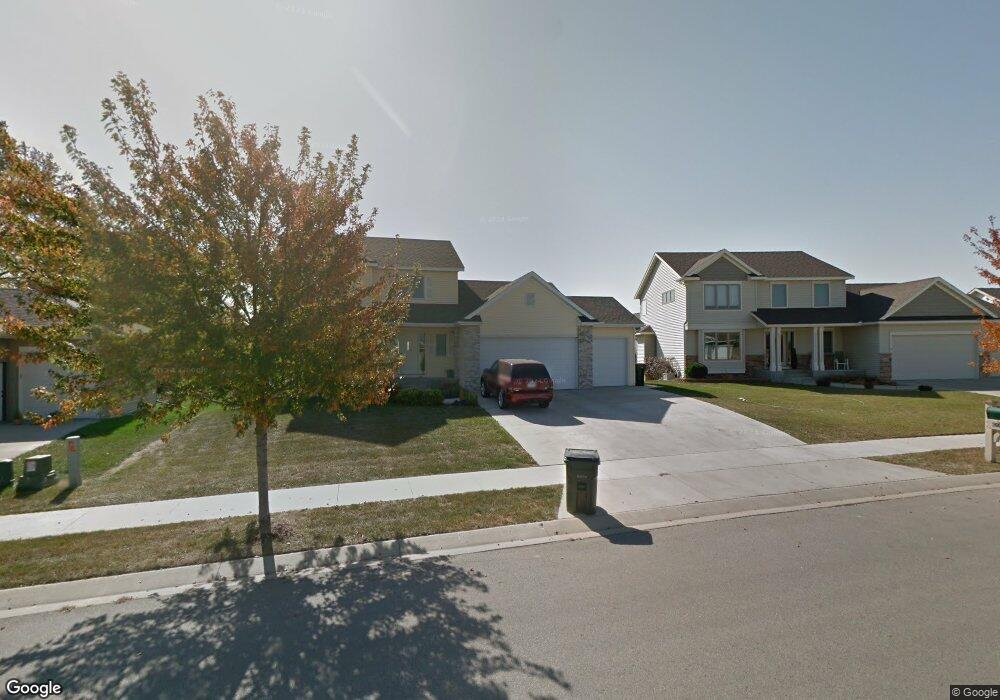

2006 Fieldstone Rd SW Rochester, MN 55902

Hart Farms NeighborhoodEstimated Value: $512,000 - $601,000

4

Beds

4

Baths

2,828

Sq Ft

$190/Sq Ft

Est. Value

About This Home

This home is located at 2006 Fieldstone Rd SW, Rochester, MN 55902 and is currently estimated at $537,206, approximately $189 per square foot. 2006 Fieldstone Rd SW is a home located in Olmsted County with nearby schools including Bamber Valley Elementary School, Willow Creek Middle School, and Mayo Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 30, 2019

Sold by

Stropp Zepplin A

Bought by

Zander Jacob and Zander Emily

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$284,000

Outstanding Balance

$249,270

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$287,936

Purchase Details

Closed on

May 31, 2005

Sold by

Gallant Homes Inc

Bought by

Fasbender Jeffrey D and Fasbender Jill A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$259,760

Interest Rate

5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zander Jacob | $355,000 | Rochester Title & Escrow Co | |

| Fasbender Jeffrey D | $324,700 | Rochester Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zander Jacob | $284,000 | |

| Previous Owner | Fasbender Jeffrey D | $259,760 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,528 | $466,100 | $75,000 | $391,100 |

| 2023 | $5,832 | $463,000 | $75,000 | $388,000 |

| 2022 | $5,140 | $413,400 | $75,000 | $338,400 |

| 2021 | $4,766 | $376,500 | $50,000 | $326,500 |

| 2020 | $4,870 | $350,900 | $50,000 | $300,900 |

| 2019 | $4,698 | $344,500 | $50,000 | $294,500 |

| 2018 | $4,425 | $334,700 | $50,000 | $284,700 |

| 2017 | $4,356 | $319,600 | $50,000 | $269,600 |

| 2016 | $4,416 | $297,100 | $48,400 | $248,700 |

| 2015 | $4,054 | $294,600 | $48,400 | $246,200 |

| 2014 | $3,880 | $287,700 | $48,300 | $239,400 |

| 2012 | -- | $279,700 | $48,091 | $231,609 |

Source: Public Records

Map

Nearby Homes

- 1962 Fieldstone Rd SW

- 3479 Hart Ln SW

- 2087 Thea Ln SW

- 3440 18th Ave SW

- 2214 Weston Place SW

- 2250 Galileo Place SW

- 1608 Greystone Ln SW

- 2285 Orion St SW

- 3039 Lady Slipper Ln SW

- 1402 36th St SW

- 1315 Wicklow Ln SW

- 2333 Orion St SW

- 1312 Wicklow Ln SW

- 2377 Starburst Dr SW

- 3831 Halling Place SW

- 2260 Starburst Dr SW

- 2326 Phoenix Rd SW

- 3726 11th Ave SW

- 2431 Phoenix Rd SW

- 2467 Phoenix Rd SW

- 1984 Fieldstone Rd SW

- 2028 Fieldstone Rd SW

- 3387 Christy Ln SW

- xxx Fieldstone (L1b3) Rd SW

- 2050 Fieldstone Rd SW

- 3384 Woodstone Dr SW

- 3403 Christy Ln SW

- 2005 Fieldstone Rd SW

- 3398 Woodstone Dr SW

- 2027 Fieldstone Rd SW

- 1983 Fieldstone Rd SW

- 3396 Christy Ln SW

- 3412 Christy Ln SW

- 3380 Christy Ln SW

- 1961 Fieldstone Rd SW

- 3412 Woodstone Dr SW

- 3364 Christy Ln SW

- 3419 Christy Ln SW

- 3348 Christy Ln SW

- 3353 Woodstone Dr SW