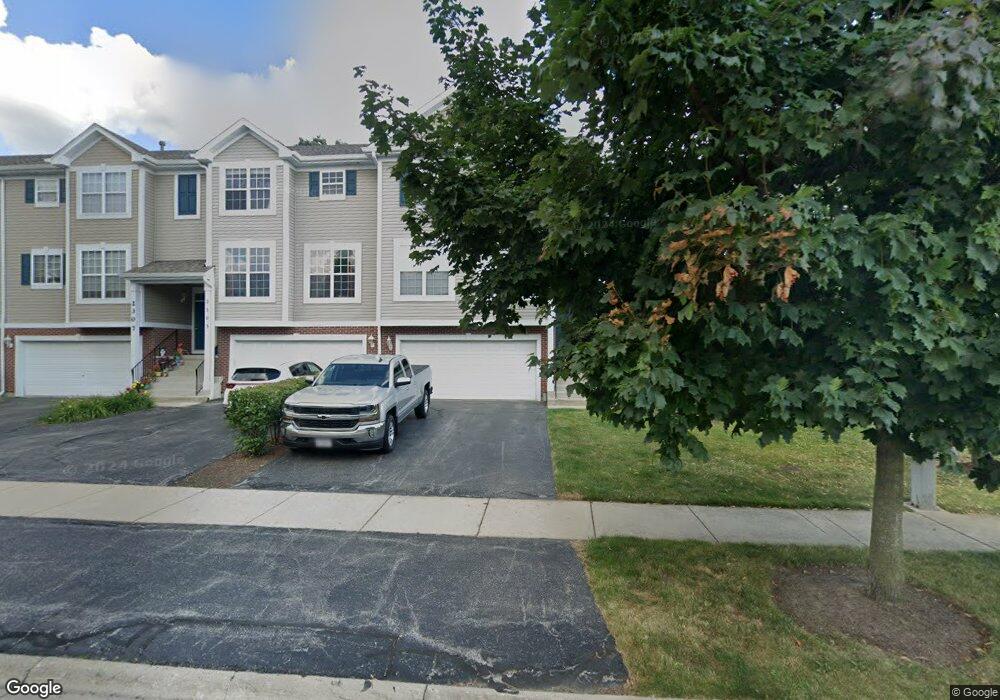

2299 Hudson Cir Unit 2804 Aurora, IL 60502

Eola Yards NeighborhoodEstimated Value: $323,000 - $350,000

3

Beds

3

Baths

1,588

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 2299 Hudson Cir Unit 2804, Aurora, IL 60502 and is currently estimated at $341,373, approximately $214 per square foot. 2299 Hudson Cir Unit 2804 is a home located in DuPage County with nearby schools including Nancy Young Elementary School, Francis Granger Middle School, and Metea Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2009

Sold by

Carlentine Francyne

Bought by

Thiel Justin and Chavez Lorena

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,312

Outstanding Balance

$111,179

Interest Rate

5.27%

Mortgage Type

FHA

Estimated Equity

$230,194

Purchase Details

Closed on

Nov 26, 2003

Sold by

Wiseman Hughes Enterprises Inc

Bought by

Carlentine Francyne E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,440

Interest Rate

6.01%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thiel Justin | $208,000 | First American Title | |

| Carlentine Francyne E | $199,500 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thiel Justin | $169,312 | |

| Previous Owner | Carlentine Francyne E | $159,440 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,607 | $94,897 | $20,210 | $74,687 |

| 2023 | $6,280 | $85,270 | $18,160 | $67,110 |

| 2022 | $5,812 | $75,310 | $16,040 | $59,270 |

| 2021 | $5,652 | $72,620 | $15,470 | $57,150 |

| 2020 | $5,721 | $72,620 | $15,470 | $57,150 |

| 2019 | $5,510 | $69,070 | $14,710 | $54,360 |

| 2018 | $5,213 | $65,020 | $13,850 | $51,170 |

| 2017 | $5,119 | $62,810 | $13,380 | $49,430 |

| 2016 | $5,019 | $60,280 | $12,840 | $47,440 |

| 2015 | $4,955 | $57,230 | $12,190 | $45,040 |

| 2014 | $4,871 | $54,890 | $11,690 | $43,200 |

| 2013 | $4,823 | $55,270 | $11,770 | $43,500 |

Source: Public Records

Map

Nearby Homes

- 452 Jamestown Ct Unit 506

- 2494 Stoughton Cir Unit 352504

- 2481 Stoughton Cir Unit 351402

- 2479 Stoughton Cir Unit 351403

- 2295 Stoughton Dr Unit 904D

- 2279 Reflections Dr Unit 1208

- 2263 Reflections Dr Unit C1108

- 2235 Cheshire Dr

- 354 Vaughn Cir

- 2225 Beaumont Ct

- 369 Vaughn Cir

- 494 Vaughn Cir

- 1900 E New York St

- 227 Vaughn Rd

- 167 Forestview Ct

- 1008 Asbury Dr

- 2578 Crestview Dr

- 2420 Glenford Dr

- 921 Parkhill Cir

- 973 Parkhill Cir Unit 973-B

- 2303 Hudson Cir Unit 2803

- 2307 Hudson Cir Unit 2802

- 2293 Hudson Cir Unit 2901

- 2289 Hudson Cir Unit 2902

- 2289 Hudson Cir Unit 2

- 2311 Hudson Cir Unit 2706

- 2313 Hudson Cir Unit 2705

- 2285 Hudson Cir Unit 2903

- 2315 Hudson Cir Unit 2704

- 2301 Hudson Cir Unit 3205

- 2305 Hudson Cir Unit 3206

- 2283 Hudson Cir Unit 2904

- 2317 Hudson Cir Unit 2703

- 2297 Hudson Cir Unit 3204

- 2295 Hudson Cir Unit 3203

- 2291 Hudson Cir Unit 3202

- 2319 Hudson Cir Unit 2702

- 2287 Hudson Cir Unit 3201

- 2333 Hudson Cir Unit 2601

- 2321 Hudson Cir Unit 2701