2007 Dream Dr Normal, IL 61761

Estimated Value: $305,975 - $323,000

3

Beds

3

Baths

2,810

Sq Ft

$111/Sq Ft

Est. Value

About This Home

This home is located at 2007 Dream Dr, Normal, IL 61761 and is currently estimated at $313,244, approximately $111 per square foot. 2007 Dream Dr is a home located in McLean County with nearby schools including Northpoint Elementary School, Kingsley Junior High School, and Normal Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 22, 2017

Sold by

Ahrens Paul C and Ahrens Mary L

Bought by

Lasser David R and Lasser Marianne E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Outstanding Balance

$90,572

Interest Rate

3.89%

Estimated Equity

$222,672

Purchase Details

Closed on

Jul 25, 2012

Sold by

Thetard Edward A and Thetard Harrie L

Bought by

Ahrens Paul C and Ahrens Mary L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,000

Interest Rate

3.65%

Purchase Details

Closed on

Feb 2, 2008

Sold by

Thetard Edward A and Thetard Harriet L

Bought by

Thetard Edward A and Thetard Harriet L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lasser David R | $210,000 | Mclean County Title | |

| Ahrens Paul C | $192,000 | None Available | |

| Thetard Edward A | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lasser David R | $168,000 | |

| Previous Owner | Ahrens Paul C | $142,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,157 | $92,138 | $14,181 | $77,957 |

| 2022 | $6,157 | $74,535 | $11,472 | $63,063 |

| 2021 | $5,915 | $70,323 | $10,824 | $59,499 |

| 2020 | $5,877 | $69,593 | $10,712 | $58,881 |

| 2019 | $5,226 | $69,219 | $10,654 | $58,565 |

| 2018 | $5,158 | $68,486 | $10,541 | $57,945 |

| 2017 | $4,974 | $68,486 | $10,541 | $57,945 |

| 2016 | $4,920 | $68,486 | $10,541 | $57,945 |

| 2015 | $4,765 | $66,881 | $10,294 | $56,587 |

| 2014 | $4,706 | $66,881 | $10,294 | $56,587 |

| 2013 | -- | $66,881 | $10,294 | $56,587 |

Source: Public Records

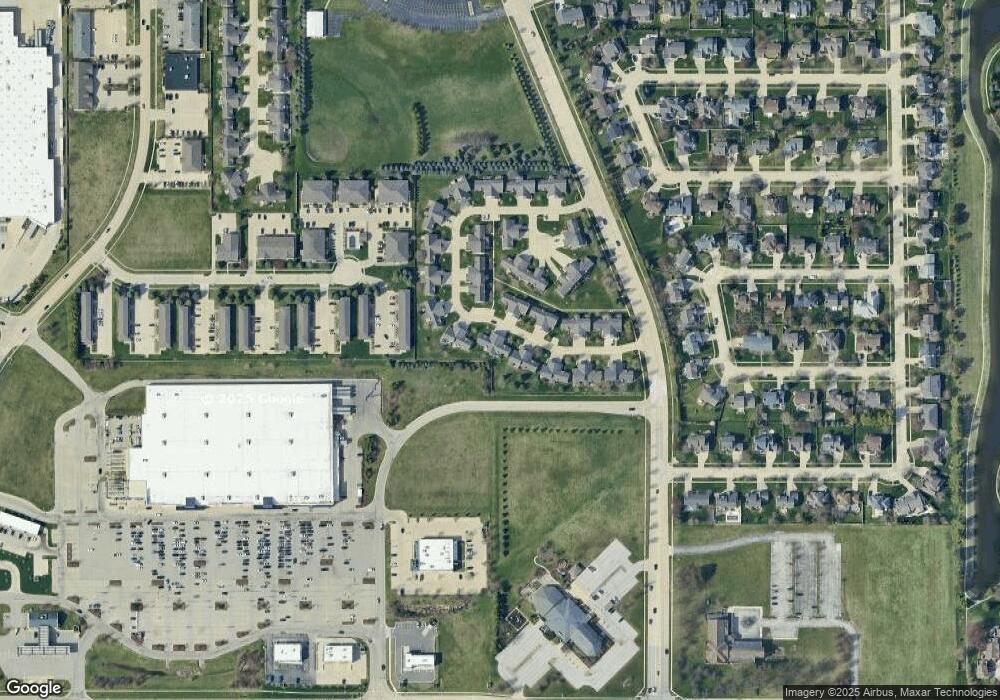

Map

Nearby Homes

- 2611 Kolby Ct

- Lot 21 Susan Dr

- 26 Brunton Ct

- 2215 Woodfield Rd

- 4 Monarch Dr

- 1721 Johnson Dr

- 404 Lake Shore Cir

- 1550 Hunt Dr Unit C

- 311 S Towanda Ave Unit 1

- 105 S Towanda Ave Unit 19

- Lot D Fort Jesse Rd

- Lot F Fort Jesse Rd

- Lot E Fort Jesse Rd

- 208 Hammitt Dr

- 9 Spruce Ct

- 1211 Travertine Rd

- 11 Spruce Ct

- Town ship 24 North SE (1 4) of Section 19

- Lot G Corner Fort Jesse & Towanda Barnes

- Lot H Towanda Barnes