212 Maxwell Dr SW Shellsburg, IA 52332

Estimated Value: $276,000 - $342,000

4

Beds

3

Baths

1,478

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 212 Maxwell Dr SW, Shellsburg, IA 52332 and is currently estimated at $298,557, approximately $202 per square foot. 212 Maxwell Dr SW is a home located in Benton County with nearby schools including Shellsburg Elementary School, Vinton-Shellsburg Middle School, and Vinton-Shellsburg High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2016

Sold by

Dietrich Terry and Dietrich Karee

Bought by

Wallace Ryan P

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2007

Sold by

Kreutner Bruce A and Kreutner Shelly A

Bought by

Trask Bradley and Trask Amanda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,125

Interest Rate

6.18%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 24, 2006

Sold by

Wildeat Golf Course & Development Inc

Bought by

Peacock Donald G and Peacock Kay A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wallace Ryan P | -- | None Available | |

| Trask Bradley | $187,500 | None Available | |

| Peacock Donald G | $30,000 | None Available | |

| Wildcat Golf Course & Development Inc | $1,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Trask Bradley | $178,125 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,302 | $283,800 | $37,500 | $246,300 |

| 2024 | $4,302 | $255,700 | $36,900 | $218,800 |

| 2023 | $4,340 | $255,700 | $36,900 | $218,800 |

| 2022 | $4,192 | $227,200 | $29,500 | $197,700 |

| 2021 | $4,192 | $222,400 | $29,500 | $192,900 |

| 2020 | $3,948 | $207,500 | $25,300 | $182,200 |

| 2019 | $3,900 | $207,500 | $25,300 | $182,200 |

| 2018 | $3,752 | $205,200 | $23,600 | $181,600 |

| 2017 | $3,752 | $205,200 | $23,600 | $181,600 |

| 2016 | $2,980 | $160,100 | $22,700 | $137,400 |

| 2015 | $2,980 | $160,100 | $22,700 | $137,400 |

| 2014 | $3,172 | $169,500 | $0 | $0 |

Source: Public Records

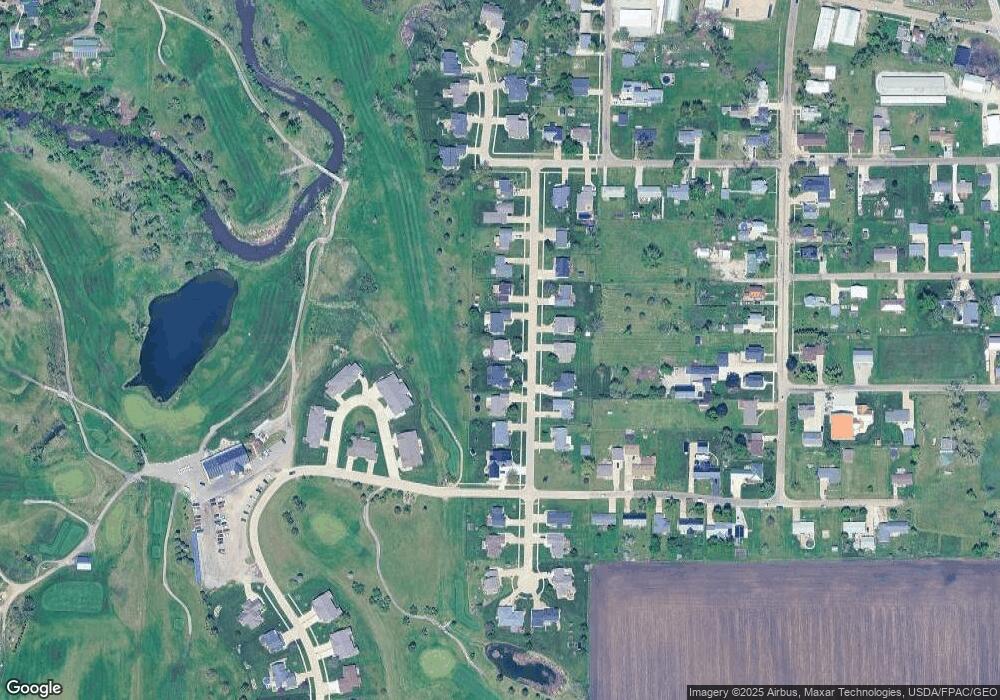

Map

Nearby Homes

- 301 Wildcat Ct

- 700 Sunset Blvd

- 804 Fairway Dr

- 6127 32nd Ave Unit Lot 3

- 205 Grove St NW

- 201 Grove St NW

- 105 Meadow Dr

- 103 Meadow Dr

- 101 Meadow Dr

- 6240 33rd Avenue Dr

- 0 31st Ave

- 0 31st Ave

- 6115 32nd Ave

- 2573 Linn Benton Rd

- 3127 61st Street Ln

- 0 Benton Linn Rd

- 810 Indigo Dr

- 737 Indigo Dr

- 926 Indigo Dr

- 818 Indigo Dr

- 210 Maxwell Dr SW

- 214 Maxwell Dr SW

- 0 Maxwell Dr

- 208 Maxwell Dr SW

- 216 Maxwell Dr SW

- 211 Maxwell Dr SW

- 209 Maxwell Dr SW

- 213 Maxwell Dr SW

- 206 Maxwell Dr SW

- 218 Maxwell Dr SW

- 207 Maxwell Dr SW

- 215 Maxwell Dr SW

- 205 Maxwell Dr SW

- 204 Maxwell Dr SW

- 217 Maxwell Dr SW

- 220 Maxwell Dr SW

- 214 Golfview Ct

- 202 Maxwell Dr SW

- 202 Golfview Ct

- 204 Golfview Ct