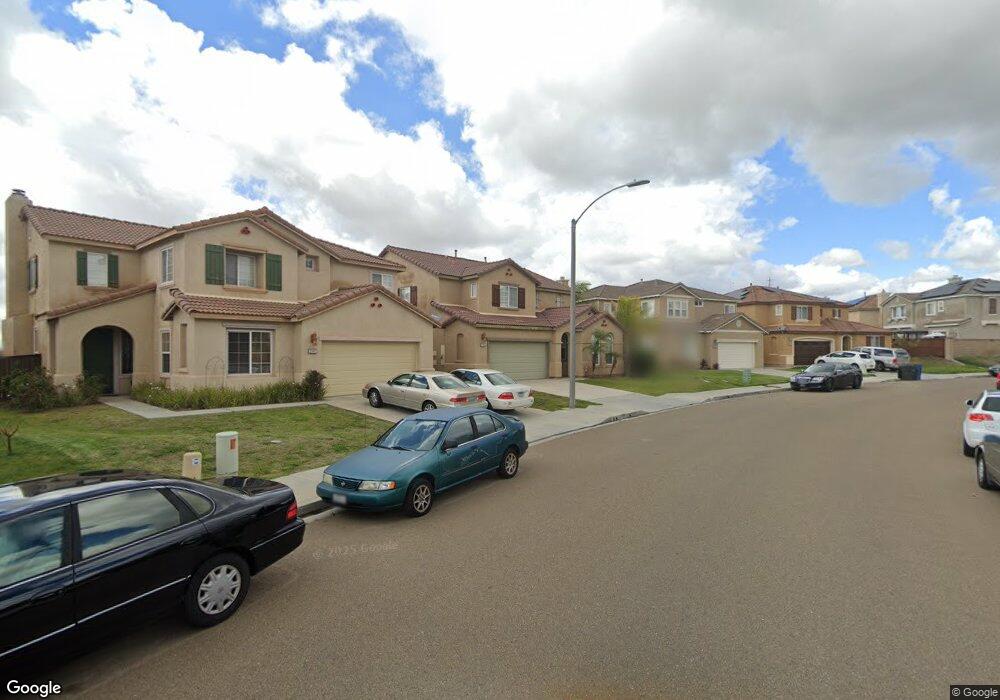

2165 Plaza Kadie Chula Vista, CA 91914

San Miguel Ranch NeighborhoodEstimated Value: $1,121,967 - $1,187,000

3

Beds

3

Baths

2,616

Sq Ft

$445/Sq Ft

Est. Value

About This Home

This home is located at 2165 Plaza Kadie, Chula Vista, CA 91914 and is currently estimated at $1,163,242, approximately $444 per square foot. 2165 Plaza Kadie is a home located in San Diego County with nearby schools including Liberty Elementary School, Eastlake Middle School, and Eastlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2008

Sold by

Equifirst Corp

Bought by

Weeks Greg and Weeks Norma B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$441,626

Outstanding Balance

$288,353

Interest Rate

6.31%

Mortgage Type

FHA

Estimated Equity

$874,889

Purchase Details

Closed on

Dec 18, 2007

Sold by

Moss Scott H and Moss Yvonne

Bought by

Equifirst Corp

Purchase Details

Closed on

Nov 21, 2006

Sold by

Moss Scott H

Bought by

Moss Scott H and Moss Yvonne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$573,750

Interest Rate

10.19%

Mortgage Type

Balloon

Purchase Details

Closed on

Mar 29, 2004

Sold by

Altamira Development Co Llc

Bought by

Moss Scott H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$443,500

Interest Rate

5%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weeks Greg | $458,000 | Chicago Title Company | |

| Equifirst Corp | $518,623 | Accommodation | |

| Moss Scott H | -- | Chicago Title | |

| Moss Scott H | $554,500 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Weeks Greg | $441,626 | |

| Previous Owner | Moss Scott H | $573,750 | |

| Previous Owner | Moss Scott H | $443,500 | |

| Closed | Moss Scott H | $35,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,059 | $589,775 | $310,410 | $279,365 |

| 2024 | $9,059 | $578,212 | $304,324 | $273,888 |

| 2023 | $8,918 | $566,875 | $298,357 | $268,518 |

| 2022 | $8,692 | $555,760 | $292,507 | $263,253 |

| 2021 | $8,516 | $544,864 | $286,772 | $258,092 |

| 2020 | $8,327 | $539,278 | $283,832 | $255,446 |

| 2019 | $8,137 | $528,705 | $278,267 | $250,438 |

| 2018 | $8,015 | $518,339 | $272,811 | $245,528 |

| 2017 | $12 | $508,176 | $267,462 | $240,714 |

| 2016 | $7,697 | $498,213 | $262,218 | $235,995 |

| 2015 | $7,644 | $490,731 | $258,280 | $232,451 |

| 2014 | -- | $481,119 | $253,221 | $227,898 |

Source: Public Records

Map

Nearby Homes

- 348 Plaza Los Osos

- 418 Corte Calypso

- 283 Aventura Dr Unit 12

- 380 Callesita Mariola

- 278 Avenida Loretta

- 262 Avenida Loretta

- 2170 Lago Ventana

- 2401 Paseo Los Gatos

- 1950 Rue Michelle

- 2180 Hamden Dr

- 2100 Northshore Dr Unit A

- 544 Rocking Horse Dr

- 732 Eastshore Terrace Unit 77

- 2018 Bridgeport

- 2151 Northshore Dr

- 742 Eastshore Terrace Unit 98

- 746 Eastshore Terrace Unit 108

- 2264 Huntington Point Rd Unit 102

- 750 Eastshore Terrace Unit 120

- 1833 Corte Galeana

- 2169 Plaza Kadie

- 2161 Plaza Kadie

- 2157 Plaza Kadie

- 2173 Plaza Kadie

- 2152 Plaza Kadie

- 2153 Plaza Kadie

- 352 Circulo Coronado

- 348 Circulo Coronado

- 364 Circulo Coronado

- 2148 Plaza Kadie

- 2149 Plaza Kadie

- 344 Circulo Coronado

- 368 Circulo Coronado

- 2144 Plaza Kadie

- 340 Circulo Coronado

- 2140 Plaza Kadie

- 2145 Plaza Kadie

- 2141 Plaza Kadie

- 372 Circulo Coronado

- 336 Circulo Coronado