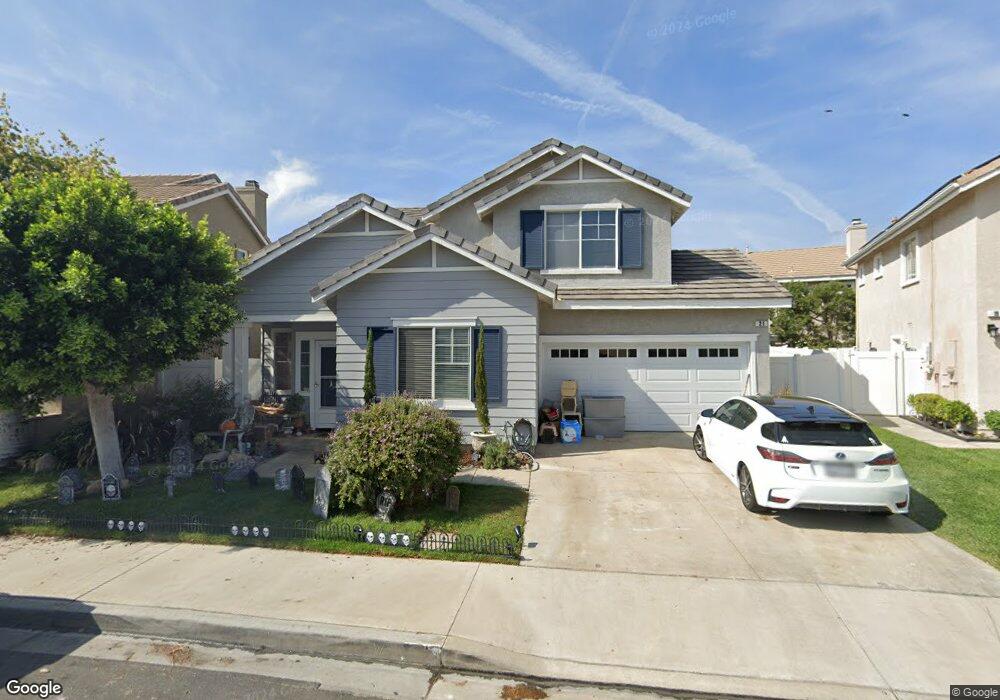

21 Calotte Place Foothill Ranch, CA 92610

Estimated Value: $1,099,618 - $1,200,000

3

Beds

3

Baths

1,663

Sq Ft

$686/Sq Ft

Est. Value

About This Home

This home is located at 21 Calotte Place, Foothill Ranch, CA 92610 and is currently estimated at $1,140,905, approximately $686 per square foot. 21 Calotte Place is a home located in Orange County with nearby schools including Foothill Ranch Elementary School, Rancho Santa Margarita Intermediate School, and Trabuco Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 14, 2000

Sold by

Manuel Archer and Manuel Jennifer

Bought by

Malone Charles E and Malone Shelmarie M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$303,000

Outstanding Balance

$102,686

Interest Rate

8.08%

Mortgage Type

Stand Alone First

Estimated Equity

$1,038,219

Purchase Details

Closed on

Feb 5, 1997

Sold by

Centex Real Est Corp

Bought by

Archer Manuel and Archer Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,150

Interest Rate

7.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Malone Charles E | $303,000 | Orange Coast Title Company | |

| Archer Manuel | $193,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Malone Charles E | $303,000 | |

| Previous Owner | Archer Manuel | $183,150 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,787 | $465,692 | $262,622 | $203,070 |

| 2024 | $4,787 | $456,561 | $257,472 | $199,089 |

| 2023 | $4,674 | $447,609 | $252,423 | $195,186 |

| 2022 | $4,591 | $438,833 | $247,474 | $191,359 |

| 2021 | $3,881 | $430,229 | $242,622 | $187,607 |

| 2020 | $4,459 | $425,818 | $240,134 | $185,684 |

| 2019 | $4,371 | $417,469 | $235,425 | $182,044 |

| 2018 | $4,289 | $409,284 | $230,809 | $178,475 |

| 2017 | $4,204 | $401,259 | $226,283 | $174,976 |

| 2016 | $4,841 | $393,392 | $221,846 | $171,546 |

| 2015 | $4,834 | $387,483 | $218,513 | $168,970 |

| 2014 | $5,389 | $379,893 | $214,232 | $165,661 |

Source: Public Records

Map

Nearby Homes

- 19431 14H Rue de Valore

- 19431 57D Rue de Valore

- 19431 Rue de Valore Unit 19B

- 19431 Rue de Valore Unit 37A

- 39 Touraine Place

- 51 Toulon Ave

- 56 Tessera Ave

- 1161 Summit Oak Dr

- 506 Deeann

- 704 Dusky Creek

- 109 Alder Ridge

- 420 Coyote Pass

- 201 Mountain Sage

- 606 White Oaks

- 207 Winterbrook

- 608 Shadowbrook

- 20 Flores

- 115 Primrose Dr

- 1621 Sunset View Dr

- 28372 Boulder Dr

- 23 Calotte Place

- 19 Calotte Place

- 58 Parterre Ave

- 56 Parterre Ave

- 60 Parterre Ave

- 54 Parterre Ave

- 17 Calotte Place

- 25 Calotte Place

- 20 Calotte Place

- 62 Parterre Ave

- 18 Calotte Place

- 24 Calotte Place

- 52 Parterre Ave

- 15 Calotte Place

- 16 Calotte Place

- 28 Calotte Place

- 57 Parterre Ave

- 50 Parterre Ave

- 14 Arcella Cir

- 194321 Rue de Valore

Your Personal Tour Guide

Ask me questions while you tour the home.