Lofts on Post Oak 1901 Post Oak Blvd Unit 3212 Houston, TX 77056

Uptown-Galleria District NeighborhoodEstimated Value: $271,000 - $376,000

1

Bed

1

Bath

1,075

Sq Ft

$280/Sq Ft

Est. Value

About This Home

This home is located at 1901 Post Oak Blvd Unit 3212, Houston, TX 77056 and is currently estimated at $301,065, approximately $280 per square foot. 1901 Post Oak Blvd Unit 3212 is a home located in Harris County with nearby schools including Briargrove Elementary School, Tanglewood Middle, and Wisdom High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 24, 2016

Sold by

Ramineni Naveen and Ramineni Shubhra

Bought by

Gonzalez Oviedo Linna Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,350

Outstanding Balance

$161,457

Interest Rate

3.58%

Mortgage Type

New Conventional

Estimated Equity

$139,608

Purchase Details

Closed on

Apr 15, 2013

Sold by

Ramineni Naveen and Ramineni Shubhra

Bought by

Ramineni Naveen and Ramineni Shubhra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,500

Interest Rate

3.55%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 31, 2008

Sold by

Rivera Miriam V and Rivera Venessa

Bought by

Ramineni Naveen and Ramineni Shubrha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,500

Interest Rate

6.38%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 31, 2006

Sold by

Lopo Lp

Bought by

Rivera Miriam V and Rivera Vanessa

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gonzalez Oviedo Linna Maria | -- | None Available | |

| Ramineni Naveen | -- | None Available | |

| Ramineni Naveen | -- | Etc | |

| Rivera Miriam V | -- | Stewart Title Fort Bend |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gonzalez Oviedo Linna Maria | $203,350 | |

| Previous Owner | Ramineni Naveen | $138,500 | |

| Previous Owner | Ramineni Naveen | $143,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,425 | $288,661 | $54,846 | $233,815 |

| 2024 | $6,425 | $287,389 | $54,604 | $232,785 |

| 2023 | $6,425 | $265,436 | $50,433 | $215,003 |

| 2022 | $6,004 | $255,999 | $48,640 | $207,359 |

| 2021 | $6,334 | $255,999 | $48,640 | $207,359 |

| 2020 | $6,566 | $255,999 | $48,640 | $207,359 |

| 2019 | $6,845 | $255,999 | $48,640 | $207,359 |

| 2018 | $6,845 | $255,999 | $48,640 | $207,359 |

| 2017 | $7,601 | $284,457 | $54,047 | $230,410 |

| 2016 | $7,474 | $279,701 | $59,141 | $220,560 |

| 2015 | $6,729 | $279,701 | $59,141 | $220,560 |

| 2014 | $6,729 | $247,926 | $51,992 | $195,934 |

Source: Public Records

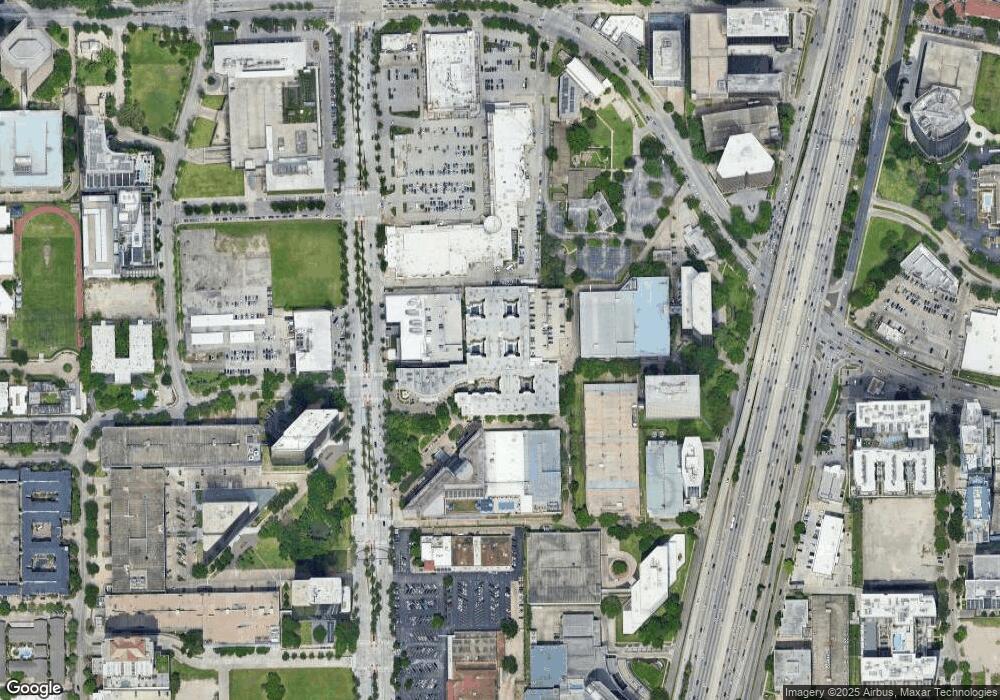

About Lofts on Post Oak

Map

Nearby Homes

- 1901 Post Oak Blvd Unit 2220

- 1901 Post Oak Blvd Unit 104

- 1901 Post Oak Blvd Unit 2219

- 1901 Post Oak Blvd Unit 4303

- 1901 Post Oak Blvd Unit 4605

- 1901 Post Oak Blvd Unit 408

- 1901 Post Oak Blvd Unit 1405

- 1901 Post Oak Blvd Unit 1606

- 1901 Post Oak Blvd Unit 4304

- 1901 Post Oak Blvd Unit 2112

- 1901 Post Oak Blvd Unit 3609

- 1901 Post Oak Blvd Unit 204

- 1901 Post Oak Blvd Unit 4308

- 1901 Post Oak Blvd Unit 306

- 1901 Post Oak Blvd Unit 402

- 1901 Post Oak Blvd Unit 4409

- 1901 Post Oak Blvd Unit 1504

- 1901 Post Oak Blvd Unit 1206

- 1901 Post Oak Blvd Unit 1601

- 1901 Post Oak Blvd Unit 3607

- 1901 Post Oak Blvd Unit 2109

- 1901 Post Oak Blvd Unit 1207

- 1901 Post Oak Blvd Unit 3203

- 1901 Post Oak Blvd Unit 4220

- 1901 Post Oak Blvd Unit 3604

- 1901 Post Oak Blvd Unit 3605

- 1901 Post Oak Blvd Unit 2211

- 1901 Post Oak Blvd Unit 2304

- 1901 Post Oak Blvd Unit 2103

- 1901 Post Oak Blvd Unit 4103

- 1901 Post Oak Blvd Unit 1302

- 1901 Post Oak Blvd Unit 3307

- 1901 Post Oak Blvd Unit 703

- 1901 Post Oak Blvd Unit 1408

- 1901 Post Oak Blvd Unit 405

- 1901 Post Oak Blvd Unit 1602

- 1901 Post Oak Blvd Unit 308

- 1901 Post Oak Blvd Unit 3407

- 1901 Post Oak Blvd Unit 3111

- 1901 Post Oak Blvd Unit 3219