21773 Linden Way Rogers, MN 55374

Estimated Value: $249,441 - $276,000

2

Beds

2

Baths

904

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 21773 Linden Way, Rogers, MN 55374 and is currently estimated at $262,360, approximately $290 per square foot. 21773 Linden Way is a home located in Hennepin County with nearby schools including Rogers Elementary School, Rogers Middle School, and Rogers Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2018

Sold by

Watters Amanda L and Watters Dustin D

Bought by

Palmer Deborah J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,059

Outstanding Balance

$145,343

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$117,017

Purchase Details

Closed on

Jun 8, 2015

Sold by

Kramer Steven W

Bought by

Pavlik Amanda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,400

Interest Rate

0.78%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 14, 2009

Sold by

Daggett Kristin A and Daggett Eric

Bought by

Kramer Steven W

Purchase Details

Closed on

Nov 22, 2000

Sold by

Shamrock Builders Inc

Bought by

Butcher Kristin A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Palmer Deborah J | $182,000 | Titlesmart Inc | |

| Pavlik Amanda | $116,000 | Alliance Title Llc | |

| Kramer Steven W | $116,500 | -- | |

| Butcher Kristin A | $116,875 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Palmer Deborah J | $168,059 | |

| Previous Owner | Pavlik Amanda | $104,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,748 | $228,100 | $17,000 | $211,100 |

| 2023 | $2,695 | $227,100 | $10,000 | $217,100 |

| 2022 | $2,475 | $219,000 | $10,000 | $209,000 |

| 2021 | $2,223 | $193,000 | $10,000 | $183,000 |

| 2020 | $2,292 | $175,000 | $10,000 | $165,000 |

| 2019 | $1,901 | $172,000 | $10,000 | $162,000 |

| 2018 | $1,838 | $158,000 | $10,000 | $148,000 |

| 2017 | $1,344 | $115,000 | $10,000 | $105,000 |

| 2016 | $1,263 | $108,000 | $15,000 | $93,000 |

| 2015 | $1,199 | $101,000 | $10,000 | $91,000 |

| 2014 | -- | $85,000 | $10,000 | $75,000 |

Source: Public Records

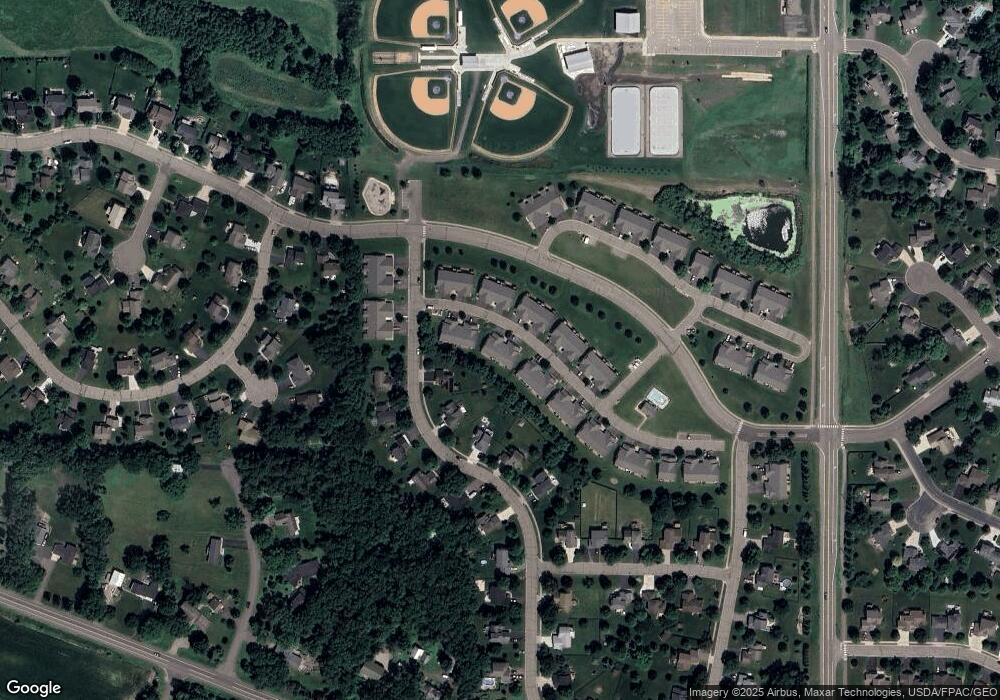

Map

Nearby Homes

- 21910 Territorial Rd

- 21412 Poate Ct

- 22911 Hazel Ln

- 22201 Jed Dr

- 21310 Poate Ct

- 22408 Isla Way

- 12608 Garden Meadow Ln

- 22401 Isla Way

- 12204 Aurora Ave

- 22448 Isla Way

- 22425 Isla Way

- 22435 Isla Way

- 12605 Garden Meadow Ln

- 12220 Aurora Ave

- 12648 Garden Meadow Ln

- Carlton Plan at Skye Meadows - Venture Collection

- Markham Plan at Skye Meadows - Venture Collection

- Berkley Plan at Skye Meadows - Venture Collection

- Sequoia Plan at Skye Meadows - Venture Collection

- Davidson Plan at Skye Meadows - Venture Collection

- 21763 Linden Way

- 21783 Linden Way

- 21753 Linden Way

- 21793 Linden Way

- 21743 Linden Way

- 21743 Linden Way Unit B

- 21803 Linden Way

- 21737 Linden Way

- 21813 Linden Way

- 21766 Linden Way

- 21756 Linden Way

- 21752 Linden Way

- 21776 Linden Way

- 21746 Linden Way

- 21786 Linden Way

- 21731 Linden Way

- 21823 Linden Way

- 12330 Walnut Dr

- 21796 Linden Way

- 21725 Linden Way