1922 Winterport Cluster Reston, VA 20191

Estimated Value: $705,000 - $751,931

4

Beds

4

Baths

1,677

Sq Ft

$436/Sq Ft

Est. Value

About This Home

This home is located at 1922 Winterport Cluster, Reston, VA 20191 and is currently estimated at $731,233, approximately $436 per square foot. 1922 Winterport Cluster is a home located in Fairfax County with nearby schools including Sunrise Valley Elementary, South Lakes High School, and Sunset Hills Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2024

Sold by

Leslie M Rollins Trust and Rollins Leslie M

Bought by

Wolak Anthony P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$584,000

Outstanding Balance

$577,065

Interest Rate

7.02%

Mortgage Type

New Conventional

Estimated Equity

$154,168

Purchase Details

Closed on

Mar 28, 2017

Sold by

Rollins Leslie M

Bought by

Leslie M Rollins Trustee Under The Lesli

Purchase Details

Closed on

May 4, 1998

Sold by

Beged Dov Yael and Beged Dov Gabriel B

Bought by

Rollins Theodore A and Rollins Leslie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,400

Interest Rate

7.04%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wolak Anthony P | $730,000 | Chicago Title | |

| Leslie M Rollins Trustee Under The Lesli | -- | None Available | |

| Rollins Theodore A | $189,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wolak Anthony P | $584,000 | |

| Previous Owner | Rollins Theodore A | $142,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,235 | $652,680 | $165,000 | $487,680 |

| 2024 | $7,235 | $600,200 | $165,000 | $435,200 |

| 2023 | $6,821 | $580,230 | $165,000 | $415,230 |

| 2022 | $6,709 | $563,530 | $155,000 | $408,530 |

| 2021 | $6,289 | $515,260 | $150,000 | $365,260 |

| 2020 | $5,983 | $486,210 | $135,000 | $351,210 |

| 2019 | $5,817 | $472,700 | $135,000 | $337,700 |

| 2018 | $5,090 | $442,620 | $121,000 | $321,620 |

| 2017 | $5,020 | $415,580 | $115,000 | $300,580 |

| 2016 | $5,010 | $415,580 | $115,000 | $300,580 |

| 2015 | $4,833 | $415,580 | $115,000 | $300,580 |

| 2014 | $4,663 | $401,830 | $110,000 | $291,830 |

Source: Public Records

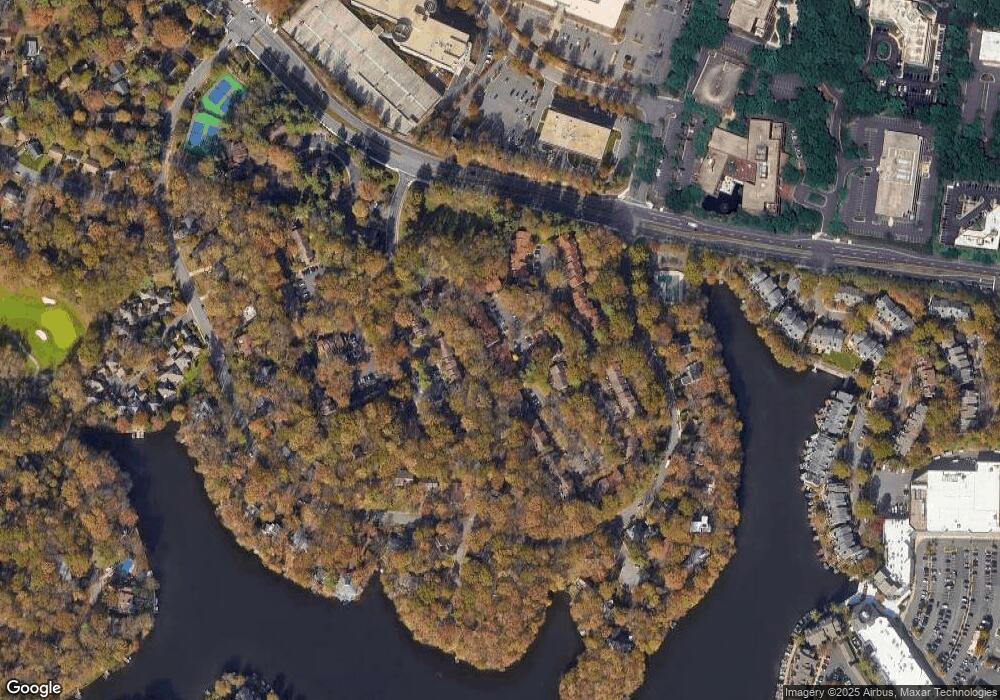

Map

Nearby Homes

- 2060 Headlands Cir

- 1933 Lakeport Way

- 11428 Purple Beech Dr

- 11110 Lakespray Way

- 1950 Weybridge Ln

- 1951 Sagewood Ln Unit 226

- 1951 Sagewood Ln Unit 315

- 2037 Wethersfield Ct

- 11184 Silentwood Ln

- 2029 Wethersfield Ct

- 2031 Beacon Place

- 2180 Whisperwood Glen Ln

- 2045 Winged Foot Ct

- 1820 Reston Row Plaza Unit 1604

- 11142 Beaver Trail Ct

- 11116 Beaver Trail Ct Unit 11116

- 2025 Winged Foot Ct

- 2152 Glencourse Ln

- 11604 Ivystone Ct Unit 6

- 2118 Green Watch Way Unit 10/201C

- 1922 Winterport Cluster

- 1924 Winterport Cluster

- 1920 Winterport Cluster

- 1926 Winterport Cluster

- 1918 Winterport Cluster

- 1928 Winterport Cluster

- 1928 Winterport Cluster

- 1916 Winterport Cluster

- 1916 Winterport Cluster

- 1930 Winterport Cluster

- 1930 Winterport Cluster

- 1930 Winterport Cluster

- 1914 Winterport Cluster

- 1914 Winterport Cluster

- 1912 Winterport Cluster

- 1912 Winterport Cluster

- 1912 Winterport Cluster

- 1910 Winterport Cluster

- 1910 Winterport Cluster

- 1910 Winterport Cluster