223 Linn Ct Unit B North Aurora, IL 60542

Estimated Value: $172,000 - $310,000

3

Beds

2

Baths

1,160

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 223 Linn Ct Unit B, North Aurora, IL 60542 and is currently estimated at $236,405, approximately $203 per square foot. 223 Linn Ct Unit B is a home located in Kane County with nearby schools including Schneider Elementary School, Herget Middle School, and West Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2017

Sold by

Jarvis Robert

Bought by

Zagai Mario

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,810

Outstanding Balance

$63,825

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$172,580

Purchase Details

Closed on

Jul 21, 2009

Sold by

Secretary Of Housing & Urban Development

Bought by

Jarvis Robert

Purchase Details

Closed on

Dec 14, 2007

Sold by

Stojek Elizabeth C

Bought by

Hud

Purchase Details

Closed on

Jul 31, 1998

Sold by

Johnson Patricia H and Grajek Patricia H

Bought by

Stojek Elizabeth C and Stojek Jane F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,967

Interest Rate

7.05%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zagai Mario | $80,000 | Attorneys Title Guaranty Fun | |

| Jarvis Robert | -- | Stewart Title Company | |

| Hud | -- | None Available | |

| Stojek Elizabeth C | $63,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zagai Mario | $75,810 | |

| Previous Owner | Stojek Elizabeth C | $62,967 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,002 | $47,934 | $5,360 | $42,574 |

| 2023 | $2,581 | $39,716 | $4,865 | $34,851 |

| 2022 | $1,803 | $27,812 | $4,547 | $23,265 |

| 2021 | $1,732 | $26,377 | $4,312 | $22,065 |

| 2020 | $1,762 | $26,367 | $4,229 | $22,138 |

| 2019 | $1,767 | $25,433 | $4,079 | $21,354 |

| 2018 | $1,698 | $24,062 | $3,924 | $20,138 |

| 2017 | $2,145 | $22,167 | $3,795 | $18,372 |

| 2016 | $1,735 | $17,405 | $3,684 | $13,721 |

| 2015 | -- | $13,682 | $3,600 | $10,082 |

| 2014 | -- | $13,252 | $3,487 | $9,765 |

| 2013 | -- | $12,993 | $3,419 | $9,574 |

Source: Public Records

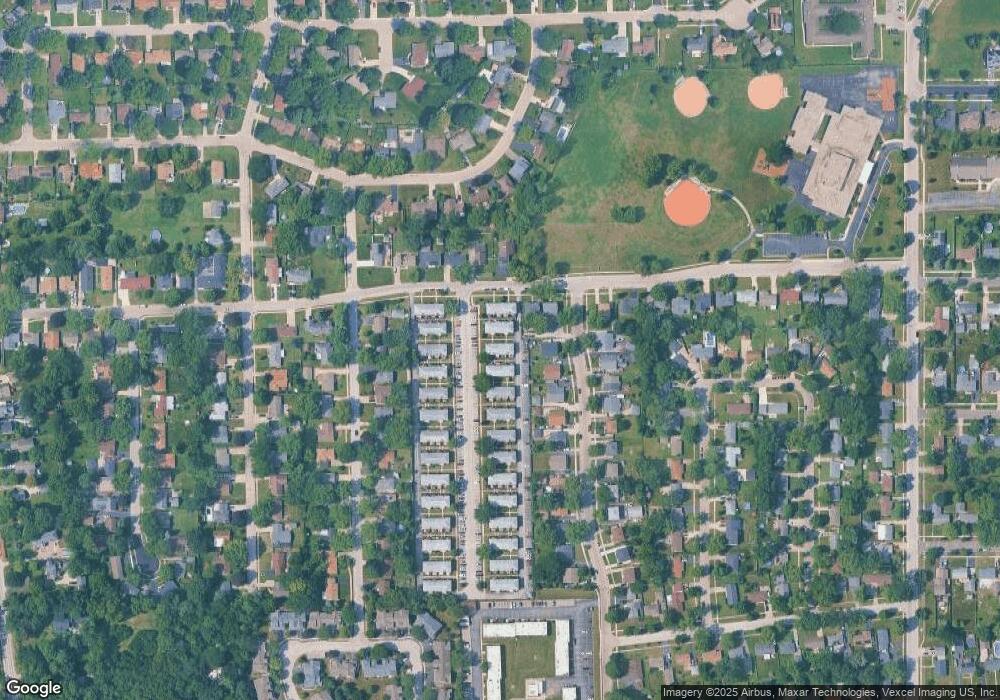

Map

Nearby Homes

- 203 Hill Ave

- 317 Butterfield Rd

- 113 April Ln

- 242 Sussex Ln

- 273 Ridley St

- 24 S Grant St

- 719 Pinecreek Dr

- 616 Pinehurst Dr

- 509 Wingfoot Dr

- 239 Durham St

- 355 Hilltop Dr

- 310 Oak St

- 952 Darwin St

- 451 Pheasant Hill Dr

- 306 Harmony Dr

- 220 Larchwood Ln

- 328 W State St

- 556 Quail St

- 444 Prairie Ridge Ln

- 572 Quail Ln

- 223 Linn Ct Unit A

- 223 Linn Ct Unit D

- 223 Linn Ct Unit C

- 221 Linn Ct Unit A

- 221 Linn Ct Unit B

- 221 Linn Ct Unit C

- 225 Linn Ct Unit B

- 225 Linn Ct Unit A

- 225 Linn Ct Unit C

- 225 Linn Ct Unit D

- 216C Dee Rd

- 218A Dee Rd Unit B

- 222A Laurel Dr

- 222B Laurel Dr

- 216D Dee Rd

- 219 Linn Ct Unit C

- 219 Linn Ct Unit D

- 219 Linn Ct Unit B

- 219 Linn Ct Unit A

- 219 Linn Ct