18903 Sun Pass Dr Tomball, TX 77377

Northpointe NeighborhoodEstimated Value: $351,029 - $370,000

4

Beds

3

Baths

2,628

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 18903 Sun Pass Dr, Tomball, TX 77377 and is currently estimated at $362,007, approximately $137 per square foot. 18903 Sun Pass Dr is a home located in Harris County with nearby schools including Canyon Pointe Elementary School, Oakcrest Intermediate School, and Tomball Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 5, 2016

Sold by

Fairport Ventures Llc

Bought by

Mcquiston Triss M

Current Estimated Value

Purchase Details

Closed on

Sep 4, 2015

Sold by

Mcquitston Triss M

Bought by

Fairport Ventures Llc

Purchase Details

Closed on

Aug 20, 2002

Sold by

Foster Steven R

Bought by

Mcquiston Triss M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,600

Interest Rate

4.87%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 31, 2000

Sold by

Royce Homes Lp

Bought by

Foster Steven R and Mcquiston Triss M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,050

Interest Rate

7.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcquiston Triss M | -- | None Available | |

| Fairport Ventures Llc | -- | None Available | |

| Mcquiston Triss M | -- | -- | |

| Foster Steven R | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mcquiston Triss M | $145,600 | |

| Previous Owner | Mcquiston Triss M | $13,500 | |

| Previous Owner | Foster Steven R | $138,050 | |

| Closed | Foster Steven R | $17,258 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,018 | $366,464 | $65,983 | $300,481 |

| 2024 | $6,018 | $339,000 | $65,983 | $273,017 |

| 2023 | $6,018 | $340,000 | $65,983 | $274,017 |

| 2022 | $6,580 | $310,000 | $57,832 | $252,168 |

| 2021 | $6,276 | $215,207 | $42,695 | $172,512 |

| 2020 | $7,217 | $238,291 | $42,695 | $195,596 |

| 2019 | $6,615 | $212,460 | $37,649 | $174,811 |

| 2018 | $2,725 | $203,390 | $30,754 | $172,636 |

| 2017 | $6,199 | $203,390 | $30,754 | $172,636 |

| 2016 | $6,199 | $203,390 | $30,754 | $172,636 |

| 2015 | $5,852 | $203,390 | $30,754 | $172,636 |

| 2014 | $5,852 | $180,545 | $30,754 | $149,791 |

Source: Public Records

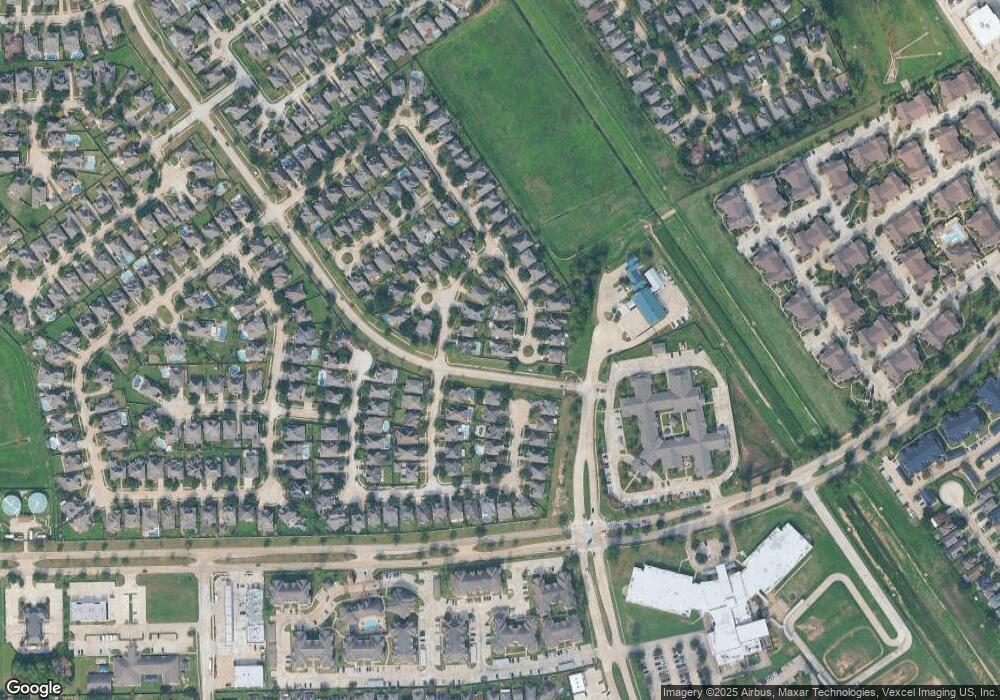

Map

Nearby Homes

- 12006 Canyon Star Ln

- 19010 Canyon Star Ct

- 12022 Canyon Star Ln

- 11711 Canyon Drop Dr

- 19114 Canyon Vista Ct

- 12007 Northpointe Meadows Dr

- 18814 Emery Meadows Ln

- 18314 Westlock St

- 11902 Oakner Dr

- 11831 Westlock Dr

- 18135 Gravenhurst Ln

- 18703 Summercliff Ln

- 12046 Westlock Dr

- 11922 Westwold Dr

- 12242 Westlock Dr

- 19215 Diablo Canyon Ln

- 11934 Westwold Dr

- 12414 Montebello Manor Ln

- 12226 Westwold Dr

- 12107 Westwold Dr

- 18907 Sun Pass Dr

- 11923 Canyon Star Ln

- 11919 Canyon Star Ln

- 18915 Sun Pass Dr

- 11915 Canyon Star Ln

- 12002 Sun Canyon Ct

- 18902 Sun Pass Dr

- 18906 Sun Pass Dr

- 18906R Sun Pass Dr

- 12003 Canyon Star Ln

- 18910 Sun Pass Dr

- 12006 Sun Canyon Ct

- 11903 Canyon Star Ln

- 12003 Sun Canyon Ct

- 12007 Canyon Star Ln

- 18914 Sun Pass Dr

- 19003 Canyon Star Ct

- 12010 Sun Canyon Ct

- 18918 Sun Pass Dr

- 12007 Sun Canyon Ct