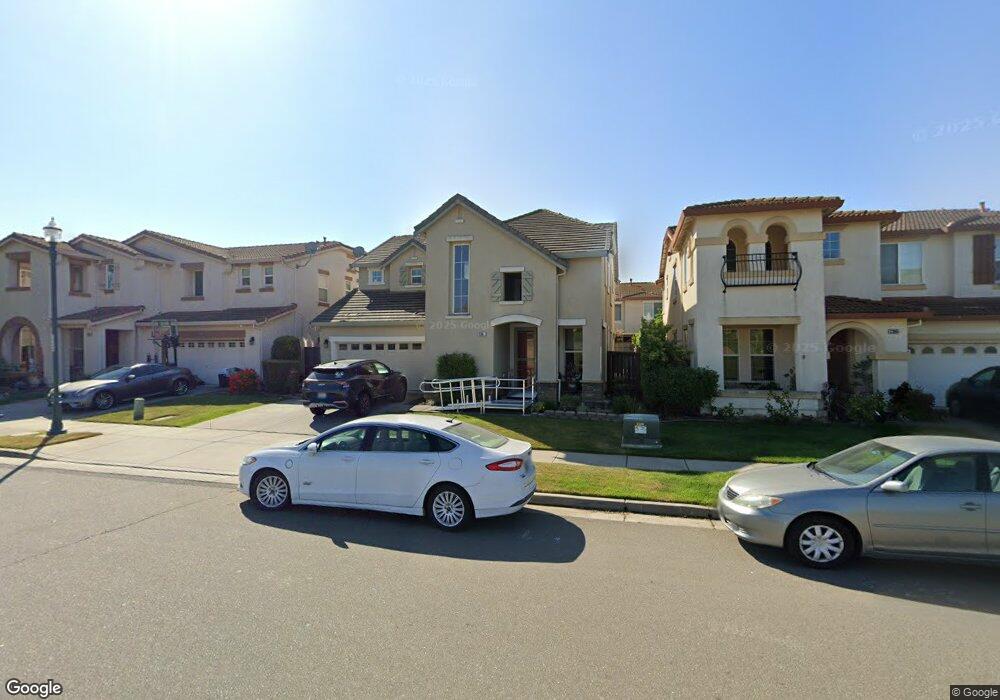

2369 Josiah Wing Dr Fairfield, CA 94533

Estimated Value: $629,000 - $680,000

3

Beds

3

Baths

2,520

Sq Ft

$262/Sq Ft

Est. Value

About This Home

This home is located at 2369 Josiah Wing Dr, Fairfield, CA 94533 and is currently estimated at $660,255, approximately $262 per square foot. 2369 Josiah Wing Dr is a home located in Solano County with nearby schools including Center Elementary School, Golden West Middle School, and Vanden High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2014

Sold by

Wilson Timothy Earl and Wilson Maria Theresa P

Bought by

Mimay Grant A and Mimay Christina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$418,365

Outstanding Balance

$317,646

Interest Rate

4.23%

Mortgage Type

VA

Estimated Equity

$342,609

Purchase Details

Closed on

Apr 12, 2010

Sold by

E Trade Bank

Bought by

Wilson Timothy Earl and Wilson Maria Theresa P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

5.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 16, 2009

Sold by

Henderson John C

Bought by

E*Trade Bank

Purchase Details

Closed on

Jun 9, 2004

Sold by

Wester Pacific Housing Inc

Bought by

Henderson John C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$310,200

Interest Rate

4%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mimay Grant A | $405,000 | Old Republic Title Company | |

| Wilson Timothy Earl | $300,000 | Orange Coast Title Lender Se | |

| E*Trade Bank | $295,000 | Accommodation | |

| Henderson John C | $388,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mimay Grant A | $418,365 | |

| Previous Owner | Wilson Timothy Earl | $300,000 | |

| Previous Owner | Henderson John C | $310,200 | |

| Closed | Henderson John C | $58,163 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,578 | $496,463 | $91,934 | $404,529 |

| 2024 | $5,578 | $486,730 | $90,132 | $396,598 |

| 2023 | $7,282 | $477,187 | $88,365 | $388,822 |

| 2022 | $6,918 | $467,832 | $86,633 | $381,199 |

| 2021 | $6,820 | $458,660 | $84,935 | $373,725 |

| 2020 | $6,728 | $453,958 | $84,065 | $369,893 |

| 2019 | $6,609 | $445,058 | $82,417 | $362,641 |

| 2018 | $6,521 | $436,332 | $80,801 | $355,531 |

| 2017 | $6,337 | $427,777 | $79,217 | $348,560 |

| 2016 | $6,253 | $419,390 | $77,664 | $341,726 |

| 2015 | $6,158 | $413,091 | $76,498 | $336,593 |

| 2014 | $5,104 | $315,899 | $78,975 | $236,924 |

Source: Public Records

Map

Nearby Homes

- 2472 Shorey Way

- 2438 Sheldon Dr

- 5018 Brown Ln

- 5206 Conley Ln

- 5277 Shumway Place

- 2433 Sanders Ln

- 5360 Discovery Way

- 5300 Finkas Ln

- 5311 Gramercy Cir

- 2426 Lake Club Dr

- 6012 Big Sky Dr

- 2429 Artisan Way

- 6008 Big Sky Dr

- 5987 Big Sky Dr

- 2529 Lake Club Dr

- 3029 Puffin Cir

- 5712 Lake Club Dr

- 5716 Lake Club Dr

- Residence 2 Plan at Emerald at One Lake

- Residence 1X Plan at Emerald at One Lake

- 2373 Josiah Wing Dr

- 2410 Flatley Cir

- 2414 Flatley Cir

- 2377 Josiah Wing Dr

- 2361 Josiah Wing Dr

- 2406 Flatley Cir

- 2418 Flatley Cir

- 2402 Flatley Cir

- 2381 Josiah Wing Dr

- 2357 Josiah Wing Dr

- 2422 Flatley Cir

- 2398 Flatley Cir

- 2385 Josiah Wing Dr

- 2426 Flatley Cir

- 2390 Flatley Cir

- 2405 Flatley Cir

- 2353 Josiah Wing Dr

- 2409 Flatley Cir

- 2397 Flatley Cir