2061 W Redlands Blvd Unit 12E Redlands, CA 92373

West Redlands NeighborhoodEstimated Value: $391,000 - $421,700

3

Beds

3

Baths

1,444

Sq Ft

$283/Sq Ft

Est. Value

About This Home

This home is located at 2061 W Redlands Blvd Unit 12E, Redlands, CA 92373 and is currently estimated at $408,425, approximately $282 per square foot. 2061 W Redlands Blvd Unit 12E is a home located in San Bernardino County with nearby schools including Mission Elementary School, Cope Middle School, and Redlands Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 1, 2024

Sold by

Starbuck Sophie and Starbuck David

Bought by

Sophie Starbuck And David Starbuck Joint Livi and Starbuck

Current Estimated Value

Purchase Details

Closed on

Dec 17, 2001

Sold by

Starbuck David Leroy and Starbuck Sophia Lynn

Bought by

Starbuck David Leroy and Starbuck Sophia L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,259

Interest Rate

6.39%

Mortgage Type

VA

Purchase Details

Closed on

Apr 8, 1996

Sold by

Cunningham R Gregory and Cunningham Carol J

Bought by

Starbuck David Leroy and Starbuck Sophia Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,340

Interest Rate

7.68%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sophie Starbuck And David Starbuck Joint Livi | -- | Accommodation/Courtesy Recordi | |

| Starbuck David Leroy | -- | Fidelity National Title Ins | |

| Starbuck David Leroy | $67,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Starbuck David Leroy | $67,259 | |

| Previous Owner | Starbuck David Leroy | $68,340 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,347 | $112,968 | $33,227 | $79,741 |

| 2024 | $1,347 | $110,752 | $32,575 | $78,177 |

| 2023 | $1,345 | $108,580 | $31,936 | $76,644 |

| 2022 | $1,326 | $106,451 | $31,310 | $75,141 |

| 2021 | $1,350 | $104,364 | $30,696 | $73,668 |

| 2020 | $1,330 | $103,294 | $30,381 | $72,913 |

| 2019 | $1,294 | $101,268 | $29,785 | $71,483 |

| 2018 | $1,262 | $99,282 | $29,201 | $70,081 |

| 2017 | $1,252 | $97,335 | $28,628 | $68,707 |

| 2016 | $1,238 | $95,427 | $28,067 | $67,360 |

| 2015 | $1,229 | $93,993 | $27,645 | $66,348 |

| 2014 | $1,208 | $92,151 | $27,103 | $65,048 |

Source: Public Records

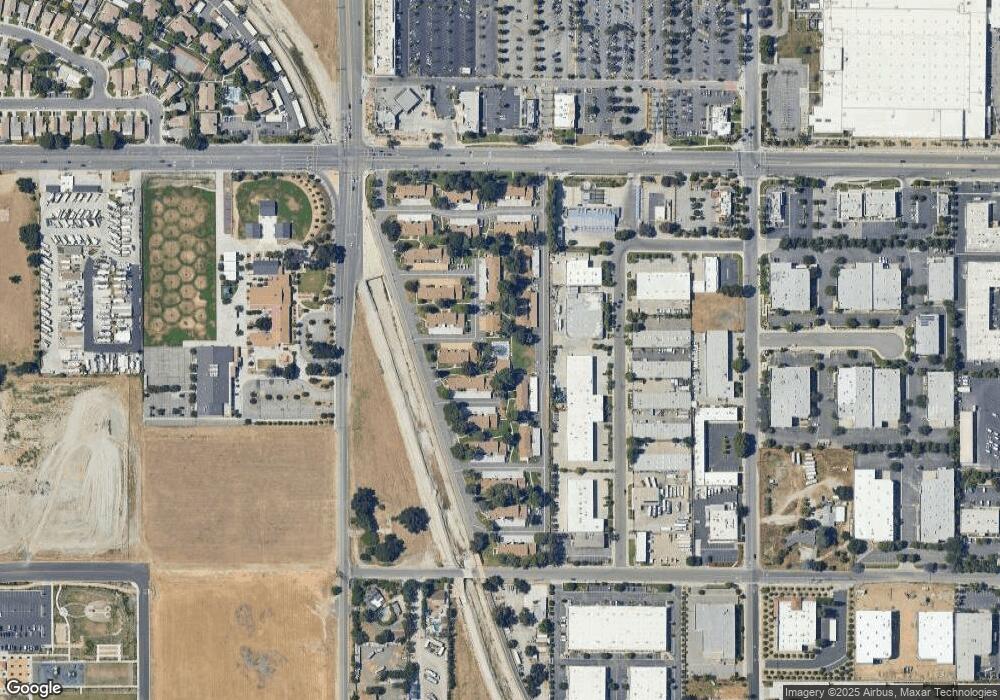

Map

Nearby Homes

- 2061 W Redlands Blvd Unit 7B

- 26397 Redlands Blvd Unit 24

- 26312 Cardigan Place

- 26349 Tangelo Way

- 26200 Redlands Blvd Unit 168

- 26200 Redlands Blvd Unit 4

- 26200 Redlands Blvd Unit 158

- 26200 Redlands Blvd Unit 96

- 26149 Park Ave Unit 6

- 26149 Park Ave Unit 21

- 26149 Park Ave Unit 14

- 10957 Frink Ranch Rd

- Residence 2 Plan at The Groves - Sierra Crest

- Residence 3 Plan at The Groves - Sierra Crest

- Residence 1 Plan at The Groves - Sierra Crest

- Residence One Plan at The Groves - Gold Crest

- Residence Two Plan at The Groves - Gold Crest

- Residence Three Plan at The Groves - Gold Crest

- 26414 Valencia Way

- 10851 Pala Bells St

- 2061 W Redlands Blvd

- 2061 W Redlands Blvd Unit C-5

- 2061 W Redlands Blvd Unit B8

- 2061 W Redlands Blvd Unit 22E

- 2061 W Redlands Blvd

- 2061 W Redlands Blvd Unit 14E

- 2061 W Redlands Blvd Unit 13E

- 2061 W Redlands Blvd Unit 13D

- 2061 W Redlands Blvd Unit 13C

- 2061 W Redlands Blvd Unit 13B

- 2061 W Redlands Blvd Unit 13A

- 2061 W Redlands Blvd Unit 12A

- 2061 W Redlands Blvd Unit 12B

- 2061 W Redlands Blvd Unit 12C

- 2061 W Redlands Blvd Unit 12D

- 2061 W Redlands Blvd Unit 12F

- 2061 W Redlands Blvd Unit 11F

- 2061 W Redlands Blvd Unit 11E

- 2061 W Redlands Blvd Unit 11D

- 2061 W Redlands Blvd Unit 11C