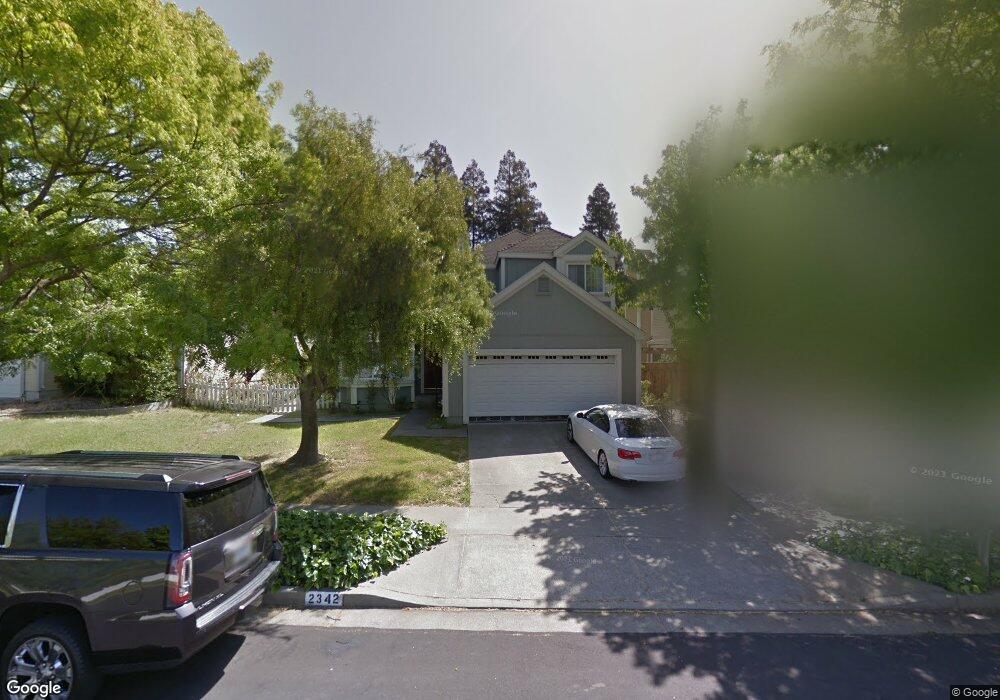

2342 10 Gate Rd Fairfield, CA 94534

Estimated Value: $572,989 - $610,000

3

Beds

3

Baths

1,502

Sq Ft

$395/Sq Ft

Est. Value

About This Home

This home is located at 2342 10 Gate Rd, Fairfield, CA 94534 and is currently estimated at $592,997, approximately $394 per square foot. 2342 10 Gate Rd is a home located in Solano County with nearby schools including K. I. Jones Elementary School, Angelo Rodriguez High School, and Solano Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 6, 2017

Sold by

2014-1 Borrower Lp

Bought by

2017-1 Ih Borrower Lp

Current Estimated Value

Purchase Details

Closed on

May 30, 2014

Sold by

Thr California Lp

Bought by

2014-1 Ih Borrower Lp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$993,738,000

Interest Rate

4.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 16, 2012

Sold by

Simon James M and Simon Kris A

Bought by

Thr California Lp

Purchase Details

Closed on

Oct 27, 1998

Sold by

Stalians Marilyn K

Bought by

Simon James M and Simon Kris A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,667

Interest Rate

6.6%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 2017-1 Ih Borrower Lp | -- | None Available | |

| 2014-1 Ih Borrower Lp | -- | None Available | |

| Thr California Lp | $198,000 | Fidelity Title Co | |

| Simon James M | $170,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | 2014-1 Ih Borrower Lp | $993,738,000 | |

| Previous Owner | Simon James M | $166,667 | |

| Closed | Simon James M | $8,333 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,124 | $441,017 | $116,056 | $324,961 |

| 2024 | $5,124 | $432,371 | $113,781 | $318,590 |

| 2023 | $4,972 | $423,894 | $111,550 | $312,344 |

| 2022 | $4,914 | $415,583 | $109,363 | $306,220 |

| 2021 | $4,868 | $407,435 | $107,219 | $300,216 |

| 2020 | $4,758 | $403,258 | $106,120 | $297,138 |

| 2019 | $4,646 | $395,352 | $104,040 | $291,312 |

| 2018 | $4,790 | $387,600 | $102,000 | $285,600 |

| 2017 | $2,802 | $224,938 | $63,661 | $161,277 |

| 2016 | $2,779 | $220,528 | $62,413 | $158,115 |

| 2015 | $2,607 | $217,216 | $61,476 | $155,740 |

| 2014 | $2,585 | $212,962 | $60,272 | $152,690 |

Source: Public Records

Map

Nearby Homes

- 2472 Vista Grande

- 2795 Vista Palomar

- 2795 Vista Palomar None

- 2837 Watson Ct

- 2051 Barbour Dr

- 58 Del Prado Cir

- 3127 Cherry Valley Cir

- 120 Goya Dr

- 1337 Avon Way

- 41 Goya Dr

- 160 Sutherlin Ln

- 1308 Sunningdale Ln

- 1300 Sunningdale Ln

- 185 Canby Way

- 1301 Sunningdale Ln

- Bryce Plan at Brighton Place

- Cora Plan at Brighton Place

- 15 Dali Ct

- 2222 Madrone Dr

- 1858 Barbour Dr