1926 Ojeman Rd Houston, TX 77080

Spring Branch Central NeighborhoodEstimated payment $4,437/month

Total Views

1,088

0.49

Acre

$1,438,258

Price per Acre

21,201

Sq Ft Lot

About This Lot

Open lot with some vegetation including trees. The previous structures were torn down.

Property Details

Property Type

- Land

Est. Annual Taxes

- $6,764

Lot Details

- 0.49 Acre Lot

- Partially Wooded Lot

- May Be Possible The Lot Can Be Split Into 2+ Parcels

Schools

- Cedar Brook Elementary School

- Spring Woods Middle School

- Northbrook High School

Community Details

- Wright Loan & Sec Co Wm Trott Subdivision

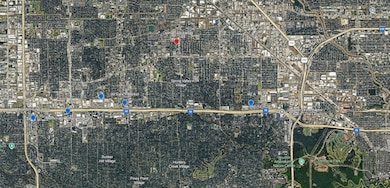

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $351,847 | $254,400 | $97,447 |

| 2023 | $4,822 | $351,847 | $254,400 | $97,447 |

| 2022 | $4,785 | $196,277 | $127,200 | $69,077 |

| 2021 | $4,386 | $179,650 | $127,200 | $52,450 |

| 2020 | $4,681 | $179,650 | $127,200 | $52,450 |

| 2019 | $4,883 | $179,650 | $127,200 | $52,450 |

| 2018 | $0 | $179,650 | $127,200 | $52,450 |

| 2017 | $4,648 | $179,650 | $127,200 | $52,450 |

| 2016 | $4,225 | $179,650 | $127,200 | $52,450 |

| 2015 | $169 | $179,650 | $127,200 | $52,450 |

| 2014 | $169 | $133,481 | $84,800 | $48,681 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 07/01/2025 07/01/25 | Price Changed | $700,000 | -12.5% | -- |

| 06/02/2025 06/02/25 | For Sale | $800,000 | -- | -- |

Source: Houston Association of REALTORS®

Source: Houston Association of REALTORS®

MLS Number: 73042006

APN: 0450700010010

Nearby Homes

- 1918 Ojeman Rd

- 1921 Ojeman Rd

- 1919 Ojeman Rd

- 1953 Coulcrest Dr

- 8545 Ridgepoint Dr

- 8550 Ridgepoint Dr

- 8546 Western Dr

- 8812 Hollister Pine Ct

- 8518 Montridge Dr

- 8514 Montridge Dr

- 8510 Montridge Dr

- 8527 Ridgepoint Dr

- 8506 Montridge Dr

- 2030 Marnel Rd

- 1905 Norcrest Dr

- 2315 Hollister St

- 8514 Highcrest Dr

- 2050 Marnel Rd

- 1747 Ojeman Spring Ln

- 1740 Ojeman Point Ln

- 1947 Ojeman Rd Unit 2

- 1947 Ojeman Rd Unit 5

- 8809 Ashbloom Ln

- 1905 Coulcrest Dr

- 8832 Ashbloom Ln

- 8821 Hollister Pine Ct

- 8840 Ashbloom Ln

- 1846 Hollister St Unit 6

- 8515 Hammerly Blvd

- 8787 Hammerly Blvd

- 8787 Hammerly Blvd Unit 120

- 8787 Hammerly Blvd Unit 1421

- 1740 Ojeman Point Ln

- 8791 Hammerly Blvd

- 2109 Marnel Rd Unit H

- 2109 Marnel Rd Unit G

- 2109 Marnel Rd Unit B

- 2109 Marnel Rd Unit A

- 1751 Moritz Dr

- 1915 Huntly Chase Dr