218 Athena Ct Wilmington, DE 19808

Westminster NeighborhoodEstimated Value: $1,483,410 - $1,652,000

4

Beds

6

Baths

4,516

Sq Ft

$348/Sq Ft

Est. Value

About This Home

This home is located at 218 Athena Ct, Wilmington, DE 19808 and is currently estimated at $1,573,803, approximately $348 per square foot. 218 Athena Ct is a home located in New Castle County with nearby schools including Skyline Middle School, Thomas McKean High School, and Gateway Charter School Delaware.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 2, 2021

Sold by

Jordan Matthew and Jordan Trisha

Bought by

Jordan Matthew and Jordan Trisha K

Current Estimated Value

Purchase Details

Closed on

Oct 29, 2015

Sold by

Toll De Ii Lp

Bought by

Jordan Matthew and Jordan Trisha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$724,808

Outstanding Balance

$572,602

Interest Rate

3.92%

Mortgage Type

New Conventional

Estimated Equity

$1,001,201

Purchase Details

Closed on

Dec 2, 2009

Sold by

Chaps 901 Llc

Bought by

Toll De Ii Lp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,680,000

Interest Rate

5.01%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jordan Matthew | -- | None Available | |

| Jordan Matthew | $906,010 | None Available | |

| Toll De Ii Lp | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jordan Matthew | $724,808 | |

| Previous Owner | Toll De Ii Lp | $15,680,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,406 | $245,100 | $30,900 | $214,200 |

| 2023 | $8,370 | $245,100 | $30,900 | $214,200 |

| 2022 | $8,427 | $245,100 | $30,900 | $214,200 |

| 2021 | $8,422 | $245,100 | $30,900 | $214,200 |

| 2020 | $8,448 | $245,100 | $30,900 | $214,200 |

| 2019 | $8,477 | $245,100 | $30,900 | $214,200 |

| 2018 | $8,304 | $245,100 | $30,900 | $214,200 |

| 2017 | $7,537 | $225,100 | $30,900 | $194,200 |

| 2016 | $7,160 | $225,100 | $30,900 | $194,200 |

| 2015 | -- | $15,900 | $15,900 | $0 |

| 2014 | $443 | $15,900 | $15,900 | $0 |

Source: Public Records

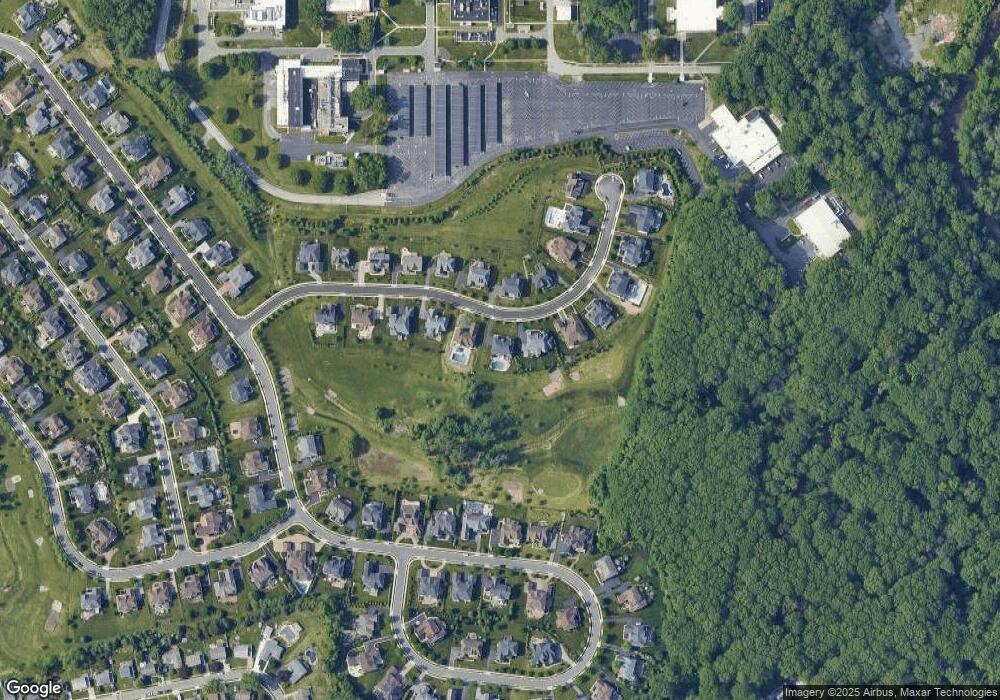

Map

Nearby Homes

- 3206 Dunlap Dr

- Cumberland Plan at Delaware National - Luxury Singles

- Saint Lawrence Plan at Delaware National - Luxury Singles

- Corsica Plan at Delaware National - Luxury Singles

- 1150 Spyglass Hill Way

- 8 Tarragon Ct

- 2737 Tanager Dr

- 2628 Newell Dr

- 713 Cheltenham Rd

- 2608 Newport Gap Pike

- 611 Phalen Ct

- 227 Phillips Dr

- 619 Phalen Ct

- 2501 Crossgates Dr

- 2511 Crossgates Dr

- 219 Phillips Dr

- 2414 Horace Dr

- 2507 Kittiwake Dr

- 14 Kentshire Ct

- 513 Ohio Ave