1983 Keltic Lodge Dr Oxnard, CA 93036

West Outer Oxnard NeighborhoodEstimated Value: $1,105,000 - $1,241,305

4

Beds

3

Baths

2,683

Sq Ft

$428/Sq Ft

Est. Value

About This Home

This home is located at 1983 Keltic Lodge Dr, Oxnard, CA 93036 and is currently estimated at $1,148,576, approximately $428 per square foot. 1983 Keltic Lodge Dr is a home located in Ventura County with nearby schools including Thurgood Marshall Elementary School, Oxnard High School, and Our Redeemer's Nursery School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 9, 2009

Sold by

The Bank Of New York

Bought by

Bisch Dietmar and Bratko Dorota

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

4.58%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 12, 2009

Sold by

Nichols Chad and Nichols Jaimene

Bought by

The Bank Of New York

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

4.58%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 12, 2003

Sold by

Wph Oxnard Coastal Llc

Bought by

Nichols Chad and Nichols Jaimene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Interest Rate

5.93%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bisch Dietmar | $505,000 | Landsafe Title | |

| The Bank Of New York | $410,500 | Landsafe Title | |

| Nichols Chad | $484,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Bisch Dietmar | $150,000 | |

| Previous Owner | Nichols Chad | $320,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,891 | $650,296 | $325,149 | $325,147 |

| 2024 | $7,891 | $637,546 | $318,774 | $318,772 |

| 2023 | $7,603 | $625,046 | $312,524 | $312,522 |

| 2022 | $7,374 | $612,791 | $306,396 | $306,395 |

| 2021 | $7,315 | $600,776 | $300,388 | $300,388 |

| 2020 | $7,452 | $594,618 | $297,309 | $297,309 |

| 2019 | $7,242 | $582,960 | $291,480 | $291,480 |

| 2018 | $7,140 | $571,530 | $285,765 | $285,765 |

| 2017 | $6,776 | $560,324 | $280,162 | $280,162 |

| 2016 | $6,648 | $549,338 | $274,669 | $274,669 |

| 2015 | $6,926 | $541,090 | $270,545 | $270,545 |

| 2014 | $6,853 | $530,494 | $265,247 | $265,247 |

Source: Public Records

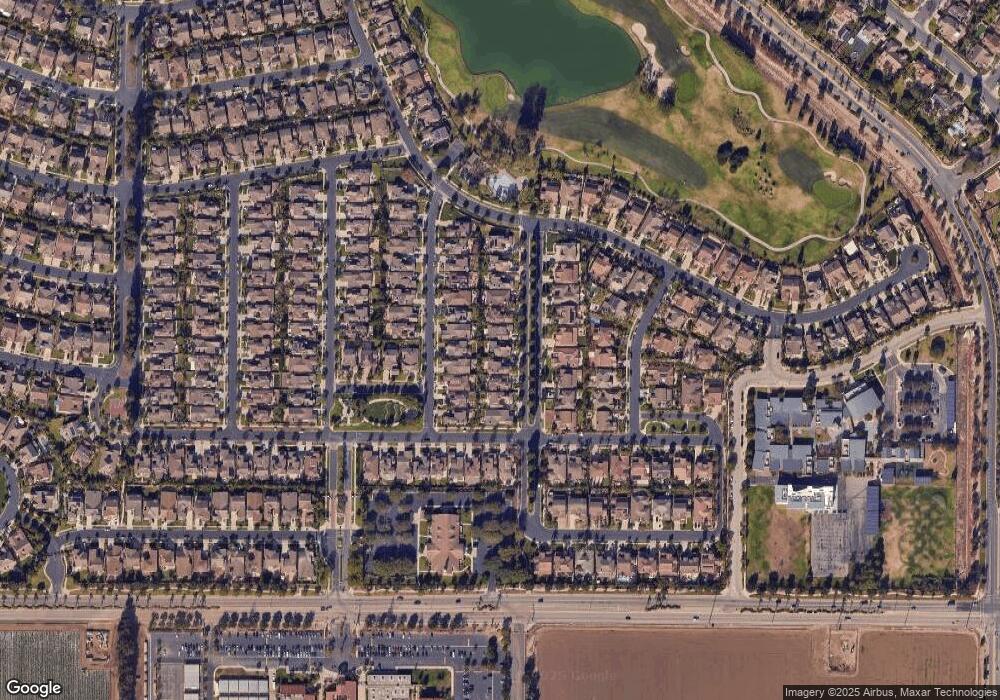

Map

Nearby Homes

- 2056 Mission Hills Dr

- 3325 Eagle Bend Ln

- 1979 Newcastle Dr

- 2310 Crown Point Ct

- 2134 Cold Stream Ct

- 1420 Joliet Place

- 1721 Joanne Way

- 2151 Olga St

- 2100 Norma St

- 1510 Holly Ave

- 670 Joliet Place

- 1440 Ivywood Dr

- 1300 Bluebell St

- 1131 Janetwood Dr

- 1000 Camellia St

- 905 Kumquat Place

- 1127 Douglas Ave

- 1920 N H St Unit 235

- 1920 N H St Unit 251

- 462 N M St

- 2003 Keltic Lodge Dr

- 1973 Keltic Lodge Dr

- 2013 Keltic Lodge Dr

- 1963 Keltic Lodge Dr

- 1984 Long Cove Dr

- 2004 Long Cove Dr

- 1974 Long Cove Dr

- 2023 Keltic Lodge Dr

- 1964 Long Cove Dr

- 2014 Long Cove Dr

- 1954 Long Cove Dr

- 2024 Long Cove Dr

- 2033 Keltic Lodge Dr

- 1972 Keltic Lodge Dr

- 1943 Keltic Lodge Dr

- 2002 Keltic Lodge Dr

- 1962 Keltic Lodge Dr

- 2012 Keltic Lodge Dr

- 2035 Long Cove

Your Personal Tour Guide

Ask me questions while you tour the home.