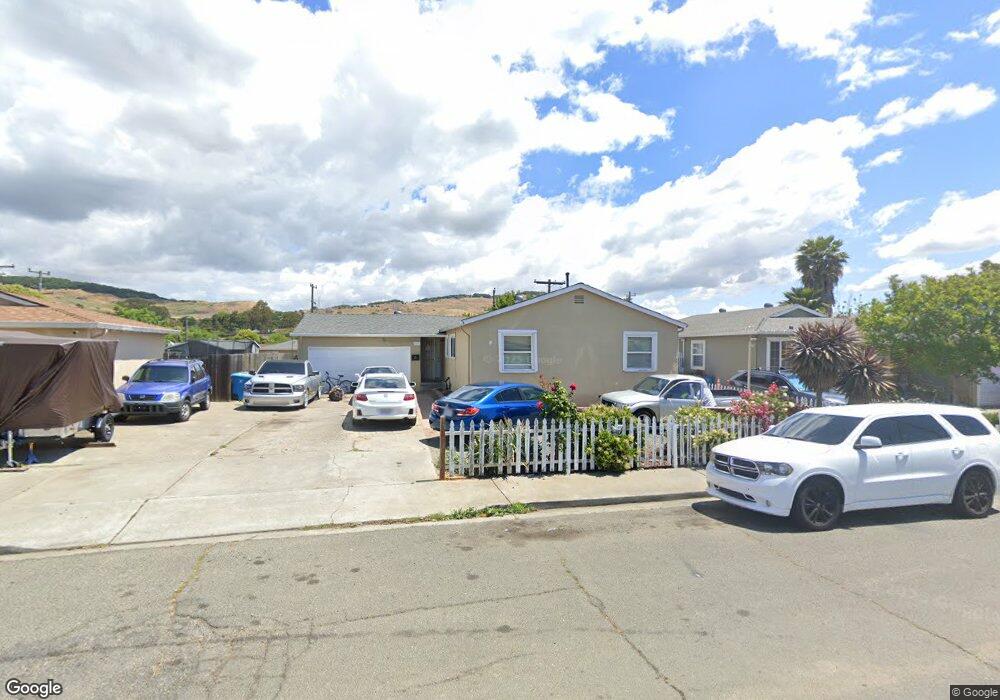

1856 Griffin Dr Vallejo, CA 94589

Country Club Crest NeighborhoodEstimated Value: $335,000 - $462,318

4

Beds

2

Baths

1,181

Sq Ft

$358/Sq Ft

Est. Value

About This Home

This home is located at 1856 Griffin Dr, Vallejo, CA 94589 and is currently estimated at $423,080, approximately $358 per square foot. 1856 Griffin Dr is a home located in Solano County with nearby schools including Elsa Widenmann Elementary, Solano Middle School, and Vallejo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2015

Sold by

Lian Yongtao and Zhong Lan

Bought by

Chung Chung Alumni Association

Current Estimated Value

Purchase Details

Closed on

Apr 10, 2015

Sold by

Fannie Mae

Bought by

Lian Yongtao and Zhong Lan

Purchase Details

Closed on

Apr 22, 2014

Sold by

Davis Rube

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Nov 15, 2006

Sold by

Davis Rube

Bought by

Davis Rube

Purchase Details

Closed on

Sep 11, 2003

Sold by

Davis Rube and Davis Nadine

Bought by

Davis Rube

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,500

Interest Rate

2.8%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 26, 2000

Sold by

Rube Davis

Bought by

Davis Rube and Davis Nadine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,500

Interest Rate

8.11%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chung Chung Alumni Association | $55,000 | None Available | |

| Lian Yongtao | $170,000 | Wfg Title Company | |

| Federal National Mortgage Association | $166,000 | None Available | |

| Davis Rube | -- | None Available | |

| Davis Rube | $57,500 | North American Title Co | |

| Davis Rube | $13,000 | First American |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Davis Rube | $325,500 | |

| Previous Owner | Davis Rube | $112,500 | |

| Closed | Davis Rube | $325,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,409 | $204,307 | $60,088 | $144,219 |

| 2024 | $3,409 | $200,302 | $58,910 | $141,392 |

| 2023 | $3,189 | $196,375 | $57,755 | $138,620 |

| 2022 | $3,087 | $192,525 | $56,624 | $135,901 |

| 2021 | $3,019 | $188,751 | $55,514 | $133,237 |

| 2020 | $3,020 | $186,816 | $54,945 | $131,871 |

| 2019 | $2,918 | $183,154 | $53,868 | $129,286 |

| 2018 | $2,725 | $179,563 | $52,812 | $126,751 |

| 2017 | $2,580 | $176,043 | $51,777 | $124,266 |

| 2016 | $2,011 | $172,592 | $50,762 | $121,830 |

| 2015 | $2,337 | $200,936 | $50,999 | $149,937 |

| 2014 | $948 | $32,341 | $9,169 | $23,172 |

Source: Public Records

Map

Nearby Homes

- 168 Simonton St

- 824 Gateway Dr

- 1990 Griffin Dr

- 330 Sawyer St

- 348 Sawyer St

- 124 Benjamin St

- 191 Cimarron Dr

- 836 Stella St

- 490 Whitney Ave

- 101 Serpentine Dr

- 475 Whitney Ave

- 121 Exposition Dr

- 240 Parkview Terrace

- 1200 Loyola Way

- 0 Antioch Dr

- 355 Parkview Terrace Unit G4

- 355 Parkview Terrace Unit 2

- 355 Parkview Terrace Unit B9

- 355 Parkview Terrace Unit A6

- 337 Whitney Ave