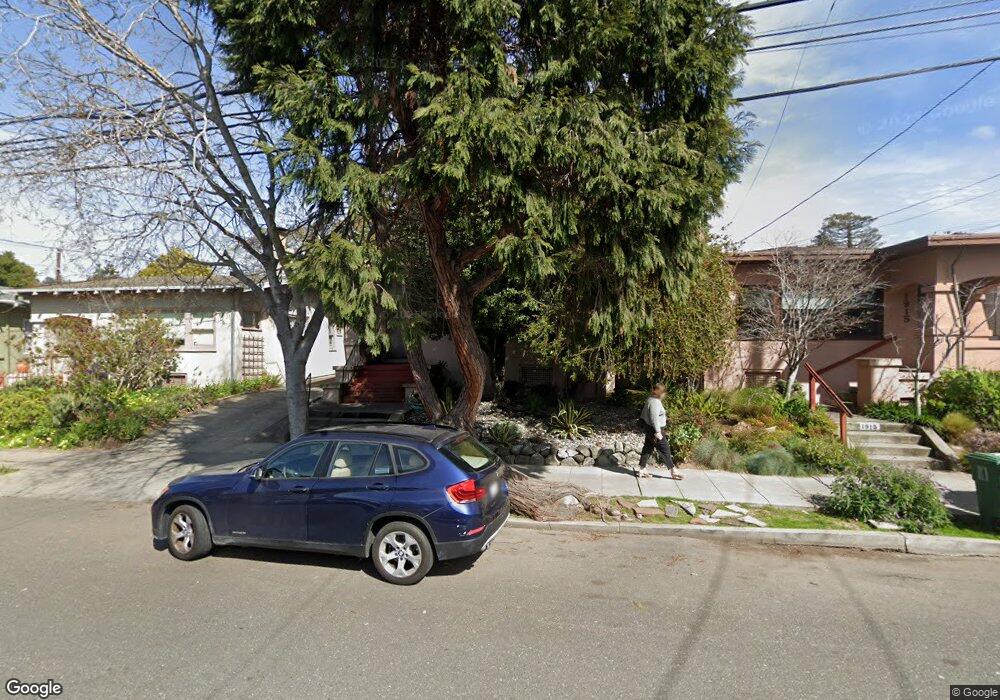

1909 Grant St Berkeley, CA 94703

Downtown Berkeley NeighborhoodEstimated Value: $1,229,354 - $1,748,000

2

Beds

1

Bath

1,790

Sq Ft

$820/Sq Ft

Est. Value

About This Home

This home is located at 1909 Grant St, Berkeley, CA 94703 and is currently estimated at $1,467,839, approximately $820 per square foot. 1909 Grant St is a home located in Alameda County with nearby schools including Berkeley Arts Magnet at Whittier School, Washington Elementary School, and Oxford Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 4, 2019

Sold by

Woodson Letitia Y and The Letitia Y Woodson Living T

Bought by

Woodson Letitia Y and The Letitia Y Woodson Living T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,680,000

Outstanding Balance

$1,480,046

Interest Rate

4.7%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Estimated Equity

-$12,207

Purchase Details

Closed on

Nov 6, 2014

Sold by

Woodson Letitia W and Letitia Y Woodson Living Trust

Bought by

Woodson Letitia Y and Letitia Y Woodson Living Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$938,250

Interest Rate

2.53%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Purchase Details

Closed on

May 23, 2012

Sold by

Kami Barry T and Kami Cathy Jo

Bought by

Kami Barry G and Kami Cathy Jo

Purchase Details

Closed on

Mar 28, 1994

Sold by

Woodson Letitia Y

Bought by

Woodson Letitia W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Woodson Letitia Y | -- | Fnc Title Services Llc | |

| Woodson Letitia Y | -- | None Available | |

| Kami Barry G | -- | None Available | |

| Woodson Letitia W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Woodson Letitia Y | $1,680,000 | |

| Closed | Woodson Letitia Y | $938,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,116 | $76,382 | $35,050 | $48,332 |

| 2024 | $5,116 | $74,747 | $34,363 | $47,384 |

| 2023 | $4,925 | $80,144 | $33,689 | $46,455 |

| 2022 | $5,002 | $71,573 | $33,029 | $45,544 |

| 2021 | $4,358 | $70,032 | $32,381 | $44,651 |

| 2020 | $3,979 | $76,242 | $32,049 | $44,193 |

| 2019 | $3,652 | $74,748 | $31,421 | $43,327 |

| 2018 | $3,535 | $73,283 | $30,805 | $42,478 |

| 2017 | $3,378 | $71,846 | $30,201 | $41,645 |

| 2016 | $3,137 | $70,437 | $29,609 | $40,828 |

| 2015 | $3,068 | $69,379 | $29,164 | $40,215 |

| 2014 | $2,986 | $68,020 | $28,593 | $39,427 |

Source: Public Records

Map

Nearby Homes

- 2218 -2222 Grant St

- 1929 California St

- 1609 Bonita Ave Unit 3

- 1609 Bonita Ave Unit 5

- 1813 Sacramento St

- 2118 California St

- 2221 McGee Ave

- 1482 Lincoln St

- 1564 Sacramento St

- 1682 Oxford St

- 2201 Virginia St Unit 2

- 1444 Walnut St

- 2304 Edwards St

- 1322 Virginia St

- 1372 Henry St

- 2340 Virginia St

- 2533 Grant St

- 2451 Le Conte Ave

- 1901 Parker St Unit 3

- 1919 Curtis St

- 1907 Grant St

- 1915 Grant St

- 1905 Grant St

- 1917 Grant St

- 1811 Berkeley Way

- 1810 Hearst Ave

- 1901 Grant St

- 1919 Grant St

- 1813 Berkeley Way

- 1906 Grant St

- 1815 Berkeley Way

- 1904 Grant St

- 1817 Berkeley Way

- 1818 Hearst Ave

- 1736 Hearst Ave

- 1927 Grant St

- 1929 Grant St

- 1820 Hearst Ave Unit C

- 1820 Hearst Ave Unit A

- 1734 Hearst Ave Unit 2