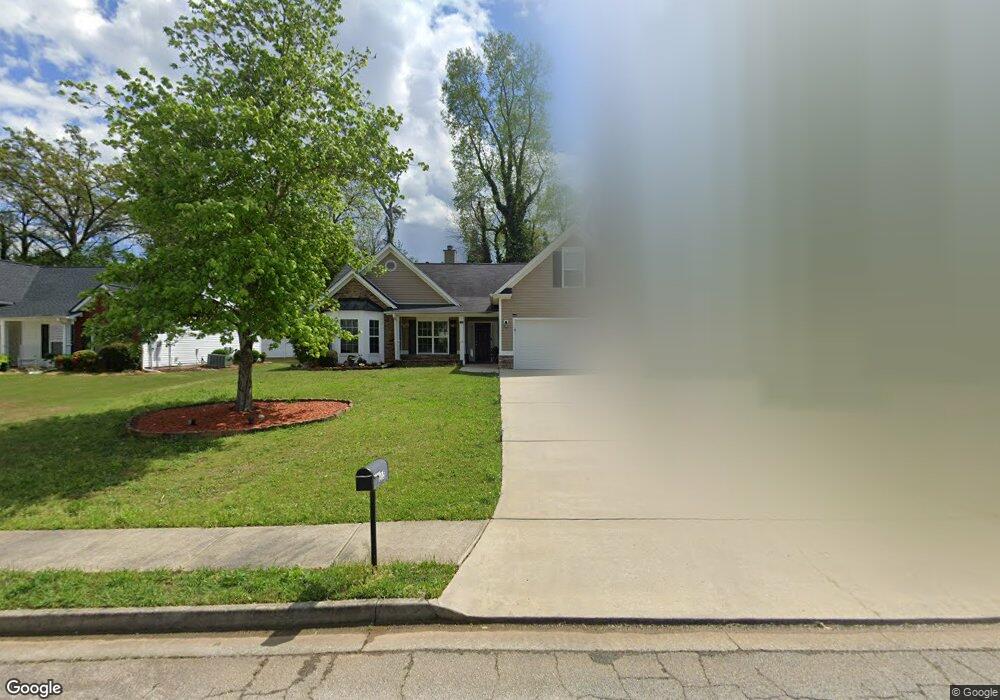

215 Sandstone Dr Unit 7 Hampton, GA 30228

Estimated Value: $293,000 - $324,000

3

Beds

2

Baths

2,136

Sq Ft

$143/Sq Ft

Est. Value

About This Home

This home is located at 215 Sandstone Dr Unit 7, Hampton, GA 30228 and is currently estimated at $304,390, approximately $142 per square foot. 215 Sandstone Dr Unit 7 is a home located in Henry County with nearby schools including Rocky Creek Elementary School, Hampton Middle School, and Hampton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 30, 2024

Sold by

Rh Partners Warehouse Ownerco Llc

Bought by

Edwards Morgan Louise and Morgan Keith

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Outstanding Balance

$316,320

Interest Rate

6.35%

Mortgage Type

VA

Estimated Equity

-$11,930

Purchase Details

Closed on

Apr 19, 2019

Sold by

Trans Am Sfe Ii Llc

Bought by

Rh Partners Ownerco Llc

Purchase Details

Closed on

Nov 6, 2018

Sold by

Gray Margaret D

Bought by

Trans Am Sfe Ii Llc

Purchase Details

Closed on

Aug 21, 2014

Sold by

Kelley Lizzette

Bought by

Gray Margaret D

Purchase Details

Closed on

Oct 31, 2006

Sold by

Newbridge Communities Llc

Bought by

Kelley Howard R and Kelley Lizzette

Purchase Details

Closed on

Jun 30, 2006

Sold by

Natl Dev Co

Bought by

Newbridge Cmntys Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$950,775

Interest Rate

6.55%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Edwards Morgan Louise | $320,000 | -- | |

| Rh Partners Ownerco Llc | $828,771 | -- | |

| Trans Am Sfe Ii Llc | $143,000 | -- | |

| Gray Margaret D | $129,990 | -- | |

| Kelley Howard R | $163,200 | -- | |

| Newbridge Cmntys Llc | $268,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Edwards Morgan Louise | $320,000 | |

| Previous Owner | Newbridge Cmntys Llc | $950,775 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,543 | $121,000 | $12,048 | $108,952 |

| 2024 | $4,543 | $121,000 | $12,000 | $109,000 |

| 2023 | $4,934 | $123,640 | $10,000 | $113,640 |

| 2022 | $3,558 | $87,560 | $10,000 | $77,560 |

| 2021 | $2,694 | $74,400 | $10,000 | $64,400 |

| 2020 | $2,602 | $71,880 | $10,000 | $61,880 |

| 2019 | $2,106 | $57,200 | $7,036 | $50,164 |

| 2018 | $428 | $61,240 | $8,000 | $53,240 |

| 2016 | $1,320 | $56,560 | $8,000 | $48,560 |

| 2015 | $1,235 | $51,120 | $8,000 | $43,120 |

| 2014 | $475 | $48,160 | $8,000 | $40,160 |

Source: Public Records

Map

Nearby Homes

- 220 Windpher Ridge

- 2040 Elm Grove Ln

- 2025 Elm Grove Ln

- 2012 Elm Grove Ln

- 252 Sandstone Dr

- 260 Sandstone Dr

- 120 Bridgemill Dr

- 21 Elm St

- 80 Knolls Ridge

- 28 Elm St

- 325 Peachtree Cir

- 6 Derrick St

- 19 Mcdonough St

- 32 Mcdonough St

- 48 Magnolia Pkwy

- 38 Mcdonough St

- 946 Damson Trail

- 453 Sawmill Trace

- 169 Cabin Way

- 120 Cabin Way

- 215 Sandstone Dr

- 213 Sandstone Dr

- 217 Sandstone Dr

- 219 Sandstone Dr

- 211 Sandstone Dr

- 191 Greenleaf Dr

- 181 Greenleaf Dr Unit 15

- 181 Greenleaf Dr

- 1201 Seagull Way

- 201 Greenleaf Dr

- 1202 Seagull Way Unit 51

- 1202 Seagull Way

- 221 Sandstone Dr

- 209 Sandstone Dr

- 171 Greenleaf Dr

- 211 Greenleaf Dr

- 207 Sandstone Dr

- 223 Sandstone Dr

- 214 Sandstone Dr

- 161 Greenleaf Dr