Estimated Value: $264,000 - $360,463

4

Beds

3

Baths

2,240

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 2266 Bowman Rd, Lima, OH 45804 and is currently estimated at $311,116, approximately $138 per square foot. 2266 Bowman Rd is a home located in Allen County with nearby schools including Perry Elementary School, Perry High School, and Auglaize County Educational Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2013

Sold by

Dorley David D and Kessen Carole S

Bought by

Kessen Carole S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,484

Outstanding Balance

$126,131

Interest Rate

3.62%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$184,985

Purchase Details

Closed on

Jun 3, 2013

Sold by

Dorley David D and Estate Of Joan Pauline Dorley

Bought by

Kessen David C and Kessen Carole S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,484

Outstanding Balance

$126,131

Interest Rate

3.62%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$184,985

Purchase Details

Closed on

Apr 1, 1983

Bought by

Kessen Carole S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kessen Carole S | $273,200 | None Available | |

| Kessen David C | $95,000 | None Available | |

| Kessen Carole S | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kessen David C | $204,484 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,636 | $95,410 | $8,470 | $86,940 |

| 2023 | $3,369 | $79,520 | $7,070 | $72,450 |

| 2022 | $3,380 | $79,520 | $7,070 | $72,450 |

| 2021 | $3,355 | $79,520 | $7,070 | $72,450 |

| 2020 | $3,137 | $69,440 | $6,370 | $63,070 |

| 2019 | $3,137 | $69,440 | $6,370 | $63,070 |

| 2018 | $3,047 | $69,440 | $6,370 | $63,070 |

| 2017 | $2,868 | $63,880 | $6,300 | $57,580 |

| 2016 | $2,906 | $63,880 | $6,300 | $57,580 |

| 2015 | $2,651 | $63,880 | $6,300 | $57,580 |

| 2014 | $2,651 | $57,580 | $5,920 | $51,660 |

| 2013 | $2,843 | $57,580 | $5,920 | $51,660 |

Source: Public Records

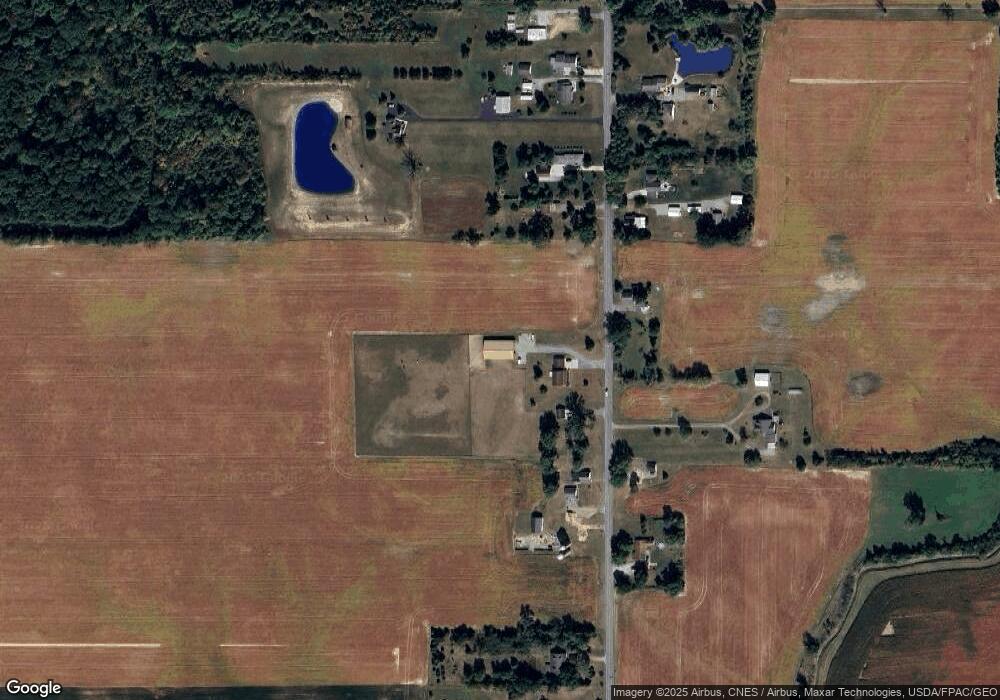

Map

Nearby Homes

- 0 Harding Hwy Unit 307187

- 0 Harding Hwy Unit 19317256

- 2500 Greely Chapel Rd

- 4160 E Hanthorn Rd

- 32 Lakeside Dr

- 2525 Harding Hwy

- 304 Pinewood Cir

- 303 Pinewood Cir

- 221 Devonshire Dr

- 712 Radcliffe St

- 125 Kensington Cir

- 108 Valley Way

- 2223 Makin Dr

- 3833 Harding Hwy

- 2213 Wellesley Dr

- 3746 Armstead Place

- 120 Barnsbury Dr

- 1803 Saint Johns Rd

- 1330 Essex Dr

- 800 Heritage Dr

Your Personal Tour Guide

Ask me questions while you tour the home.