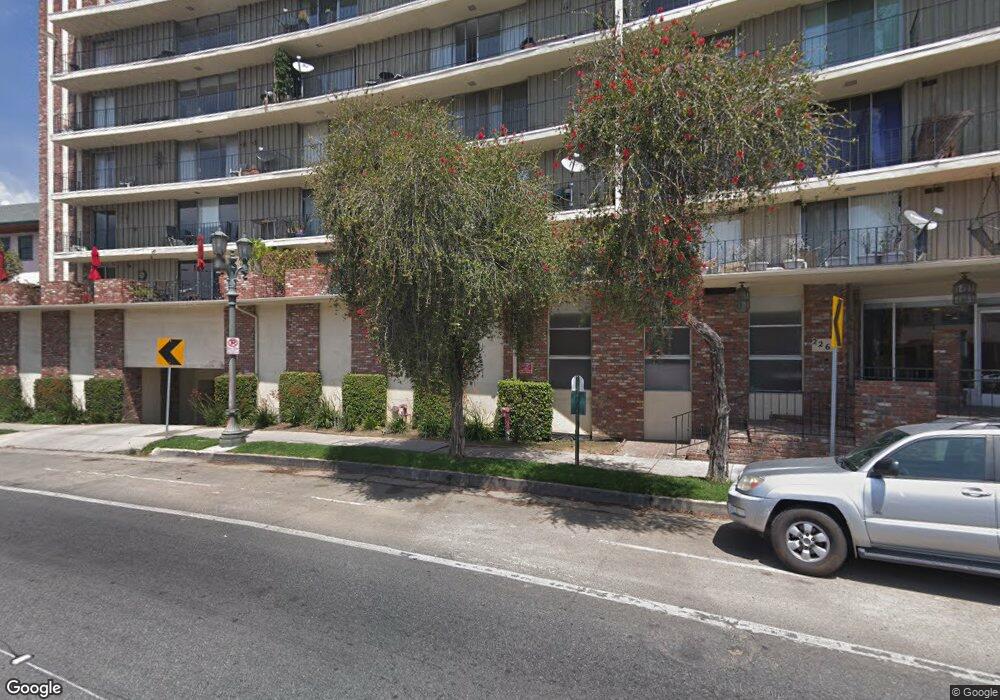

2260 N Cahuenga Blvd Unit 501 Los Angeles, CA 90068

Hollywood Hills NeighborhoodEstimated Value: $607,000 - $818,000

2

Beds

2

Baths

1,190

Sq Ft

$565/Sq Ft

Est. Value

About This Home

This home is located at 2260 N Cahuenga Blvd Unit 501, Los Angeles, CA 90068 and is currently estimated at $672,883, approximately $565 per square foot. 2260 N Cahuenga Blvd Unit 501 is a home located in Los Angeles County with nearby schools including Cheremoya Avenue Elementary School, Joseph Le Conte Middle School, and Hollywood Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 9, 2013

Sold by

Green Gail A

Bought by

Zhang Oliver

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$131,215

Interest Rate

3.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$541,668

Purchase Details

Closed on

Feb 21, 2004

Sold by

Graham Gordon

Bought by

Graham Stephen W

Purchase Details

Closed on

Oct 17, 2003

Sold by

Graham Stephen W

Bought by

Green Gail A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,900

Interest Rate

4.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zhang Oliver | $270,000 | Provident Title Company | |

| Graham Stephen W | -- | Fidelity Van Nuys | |

| Green Gail A | -- | Fidelity Van Nuys |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zhang Oliver | $180,000 | |

| Previous Owner | Green Gail A | $200,900 | |

| Closed | Green Gail A | $57,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,150 | $330,971 | $264,781 | $66,190 |

| 2024 | $4,150 | $324,483 | $259,590 | $64,893 |

| 2023 | $4,073 | $318,121 | $254,500 | $63,621 |

| 2022 | $3,911 | $311,884 | $249,510 | $62,374 |

| 2021 | $3,860 | $305,769 | $244,618 | $61,151 |

| 2019 | $3,680 | $296,701 | $237,363 | $59,338 |

| 2018 | $3,670 | $290,884 | $232,709 | $58,175 |

| 2016 | $3,467 | $279,591 | $223,674 | $55,917 |

| 2015 | $3,417 | $275,393 | $220,315 | $55,078 |

| 2014 | $3,433 | $270,000 | $216,000 | $54,000 |

Source: Public Records

Map

Nearby Homes

- 2251 N Cahuenga Blvd

- 2260 N Cahuenga Blvd Unit 502

- 2260 N Cahuenga Blvd Unit 307

- 2260 N Cahuenga Blvd Unit 203

- 6820 Whitley Terrace

- 6626 Cahuenga Terrace

- 2276 La Granada Dr

- 6476 San Marco Cir

- 2111 N Cahuenga Blvd Unit 14

- 2111 N Cahuenga Blvd Unit 1

- 2280 Holly Dr

- 6682 Whitley Terrace

- 2113 Holly Dr

- 2360 San Marco Dr

- 2001 Holly Hill Terrace

- 2354 Holly Dr

- 6325 Primrose Ave

- 6467 Deep Dell Place

- 6383 Quebec Dr

- 6477 Deep Dell Place

- 2260 N Cahuenga Blvd Unit 103

- 2260 N Cahuenga Blvd Unit 205

- 2260 N Cahuenga Blvd Unit 403

- 2260 N Cahuenga Blvd Unit 506

- 2260 N Cahuenga Blvd Unit 406

- 2260 N Cahuenga Blvd Unit 402

- 2260 N Cahuenga Blvd Unit 203

- 2260 N Cahuenga Blvd Unit 106

- 2260 N Cahuenga Blvd Unit 101

- 2260 N Cahuenga Blvd Unit 303

- 2260 N Cahuenga Blvd Unit 204

- 2260 N Cahuenga Blvd Unit 206

- 2260 N Cahuenga Blvd Unit 401

- 2260 N Cahuenga Blvd Unit 305

- 2260 N Cahuenga Blvd Unit 306

- 2260 N Cahuenga Blvd Unit 102

- 2260 N Cahuenga Blvd Unit 201

- 2260 N Cahuenga Blvd

- 2260 N Cahuenga Blvd Unit 308

- 2260 N Cahuenga Blvd Unit 104