2212 Lago Ventana Unit 82 Chula Vista, CA 91914

Eastlake NeighborhoodEstimated Value: $744,688 - $767,000

3

Beds

3

Baths

1,651

Sq Ft

$460/Sq Ft

Est. Value

About This Home

This home is located at 2212 Lago Ventana Unit 82, Chula Vista, CA 91914 and is currently estimated at $759,172, approximately $459 per square foot. 2212 Lago Ventana Unit 82 is a home located in San Diego County with nearby schools including Thurgood Marshall Elementary School, Eastlake Middle School, and Eastlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2001

Sold by

Contreras Josefina and Salinas Josefina

Bought by

Frianeza Enrico S and Frianeza Maria Antonette

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,750

Outstanding Balance

$85,674

Interest Rate

7.15%

Mortgage Type

VA

Estimated Equity

$673,498

Purchase Details

Closed on

Nov 16, 2000

Sold by

Alberto

Bought by

Salinas Josefina M

Purchase Details

Closed on

Oct 20, 1997

Sold by

Montemayor Sofronio P

Bought by

Salinas Josefina M

Purchase Details

Closed on

Jan 13, 1997

Sold by

Fn Development Company Alpha

Bought by

Montemayor Sofronio P and Montemayor Alberto

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,754

Interest Rate

7.58%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frianeza Enrico S | $235,000 | First American Title | |

| Salinas Josefina M | -- | Fidelity National Title | |

| Salinas Josefina M | -- | -- | |

| Montemayor Sofronio P | $152,000 | First American Title | |

| Montemayor Sofronio P | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Frianeza Enrico S | $224,750 | |

| Previous Owner | Montemayor Sofronio P | $145,754 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,176 | $349,578 | $78,137 | $271,441 |

| 2024 | $4,176 | $342,724 | $76,605 | $266,119 |

| 2023 | $4,101 | $336,004 | $75,103 | $260,901 |

| 2022 | $3,979 | $329,417 | $73,631 | $255,786 |

| 2021 | $5,119 | $322,959 | $72,188 | $250,771 |

| 2020 | $4,993 | $319,648 | $71,448 | $248,200 |

| 2019 | $4,865 | $313,382 | $70,048 | $243,334 |

| 2018 | $4,774 | $307,238 | $68,675 | $238,563 |

| 2017 | $4,684 | $301,215 | $67,329 | $233,886 |

| 2016 | $4,552 | $295,309 | $66,009 | $229,300 |

| 2015 | $4,473 | $290,874 | $65,018 | $225,856 |

| 2014 | $4,970 | $285,177 | $63,745 | $221,432 |

Source: Public Records

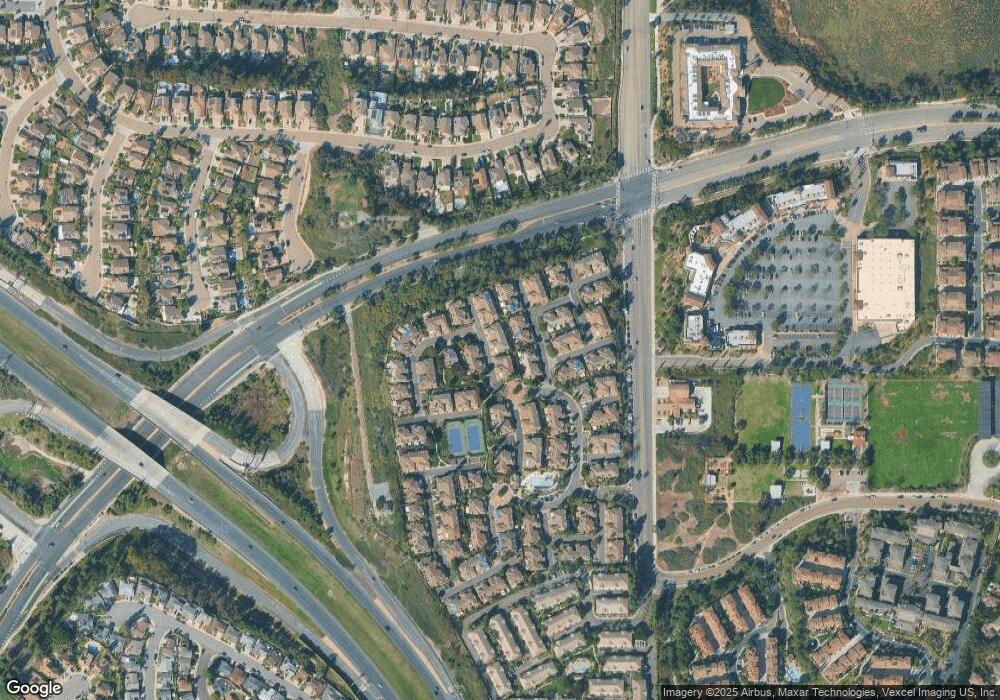

Map

Nearby Homes

- 2170 Lago Ventana

- 2180 Hamden Dr

- 2264 Huntington Point Rd Unit 102

- 418 Corte Calypso

- 732 Eastshore Terrace Unit 77

- 544 Rocking Horse Dr

- 753 Eastshore Terrace Unit 127

- 750 Eastshore Terrace Unit 120

- 2151 Northshore Dr

- 380 Callesita Mariola

- 2100 Northshore Dr Unit A

- 757 Eastshore Terrace Unit 210

- 767 Eastshore Terrace Unit 223

- 774 Eastshore Terrace Unit 169

- 773 Brookstone Rd Unit 304

- 2018 Bridgeport

- 731 Brookstone Rd Unit 103

- 749 Brookstone Rd Unit 101

- 2083 Lakeridge Cir Unit 104

- 2567 View Trail Ct Unit 1

- 2210 Lago Ventana Unit 83

- 2214 Lago Ventana

- 2208 Lago Ventana

- 2216 Lago Ventana Unit 127

- 2206 Lago Ventana Unit 85

- 2273 Lago Ventana Unit 133

- 2271 Lago Ventana

- 2275 Lago Ventana

- 2218 Lago Ventana Unit 126

- 2277 Lago Ventana

- 2270 Lago Ventana Unit 143

- 2268 Lago Ventana

- 2266 Lago Ventana Unit 141

- 2264 Lago Ventana

- 2215 Lago Ventana

- 2222 Lago Ventana

- 2220 Lago Ventana Unit 125

- 2217 Lago Ventana

- 2279 Lago Ventana

- 2188 Lago Ventana Unit 86