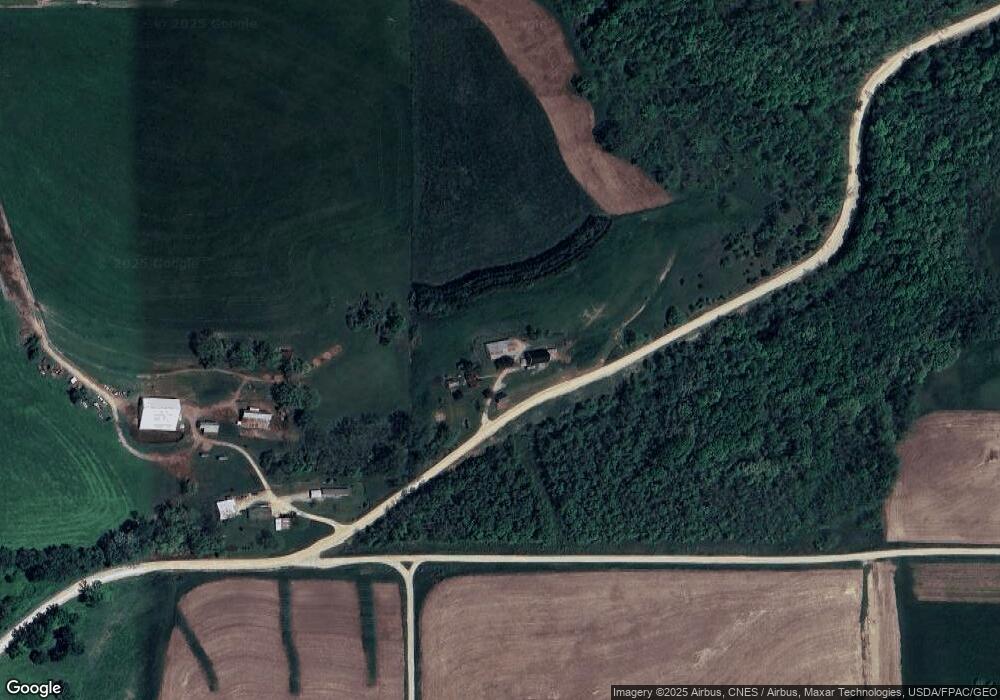

19220 County 11 Spring Grove, MN 55974

Estimated Value: $444,000

3

Beds

1

Bath

1,235

Sq Ft

$360/Sq Ft

Est. Value

About This Home

This home is located at 19220 County 11, Spring Grove, MN 55974 and is currently estimated at $444,000, approximately $359 per square foot. 19220 County 11 is a home located in Houston County with nearby schools including Spring Grove Elementary School and Spring Grove Secondary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 2022

Sold by

Holte Ronnie D and Holte Tammy

Bought by

Erickson John A

Current Estimated Value

Purchase Details

Closed on

Apr 8, 2022

Sold by

Bratland and Gary

Bought by

Holte Ronnie D and Holte Tammy

Purchase Details

Closed on

Mar 4, 2013

Sold by

Staven Herbert C and Staven Mardelle

Bought by

Bratland Nancy and Bratland Gary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

3.5%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Apr 20, 2004

Sold by

Staven Herbert and Staven Mardelle

Bought by

Bratland Nancy and Bratland Gary

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Erickson John A | $150,000 | -- | |

| Holte Ronnie D | $340,000 | None Listed On Document | |

| Bratland Nancy | $75,000 | None Available | |

| Bratland Nancy | $75,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bratland Nancy | $30,000 | |

| Closed | Bratland Nancy | $0 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,012 | $411,600 | $411,600 | $0 |

| 2024 | $956 | $335,500 | $335,500 | $0 |

| 2023 | $798 | $311,900 | $311,900 | $0 |

| 2022 | $3,478 | $404,400 | $344,800 | $59,600 |

| 2021 | $3,488 | $384,200 | $322,600 | $61,600 |

| 2020 | $3,324 | $384,200 | $322,600 | $61,600 |

| 2019 | $3,522 | $369,600 | $303,600 | $66,000 |

| 2018 | $3,512 | $376,800 | $305,000 | $71,800 |

| 2017 | $3,512 | $327,200 | $255,400 | $71,800 |

| 2016 | $2,396 | $366,300 | $294,500 | $71,800 |

| 2015 | $2,090 | $373,000 | $301,200 | $71,800 |

| 2014 | $2,090 | $290,700 | $230,585 | $60,115 |

Source: Public Records

Map

Nearby Homes

- tbd Sayles Rd

- Xxx Sayles Rd

- xxx E Twin Ridge Rd

- 14327 County 1

- TBD Cty 13

- 420 3rd Ave NW

- 106 N Mcphail Ave

- 170 1st St SW

- 137 3rd Ave SE

- 126 Bissen St

- Tbd County Road 13

- 707 N Hokah St

- 147 4th Ave SE

- 524 N Kingston St

- 118 W Grove St

- 115 E Main St

- 111 E Grove St

- 107 E Sunnyside Dr

- 501 S Jefferson St

- 309 N Badger St

- 19290 County 11

- XXX County Rd 11

- 18744 Pellowski Dr

- 18914 Pellowski Dr

- 19563 County 11

- 19513 County 11

- 1 Norgard Dr

- 18987 Pellowski Dr

- 18989 Pellowski Dr

- 12407 W Twin Ridge Rd

- 12225 E Twin Ridge Rd

- 000 County 11

- 000 T-179

- 13741 Pheasant Rd

- 19747 Red Tail Dr

- 19206 Red Tail Dr

- 18437 Pellowski Dr

- 19843 County 11