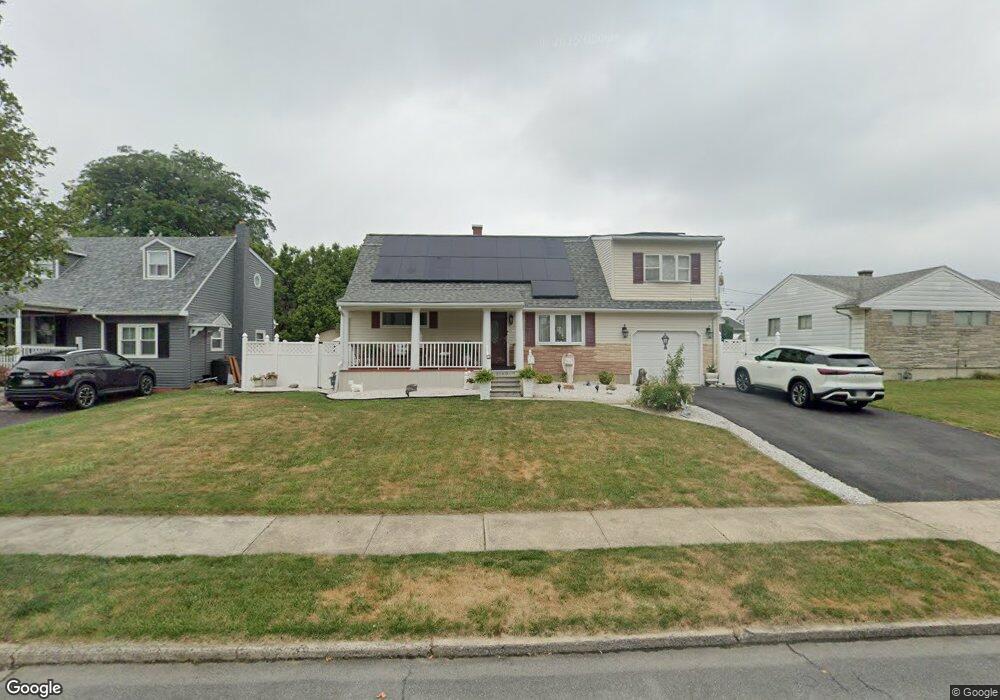

2160 Aster Rd Bethlehem, PA 18018

West Bethlehem NeighborhoodEstimated Value: $280,000 - $363,000

4

Beds

1

Bath

1,356

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 2160 Aster Rd, Bethlehem, PA 18018 and is currently estimated at $322,234, approximately $237 per square foot. 2160 Aster Rd is a home located in Lehigh County with nearby schools including Clearview Elementary School, Nitschmann Middle School, and Liberty High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2005

Sold by

Cid Alex Francisco and Guzman Angela

Bought by

Cid Alex Francisco and Cid Jose F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$93,543

Interest Rate

5.99%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$228,691

Purchase Details

Closed on

Jul 22, 2004

Sold by

Cid Jose F

Bought by

Cid Jose F and Guzman Angela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

6.2%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

May 28, 1999

Sold by

Smith Claire

Bought by

Cid Jose F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cid Alex Francisco | -- | -- | |

| Cid Jose F | $49,112 | -- | |

| Cid Jose F | $76,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cid Alex Francisco | $180,000 | |

| Closed | Cid Jose F | $30,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,574 | $159,200 | $27,500 | $131,700 |

| 2024 | $4,521 | $159,200 | $27,500 | $131,700 |

| 2023 | $4,481 | $159,200 | $27,500 | $131,700 |

| 2022 | $4,555 | $159,200 | $131,700 | $27,500 |

| 2021 | $4,534 | $159,200 | $27,500 | $131,700 |

| 2020 | $4,389 | $159,200 | $27,500 | $131,700 |

| 2019 | $4,421 | $159,200 | $27,500 | $131,700 |

| 2018 | $4,335 | $159,200 | $27,500 | $131,700 |

| 2017 | $4,142 | $159,200 | $27,500 | $131,700 |

| 2016 | -- | $159,200 | $27,500 | $131,700 |

| 2015 | -- | $159,200 | $27,500 | $131,700 |

| 2014 | -- | $159,200 | $27,500 | $131,700 |

Source: Public Records

Map

Nearby Homes

- 2141 Catasauqua Rd

- 2187 Drury Ln

- 2035 Drury Ln

- 1929 Cloverdale Rd

- 1958 Aripine Ave

- 1556 Bayberry Ln

- 1925 Troxell St

- 2214 E Fairmont St

- 1310 Beverly Ave

- 2309 E Woodlawn St Unit 2307

- 1445 Westgate Dr

- 1124 Club Ave Unit 1132

- 1920 E Woodlawn St

- 1440 Greenview Dr

- 1103 N Van Buren St

- 1305 Statten Ave

- 1104 Raymond Ave

- 1309 Greenview Dr

- 1428 Shelbourne Dr

- 0 Rosewood Dr Unit 766427