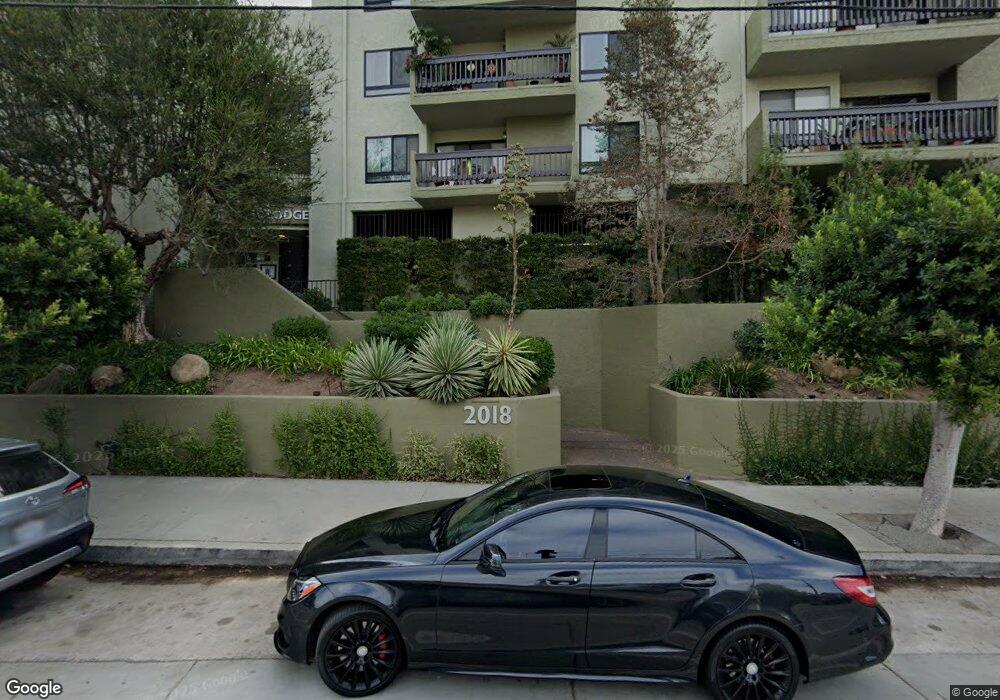

2018 Griffith pk Blvd Unit 210 Los Angeles, CA 90039

Silver Lake NeighborhoodEstimated Value: $776,000 - $906,000

2

Beds

2

Baths

1,172

Sq Ft

$725/Sq Ft

Est. Value

About This Home

This home is located at 2018 Griffith pk Blvd Unit 210, Los Angeles, CA 90039 and is currently estimated at $850,225, approximately $725 per square foot. 2018 Griffith pk Blvd Unit 210 is a home located in Los Angeles County with nearby schools including Ivanhoe Elementary, Thomas Starr King Middle School Film and Media Magnet, and John Marshall Senior High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2006

Sold by

2018 Griffith Park Blvd Unit 210 Residen

Bought by

Almiron Sylvester and Almiron Virginia

Current Estimated Value

Purchase Details

Closed on

Nov 16, 2005

Sold by

Bateman Randall L

Bought by

2018 Griffith Park Blvd Unit 210 Residen

Purchase Details

Closed on

Feb 18, 1998

Sold by

Rappoport Aron

Bought by

Bateman Randall L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,950

Interest Rate

6.9%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 18, 1994

Sold by

Rappoport Michael D

Bought by

Rappoport Aron

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Almiron Sylvester | $470,000 | Alliance Title | |

| 2018 Griffith Park Blvd Unit 210 Residen | -- | -- | |

| Bateman Randall L | $153,000 | Commonwealth Land Title Co | |

| Rappoport Aron | -- | Commonwealth Land Title Co | |

| Rappoport Aron | -- | Commonwealth Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bateman Randall L | $146,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,713 | $642,275 | $401,629 | $240,646 |

| 2024 | $7,713 | $629,682 | $393,754 | $235,928 |

| 2023 | $7,564 | $617,336 | $386,034 | $231,302 |

| 2022 | $7,208 | $605,232 | $378,465 | $226,767 |

| 2021 | $7,118 | $593,366 | $371,045 | $222,321 |

| 2019 | $6,903 | $575,769 | $360,041 | $215,728 |

| 2018 | $6,881 | $564,481 | $352,982 | $211,499 |

| 2016 | $6,575 | $542,563 | $339,276 | $203,287 |

| 2015 | $6,479 | $534,414 | $334,180 | $200,234 |

| 2014 | $6,503 | $523,946 | $327,634 | $196,312 |

Source: Public Records

Map

Nearby Homes

- 2018 Griffith Park Blvd Unit 109

- 3850 Udell Ct

- 2067 Mayview Dr

- 3901 De Longpre Ave

- 3839 Fountain Ave

- 2133 Mayview Dr

- 3209 Windsor Ave

- 3950 De Longpre Ave

- 3928 Clayton Ave

- 1757 Hollyvista Ave

- 2422 Claremont Ave

- 1651 Golden Gate Ave

- 1814 Webster Ave

- 1644 Maltman Ave

- 1923 Hollyvista Ave

- 2372 Kenilworth Ave

- 1132 Manzanita St

- 1118 Sanborn Ave

- 1734 Redesdale Ave

- 3924 W Sunset Blvd

- 2018 Griffith pk Blvd Unit 211

- 2018 Griffith pk Blvd Unit 212

- 2018 Griffith pk Blvd Unit 213

- 2018 Griffith pk Blvd Unit 120

- 2018 Griffith pk Blvd Unit 121

- 2018 Griffith pk Blvd Unit 122

- 2018 Griffith pk Blvd Unit 123

- 2018 Griffith pk Blvd Unit 124

- 2018 Griffith pk Blvd Unit 125

- 2018 Griffith pk Blvd Unit 126

- 2018 Griffith pk Blvd Unit 214

- 2018 Griffith pk Blvd Unit 215

- 2018 Griffith pk Blvd Unit 216

- 2018 Griffith pk Blvd Unit 217

- 2018 Griffith pk Blvd Unit 218

- 2018 Griffith pk Blvd Unit 320

- 2018 Griffith pk Blvd Unit 321

- 2018 Griffith pk Blvd Unit 322

- 2018 Griffith pk Blvd Unit 323

- 2018 Griffith pk Blvd Unit 219