2174 Heather Glen Way Unit 10B Franklin, IN 46131

Estimated Value: $328,514 - $514,000

3

Beds

3

Baths

1,962

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 2174 Heather Glen Way Unit 10B, Franklin, IN 46131 and is currently estimated at $391,879, approximately $199 per square foot. 2174 Heather Glen Way Unit 10B is a home located in Johnson County with nearby schools including Needham Elementary School, Franklin Community Middle School, and Custer Baker Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 9, 2013

Sold by

Roberts James G

Bought by

Mercuri Ralph N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,750

Outstanding Balance

$120,469

Interest Rate

3.31%

Mortgage Type

New Conventional

Estimated Equity

$271,410

Purchase Details

Closed on

Jan 31, 2008

Sold by

Premier Villages Llc

Bought by

Roberts James G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,000

Interest Rate

4.99%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mercuri Ralph N | -- | Ct | |

| Roberts James G | -- | Midwest Title Corporation |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mercuri Ralph N | $173,750 | |

| Previous Owner | Roberts James G | $95,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,921 | $301,700 | $40,000 | $261,700 |

| 2024 | $2,921 | $263,500 | $40,000 | $223,500 |

| 2023 | $2,829 | $254,900 | $40,000 | $214,900 |

| 2022 | $2,834 | $252,400 | $35,000 | $217,400 |

| 2021 | $2,715 | $242,000 | $35,000 | $207,000 |

| 2020 | $2,682 | $239,800 | $35,000 | $204,800 |

| 2019 | $2,481 | $222,300 | $35,000 | $187,300 |

| 2018 | $2,050 | $219,800 | $35,000 | $184,800 |

| 2017 | $1,891 | $188,100 | $35,000 | $153,100 |

| 2016 | $1,914 | $210,200 | $35,000 | $175,200 |

| 2014 | $1,908 | $190,800 | $35,000 | $155,800 |

| 2013 | $1,908 | $192,500 | $35,000 | $157,500 |

Source: Public Records

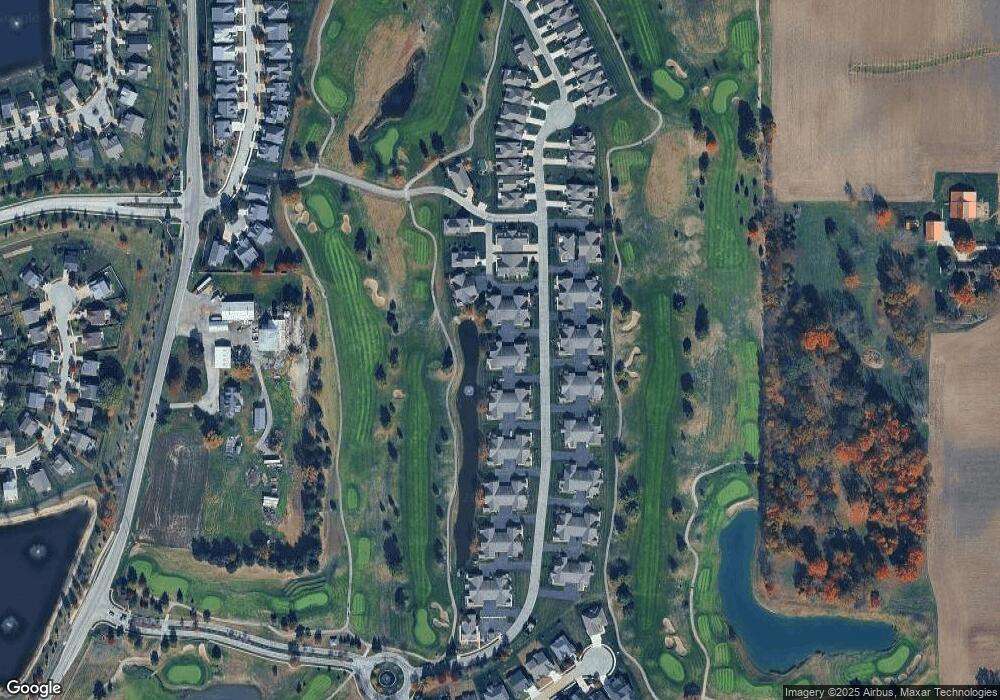

Map

Nearby Homes

- 2135 Somerset Dr

- 2159 Somerset Dr

- 2103 Cedarmill Dr

- 2265 Hampton Dr

- 2268 Hampton Dr

- 991 Ravine Dr

- 2292 Hampton Dr

- 2388 Cedarmill Dr

- 2258 Bridlewood Dr

- 2425 Bristol Dr

- 2458 Bristol Dr

- 2485 Bristol Dr

- 1682 Millpond Ln

- 1669 Millpond Ln

- 1646 Millpond Ln

- 1636 Millpond Ln

- 1679 Millpond Ln

- 1690 Millpond Ln

- 1642 Millpond Ln

- 1663 Millpond Ln

- 2174 Heather Glen Way

- 2172 Heather Glen Way

- 2176 Heather Glen Way

- 2176 Heather Glen Way

- 2178 Heather Glen Way

- 2178 Heather Glen Way Unit 10D

- 2182 Heather Glen Way

- 2188 Heather Glen Way

- 2184 Heather Glen Way

- 2164 Heather Glen Way

- 2186 Heather Glen Way

- 2166 Heather Glen Way

- 2162 Heather Glen Way

- 2168 Heather Glen Way

- 2168 Heather Glen Way Unit 11-D

- 2208 Heather Glen Way

- 2171 Heather Glen Way

- 2173 Heather Glen Way

- 2204 Heather Glen Way

- 2163 Heather Glen Way