20232 Old Alturas Rd Redding, CA 96003

Estimated Value: $181,000 - $309,000

3

Beds

1

Bath

1,290

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 20232 Old Alturas Rd, Redding, CA 96003 and is currently estimated at $261,782, approximately $202 per square foot. 20232 Old Alturas Rd is a home located in Shasta County with nearby schools including Columbia Elementary School, Mountain View Middle School, and Foothill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2021

Sold by

Gene Glynn Ernie

Bought by

Ernie G Glynn E Family Trust

Current Estimated Value

Purchase Details

Closed on

Oct 25, 2021

Sold by

Ernie G Glynn Family Trust and Glynn Ernie G

Bought by

Glynn Ernie G

Purchase Details

Closed on

Jan 28, 2019

Sold by

Glynn Ernie G

Bought by

Glynn Ernie G

Purchase Details

Closed on

Feb 24, 2010

Sold by

Sun West Mortgage Company Inc

Bought by

Glynn Ernie G

Purchase Details

Closed on

Nov 10, 2009

Sold by

Ott Kathryn L

Bought by

Sun West Mortgage Company Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ernie G Glynn E Family Trust | -- | -- | |

| Glynn Ernie G | -- | None Listed On Document | |

| Glynn Ernie G | -- | None Available | |

| Glynn Ernie G | $124,000 | First American Title Company | |

| Sun West Mortgage Company Inc | $135,000 | Stewart Title Of Ca Inc |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,840 | $160,045 | $70,986 | $89,059 |

| 2024 | $1,841 | $156,908 | $69,595 | $87,313 |

| 2023 | $1,841 | $153,832 | $68,231 | $85,601 |

| 2022 | $1,768 | $150,817 | $66,894 | $83,923 |

| 2021 | $1,776 | $147,861 | $65,583 | $82,278 |

| 2020 | $1,748 | $146,346 | $64,911 | $81,435 |

| 2019 | $1,707 | $143,478 | $63,639 | $79,839 |

| 2018 | $1,736 | $140,666 | $62,392 | $78,274 |

| 2017 | $1,751 | $137,909 | $61,169 | $76,740 |

| 2016 | $1,646 | $135,206 | $59,970 | $75,236 |

| 2015 | $1,635 | $133,176 | $59,070 | $74,106 |

| 2014 | $1,649 | $130,568 | $57,913 | $72,655 |

Source: Public Records

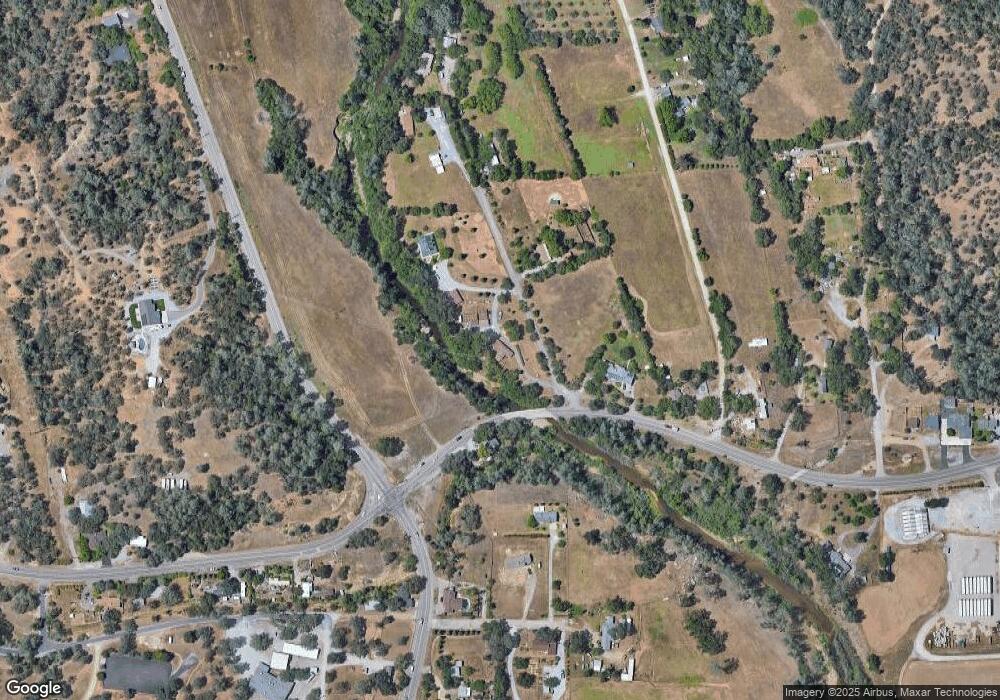

Map

Nearby Homes

- 10162 Harley Leighton Rd

- 10587 Quail Hollow Dr

- 10129 Harley Leighton Rd

- 10033 Abernathy Ln

- 2935 Snow Fire Ct

- 1637 French Lace Ln

- 1090 Gibralter Rd

- Lot4 Phase2 Stillwater Ranch

- 006 Old Oregon Trail

- 0 Lot2 Phase2 Stillwater Ranch Unit 25-4959

- 0 Lot1 Phase2 Stillwater Ranch Unit 25-4951

- 965 Willow Brook Ln

- 0 Lot15 Unit 2 Ph 2 Stillwater Unit 25-4957

- 547 Casa Buena St

- 0 Lot13 Unit 2 Ph 2 Stillwater Unit 25-4955

- 0 Lot8 Unit 2 Ph 2 Stillwater Ra Unit 25-4966

- 550 Armando Ave

- 2912 Squire Ave

- 0 Lot14 Unit 2 Ph 2 Stillwater Unit 25-4956

- 2571 Erin Ln

- 20202 Old Alturas Rd

- 20235 Old Alturas Rd

- 10435 Nora Dr

- 10416 Nora Dr

- 20258 Old Alturas Rd

- 20260 Oahu Place

- 20274 Old Alturas Rd

- 0 Hobbie Acres Dr

- 10434 Nora Dr

- 20254 Oahu Place

- 10303 Old Oregon Trail

- 10310 Old Oregon Trail

- 20292 Old Alturas Rd

- 20255 Oahu Place

- 10463 Hobbie Acres Dr

- 20263 Oahu Place

- 0 Oregon Trail

- 10285 Old Oregon Trail

- 20316 Old Alturas Rd

- 20149 Old Alturas Rd

Your Personal Tour Guide

Ask me questions while you tour the home.