23 Roosevelt Ave Unit 23C Bantam, CT 06750

Estimated Value: $331,000 - $407,000

1

Bed

1

Bath

2,705

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 23 Roosevelt Ave Unit 23C, Bantam, CT 06750 and is currently estimated at $369,755, approximately $136 per square foot. 23 Roosevelt Ave Unit 23C is a home located in Litchfield County with nearby schools including Center School, Litchfield Intermediate School, and Litchfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2005

Sold by

Blake Ronald and Blake Lenone

Bought by

Dawson Gerard and Dawson Prisca

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,500

Outstanding Balance

$102,513

Interest Rate

5.87%

Estimated Equity

$267,242

Purchase Details

Closed on

Nov 17, 1998

Sold by

Landau Tina

Bought by

Blake Lenore and Blake Ronald

Purchase Details

Closed on

Mar 18, 1997

Sold by

Ane Juliette and Clark Peter

Bought by

Burgess Tina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,954

Interest Rate

7.79%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dawson Gerard | $247,000 | -- | |

| Blake Lenore | $147,000 | -- | |

| Burgess Tina | $90,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Burgess Tina | $197,500 | |

| Previous Owner | Burgess Tina | $89,954 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,295 | $202,580 | $59,790 | $142,790 |

| 2024 | $3,991 | $202,580 | $59,790 | $142,790 |

| 2023 | $4,601 | $163,160 | $46,720 | $116,440 |

| 2022 | $4,617 | $163,160 | $46,720 | $116,440 |

| 2021 | $4,748 | $163,160 | $46,720 | $116,440 |

| 2020 | $4,764 | $163,160 | $46,720 | $116,440 |

| 2019 | $4,846 | $163,160 | $46,720 | $116,440 |

| 2018 | $5,126 | $175,560 | $57,550 | $118,010 |

| 2017 | $5,109 | $175,560 | $57,550 | $118,010 |

| 2016 | $4,951 | $175,560 | $57,550 | $118,010 |

| 2015 | -- | $175,560 | $57,550 | $118,010 |

| 2014 | $4,687 | $175,560 | $57,550 | $118,010 |

Source: Public Records

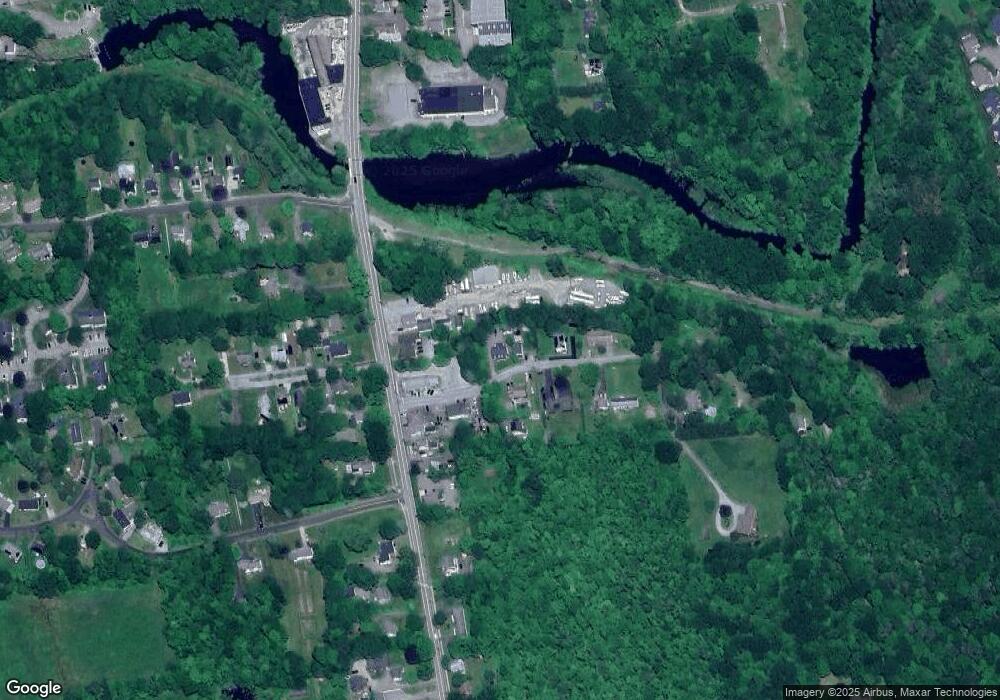

Map

Nearby Homes

- 161 Circle Dr

- 700 Bantam Rd

- 28 Trumbull St

- 36 Bantam Terrace

- 38 Old Turnpike Rd

- 17 Marsh Point

- 107 Island Trail

- 98 Island Trail

- 44 Bantam Lake Heights

- 165 Stoddard Rd

- 187 Stoddard Rd

- 262 Stoddard Rd

- 181 Stoddard Rd

- 169 E Shore Rd

- 2 Dickinson Ct

- 137 Old South Rd

- 415 South St

- 10 Gate Post Ln

- 91 North St

- 00 Torrington Rd

- 23 Roosevelt Ave Unit B

- 23 Roosevelt Ave

- 23 Roosevelt Ave Unit A

- 29 Roosevelt Ave

- 26 Roosevelt Ave

- 37 Roosevelt Ave

- 37 Roosevelt Ave Unit A

- 28 Roosevelt Ave

- 38 Roosevelt Ave

- 115 Bantam Lake Rd

- 50 Roosevelt Ave

- 47 Roosevelt Ave

- 47 Roosevelt Ave Unit Bantam 47A

- 103 Bantam Lake Rd

- 129 Bantam Lake Rd

- 120 Bantam Lake Rd

- 89 Bantam Lake Rd

- 135 Bantam Lake Rd Unit 137

- 104 Bantam Lake Rd

- 114 Bantam Lake Rd