2125 W Juliet Way Fresno, CA 93711

Van Ness Extension NeighborhoodEstimated Value: $387,000 - $443,000

2

Beds

2

Baths

1,320

Sq Ft

$313/Sq Ft

Est. Value

About This Home

This home is located at 2125 W Juliet Way, Fresno, CA 93711 and is currently estimated at $412,538, approximately $312 per square foot. 2125 W Juliet Way is a home located in Fresno County with nearby schools including Malloch Elementary School, Tenaya Middle School, and Bullard High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2020

Sold by

Meyer David R and Meyer Annilee M

Bought by

Meyer David R and Meyer Annilee M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,000

Outstanding Balance

$173,834

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$238,704

Purchase Details

Closed on

Mar 16, 2013

Sold by

Meyer David Roger and Meyer Annilee M

Bought by

Meyer David R and Meyer Annilee M

Purchase Details

Closed on

Jan 7, 2013

Sold by

Old Fig Lp

Bought by

Meyer David Roger and Meyer Annilee M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Interest Rate

3.27%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meyer David R | -- | First American Title Company | |

| Meyer David R | -- | None Available | |

| Meyer David Roger | $267,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meyer David R | $195,000 | |

| Closed | Meyer David Roger | $165,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,014 | $328,286 | $73,880 | $254,406 |

| 2023 | $3,936 | $315,540 | $71,012 | $244,528 |

| 2022 | $3,880 | $309,354 | $69,620 | $239,734 |

| 2021 | $3,772 | $303,289 | $68,255 | $235,034 |

| 2020 | $3,755 | $300,181 | $67,556 | $232,625 |

| 2019 | $3,609 | $294,296 | $66,232 | $228,064 |

| 2018 | $3,529 | $288,527 | $64,934 | $223,593 |

| 2017 | $3,466 | $282,870 | $63,661 | $219,209 |

| 2016 | $3,350 | $277,324 | $62,413 | $214,911 |

| 2015 | $3,298 | $273,159 | $61,476 | $211,683 |

| 2014 | $3,232 | $267,809 | $60,272 | $207,537 |

Source: Public Records

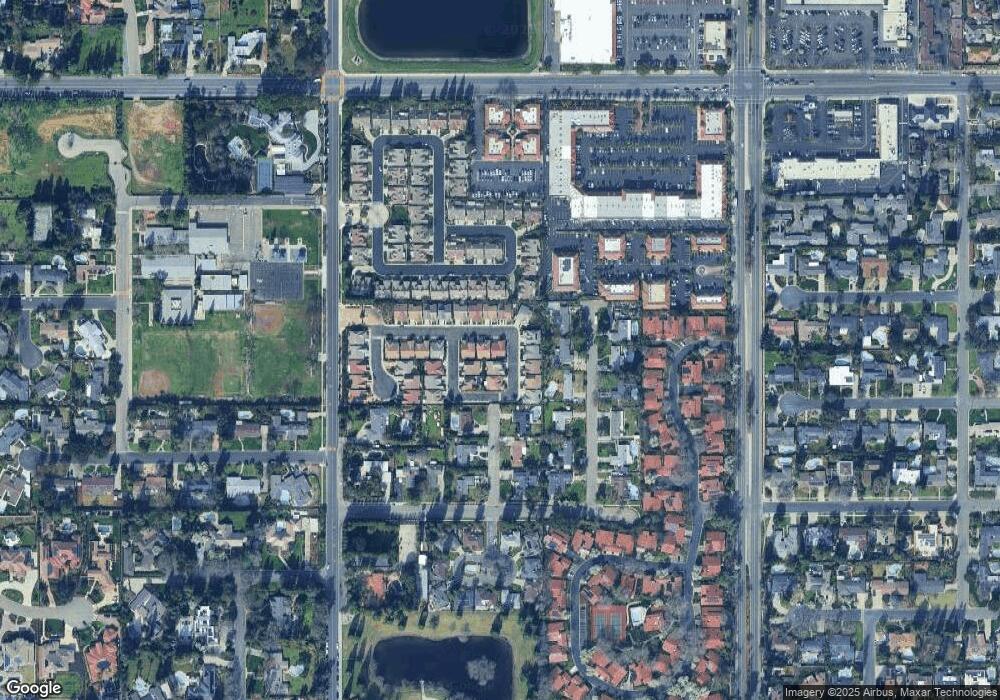

Map

Nearby Homes

- 5649 N Romeo Ln

- 5630 N El Adobe Dr

- 5811 N Forkner Ave

- 5740 N West Ave Unit 109

- 5740 N West Ave Unit 107

- 6043 N Forkner Ave

- 2073 W Calimyrna Ave Unit 101

- 2015 W Calimyrna Ave Unit 1A

- 2076 W Calimyrna Ave Unit 102

- 1702 W Bullard Ave Unit 105

- 1709 W Calimyrna Ave Unit 9A

- 5375 N Forkner Ave

- 1720 W Barstow Ave

- 1685 W Robinwood Ln

- 1647 W Wrenwood Ave

- 2044 W San Bruno Ave

- 1545 W Calimyrna Ave

- 5287 N Sequoia Dr

- 1486 W Roberts Ave

- 1611 W Escalon Ave

- 2133 W Juliet Way

- 5657 N Romeo Ln

- 2141 W Juliet Way

- 5668 N Romeo Ln

- 5676 N Romeo Ln

- 5658 N Henry Ln

- 5660 N Romeo Ln

- 2120 W Juliet Way

- 2128 W Juliet Way

- 2136 W Juliet Way

- 5650 N Henry Ln

- 5652 N Romeo Ln

- 2144 W Juliet Way

- 5644 N Romeo Ln

- 2120 W Rue st Michel

- 2118 W Rue st Michel

- 5671 N Ila Ave

- 2157 W Juliet Way

- 2122 W Rue st Michel

- 2152 W Juliet Way