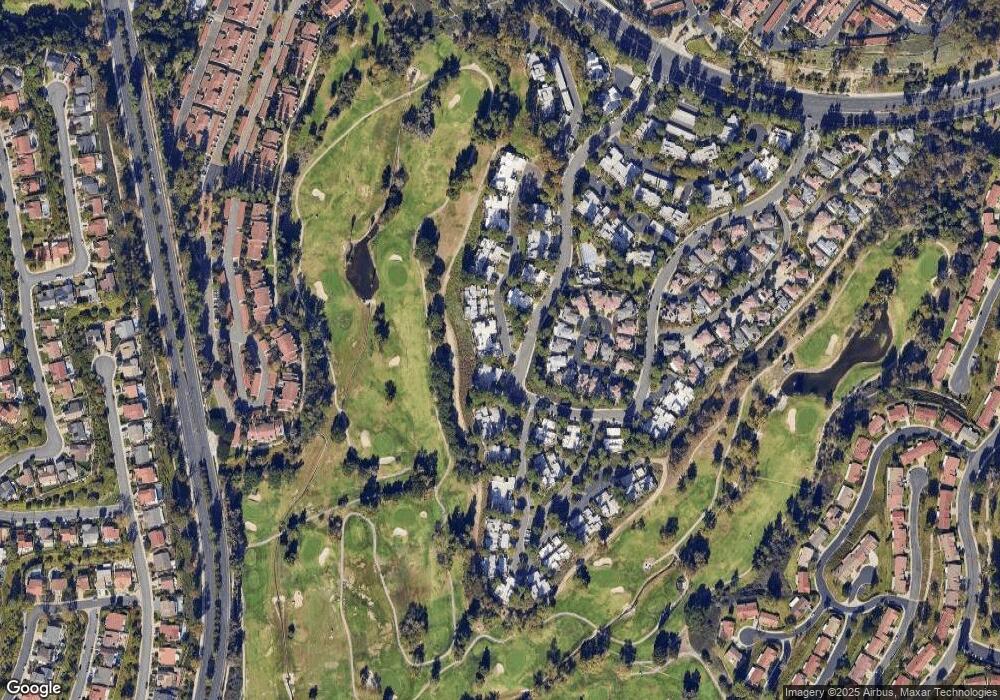

23425 Saint Andrews Mission Viejo, CA 92692

Estimated Value: $912,000 - $1,128,000

3

Beds

3

Baths

1,681

Sq Ft

$581/Sq Ft

Est. Value

About This Home

This home is located at 23425 Saint Andrews, Mission Viejo, CA 92692 and is currently estimated at $976,951, approximately $581 per square foot. 23425 Saint Andrews is a home located in Orange County with nearby schools including Castille Elementary School, Newhart Middle School, and Capistrano Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2011

Sold by

Shahabi Shawn

Bought by

Shahabi Shawn and Shahabi Kathy

Current Estimated Value

Purchase Details

Closed on

Aug 3, 2011

Sold by

Ewing Anne L and Mcgann Kraig Alan

Bought by

Shahabi Shawn

Purchase Details

Closed on

Mar 24, 2003

Sold by

Ewing Anne L and Mcgann Kraig Alan

Bought by

Mcgann Kraig Alan and Ewing Anne L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,100

Interest Rate

5.78%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Jun 16, 1998

Sold by

Brandt Kenneth O and Brandt Linda J

Bought by

Ewing Kraig Alan and Ewing Anne L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$243,000

Interest Rate

7.03%

Purchase Details

Closed on

Feb 17, 1995

Sold by

Brandt Kenneth O and Brandt Linda J

Bought by

Brandt Kenneth O and Brandt Linda J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shahabi Shawn | -- | Accommodation | |

| Shahabeddin Shahriar | -- | Accommodation | |

| Shahabi Shawn | $340,000 | Investors Title Company | |

| Mcgann Kraig Alan | -- | Equity Title Company | |

| Ewing Kraig Alan | $270,000 | Fidelity National Title Ins | |

| Brandt Kenneth O | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mcgann Kraig Alan | $232,100 | |

| Previous Owner | Ewing Kraig Alan | $243,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,180 | $427,053 | $232,771 | $194,282 |

| 2024 | $4,180 | $418,680 | $228,207 | $190,473 |

| 2023 | $4,090 | $410,471 | $223,732 | $186,739 |

| 2022 | $4,011 | $402,423 | $219,345 | $183,078 |

| 2021 | $4,003 | $394,533 | $215,044 | $179,489 |

| 2020 | $3,963 | $390,488 | $212,839 | $177,649 |

| 2019 | $3,886 | $382,832 | $208,666 | $174,166 |

| 2018 | $3,811 | $375,326 | $204,575 | $170,751 |

| 2017 | $3,737 | $367,967 | $200,564 | $167,403 |

| 2016 | $3,665 | $360,752 | $196,631 | $164,121 |

| 2015 | $3,627 | $355,334 | $193,678 | $161,656 |

| 2014 | $3,558 | $348,374 | $189,884 | $158,490 |

Source: Public Records

Map

Nearby Homes

- 23247 Cherry Hills St

- 23552 Bermuda Dunes

- 23332 Coso Unit 134

- 23224 Coso Unit 51

- 27805 Barbate Unit 15

- 23264 Copante

- 27882 Finisterra Unit 117

- 27887 Mazagon

- 27879 Chipiona Unit 52

- 23531 Via Murillo

- 27913 Trocadero Unit 68

- 23382 Via Chiripa

- 28037 Via Tirso

- 23251 Via Guadix

- 28041 Via Machado

- 23032 Sonoita

- 27241 Via Burgos

- 23902 Via Lugones

- 23247 El Greco

- 23232 El Greco

- 23423 Saint Andrews Unit 95

- 23423 Saint Andrews

- 23421 Saint Andrews Unit 94

- 23427 Saint Andrews Unit 97

- 23421 Saint Andrews

- 23403 Saint Andrews Unit 92

- 23405 Saint Andrews

- 23403 Saint Andrews

- 23401 Saint Andrews

- 23387 Saint Andrews

- 23385 Saint Andrews

- 23383 Saint Andrews

- 23383 Saint Andrews Unit 88

- 23381 Saint Andrews

- 23383 Saint Andrews

- 23357 Saint Andrews Unit 86

- 23357 Saint Andrews

- 23355 Saint Andrews Unit 85

- 23355 Saint Andrews

- 23353 Saint Andrews Unit 84