,840 |

| 2017 | $2,443 | $29,760 | $5,920 | $23,840 |

| 2016 | $2,438 | $28,010 | $5,920 | $22,090 |

| 2015 | $2,263 | $28,010 | $5,920 | $22,090 |

| 2014 | $2,262 | $28,010 | $5,920 | $22,090 |

| 2013 | $1,121 | $28,000 | $5,915 | $22,085 |

Source: Public Records

Map

Nearby Homes

- 457 E Woodrow Ave Unit 459

- 319 E Barthman Ave

- 292 E Barthman Ave

- 1696 Parsons Ave

- 314 E Woodrow Ave

- 1692 Parsons Ave

- 464 E Hinman Ave

- 472 E Hinman Ave

- 1676 Parsons Ave

- 332 E Hinman Ave

- 524 E Hinman Ave

- 308 Hosack St

- 255 E Woodrow Ave

- 238 E Barthman Ave

- 466 E Morrill Ave

- 480-482 E Morrill Ave

- 1756 Bruck St

- 1657 Ann St

- 495 E Welch Ave

- 386 E Welch Ave

- 1818 Parsons Ave

- 1814 Parsons Ave

- 1800 Parsons Ave

- 442 E Innis Ave Unit 444

- 447 Olpp Ave

- 1809 Parsons Ave

- 448 E Innis Ave Unit 448

- 451 Olpp Ave

- 1793 Parsons Ave

- 1801 Parsons Ave

- 452 E Innis Ave

- 1846 Parsons Ave

- 457 Olpp Ave

- 1793-1795 Parsons Ave Unit 795

- 1793-1795 Parsons Ave

- 458 E Innis Ave

- 459 Olpp Ave

- 1791 Parsons Ave

- 460 E Innis Ave Unit 462

- 460-462 E Innis Ave