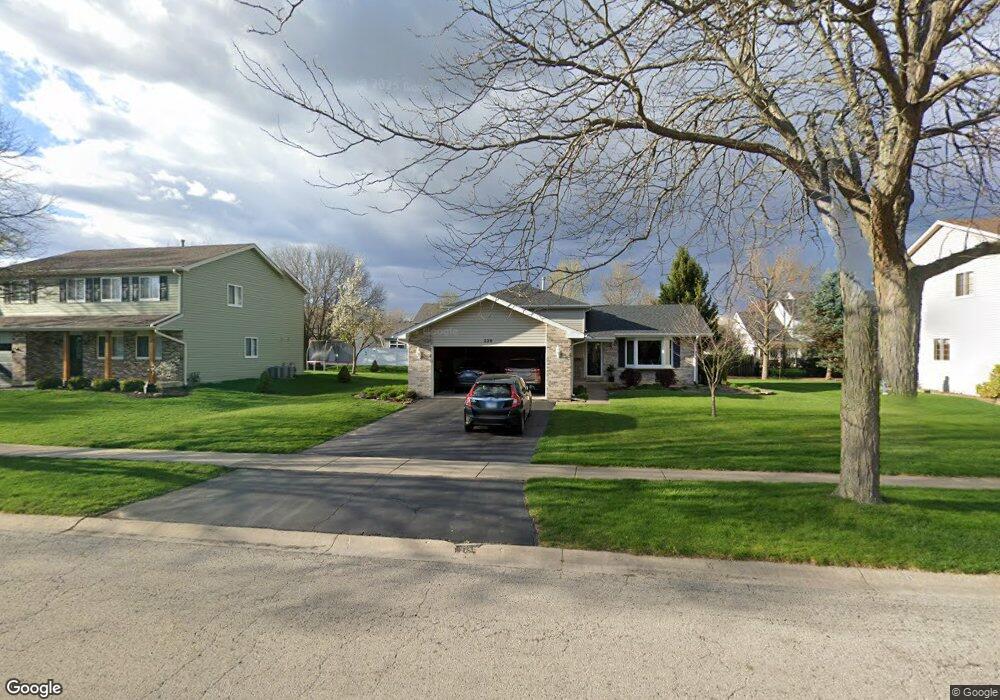

228 Fox Chase Dr N Oswego, IL 60543

Northwest Oswego NeighborhoodEstimated Value: $334,000 - $359,000

3

Beds

2

Baths

1,171

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 228 Fox Chase Dr N, Oswego, IL 60543 and is currently estimated at $344,775, approximately $294 per square foot. 228 Fox Chase Dr N is a home located in Kendall County with nearby schools including Fox Chase Elementary School, Traughber Junior High School, and Oswego High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 29, 2004

Sold by

Hauser Brian K and Hauser Melissa

Bought by

Baker John F and Baker Connie S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Outstanding Balance

$82,027

Interest Rate

5.74%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$262,748

Purchase Details

Closed on

Mar 27, 2000

Sold by

Probst James J and Probst Julie H

Bought by

Hauser Brian K and Hauser Melissa L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

8.31%

Purchase Details

Closed on

Sep 1, 1995

Bought by

Probst James J and Probst Julie H

Purchase Details

Closed on

Oct 1, 1993

Bought by

Diemer Sidney

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Baker John F | $220,000 | First American Title | |

| Hauser Brian K | $149,000 | Chicago Title Insurance Co | |

| Probst James J | $133,200 | -- | |

| Diemer Sidney | $119,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Baker John F | $176,000 | |

| Previous Owner | Hauser Brian K | $125,000 | |

| Closed | Diemer Sidney | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,177 | $95,188 | $14,485 | $80,703 |

| 2023 | $6,499 | $84,989 | $12,933 | $72,056 |

| 2022 | $6,499 | $77,971 | $11,865 | $66,106 |

| 2021 | $6,387 | $74,258 | $11,300 | $62,958 |

| 2020 | $6,380 | $73,523 | $11,188 | $62,335 |

| 2019 | $6,038 | $68,906 | $11,188 | $57,718 |

| 2018 | $5,787 | $67,748 | $11,000 | $56,748 |

| 2017 | $5,401 | $58,685 | $6,623 | $52,062 |

| 2016 | $5,512 | $58,999 | $17,007 | $41,992 |

| 2015 | $5,144 | $53,153 | $15,322 | $37,831 |

| 2014 | -- | $50,145 | $14,455 | $35,690 |

| 2013 | -- | $50,652 | $14,601 | $36,051 |

Source: Public Records

Map

Nearby Homes

- 1721 State Route 31

- 608 Clearwater Ct

- 2100 Light Rd Unit 109

- 133 River Mist Dr Unit 3

- 602 Clearwater Ct Unit 2

- 156 River Mist Dr

- 2110 State Route 31

- 173 Dolores St

- 403 Lake Ct

- 102 Mary St

- 409 Fawn Dr

- 505 Parkland Ct

- 7.43 Acres Vacant La State Route 31

- 2350 State Route 31

- 338 Millstream Ln Unit 1

- 11-13 W Anchor Rd

- 125 Presidential Blvd Unit 3248

- 435 Fawn Dr

- 5.43 B-3 Commercial State Route 31

- Parcel 004 & 003 Illinois 25

- 230 Fox Chase Dr N

- 226 Fox Chase Dr N

- 411 Lennox Dr Unit 1

- 413 Lennox Dr Unit 1

- 409 Lennox Dr Unit 1

- 224 Fox Chase Dr N Unit 1

- 232 Fox Chase Dr N Unit 1

- 241 Whitetail Crossing

- 415 Lennox Dr Unit 1

- 229 Fox Chase Dr N

- 231 Fox Chase Dr N

- 222 Fox Chase Dr N Unit 1

- 234 Fox Chase Dr N

- 417 Lennox Dr Unit 1

- 239 Whitetail Crossing

- 223 Fox Chase Dr N

- 405 Lennox Ct Unit 1

- 233 Fox Chase Dr N Unit 1

- 419 Lennox Dr Unit 1

- 220 Fox Chase Dr N Unit 1