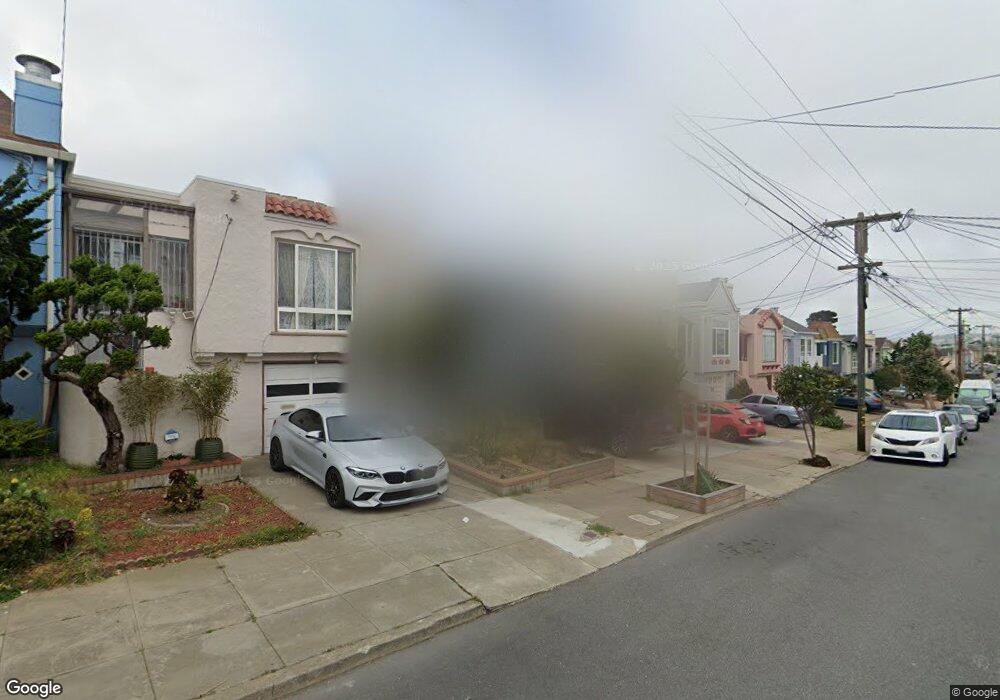

2247 43rd Ave San Francisco, CA 94116

Outer Parkside NeighborhoodEstimated Value: $1,297,000 - $1,583,000

2

Beds

1

Bath

1,192

Sq Ft

$1,227/Sq Ft

Est. Value

About This Home

This home is located at 2247 43rd Ave, San Francisco, CA 94116 and is currently estimated at $1,463,177, approximately $1,227 per square foot. 2247 43rd Ave is a home located in San Francisco County with nearby schools including Sunset Elementary School, Giannini (A.P.) Middle School, and St. Gabriel School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2006

Sold by

Belzer Paul O and Belzer Tiffany L

Bought by

Tran Kien Chi and Ng Tran Julia Wai Yee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$35,001

Outstanding Balance

$20,520

Interest Rate

6.52%

Mortgage Type

Unknown

Estimated Equity

$1,442,657

Purchase Details

Closed on

Dec 18, 1998

Sold by

Yu Hans and Yu Elaine

Bought by

Belzer Paul O and Belzer Tiffany L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Interest Rate

6.91%

Purchase Details

Closed on

Jan 10, 1997

Sold by

Leong Henry and Leong Daisy Yu

Bought by

Yu Hans and Yu Elaine Wong

Purchase Details

Closed on

Jan 9, 1997

Sold by

Yu Ruby S

Bought by

Yu Hans and Yu Elaine Wong

Purchase Details

Closed on

Dec 19, 1996

Sold by

Leong Henry and Leong Daisy Yu

Bought by

Yu Hans and Yu Elaine Wong

Purchase Details

Closed on

Dec 17, 1996

Sold by

Yu Ruby S

Bought by

Leong Henry and Leong Daisy Yu

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tran Kien Chi | $760,000 | Stewart Title Of California | |

| Belzer Paul O | $319,000 | Commonwealth Land Title Co | |

| Yu Hans | -- | -- | |

| Yu Hans | -- | -- | |

| Leong Henry | -- | -- | |

| Yu Hans | -- | -- | |

| Leong Henry | -- | -- | |

| Yu Hans | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tran Kien Chi | $35,001 | |

| Open | Tran Kien Chi | $605,000 | |

| Previous Owner | Belzer Paul O | $190,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,593 | $1,038,589 | $623,156 | $415,433 |

| 2024 | $12,593 | $1,018,226 | $610,938 | $407,288 |

| 2023 | $12,399 | $998,261 | $598,959 | $399,302 |

| 2022 | $12,155 | $978,688 | $587,215 | $391,473 |

| 2021 | $11,939 | $959,686 | $575,701 | $383,985 |

| 2020 | $12,001 | $949,848 | $569,798 | $380,050 |

| 2019 | $11,589 | $931,228 | $558,626 | $372,602 |

| 2018 | $11,197 | $912,973 | $547,673 | $365,300 |

| 2017 | $10,766 | $895,076 | $536,935 | $358,141 |

| 2016 | $10,617 | $877,530 | $526,407 | $351,123 |

| 2015 | $10,482 | $864,165 | $518,500 | $345,665 |

| 2014 | $9,181 | $805,015 | $483,000 | $322,015 |

Source: Public Records

Map

Nearby Homes

- 3421 Rivera St

- 2142 43rd Ave

- 2115 42nd Ave

- 3622 Rivera St

- 2395 44th Ave

- 2026 Great Hwy

- 1871 45th Ave

- 2274 36th Ave

- 2275 35th Ave

- 3917 Noriega St

- 2675 45th Ave

- 1834 38th Ave

- 2687 45th Ave

- 1970 35th Ave

- 3043 Noriega St

- 3621 Moraga St

- 1974 34th Ave

- 1722-1724 48th Ave

- 2430 33rd Ave

- 4108 Moraga St Unit 4110