Estimated Value: $496,514 - $619,000

2

Beds

2

Baths

1,018

Sq Ft

$531/Sq Ft

Est. Value

About This Home

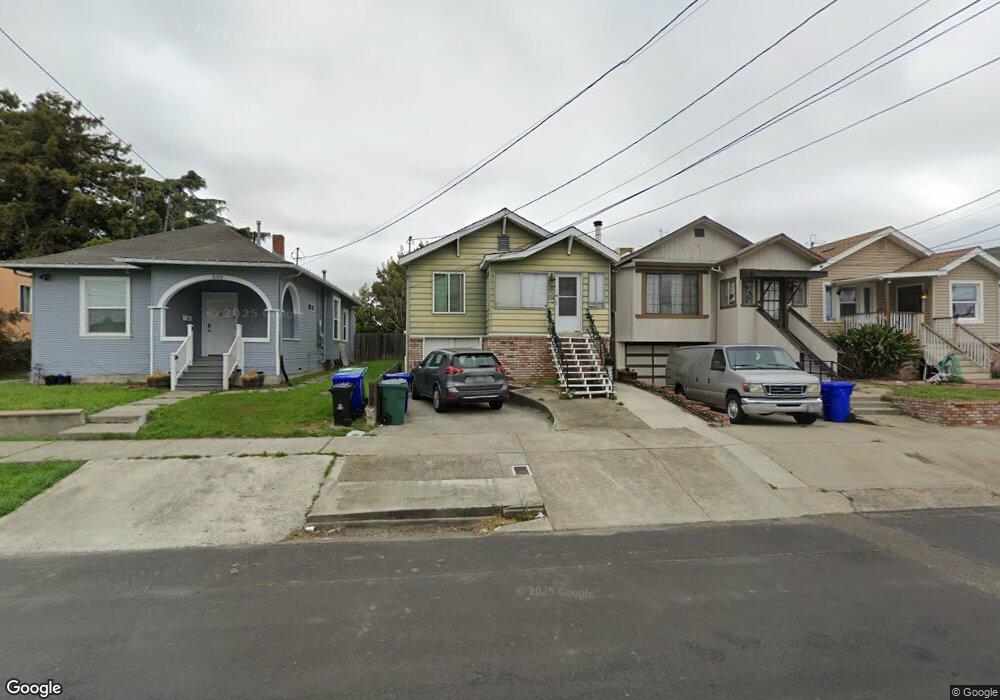

This home is located at 239 Garretson Ave, Rodeo, CA 94572 and is currently estimated at $540,129, approximately $530 per square foot. 239 Garretson Ave is a home located in Contra Costa County with nearby schools including Rodeo Hills Elementary School, Carquinez Middle School, and John Swett High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 2, 2017

Sold by

Joyce Randall Aaron

Bought by

Joyce Gloria V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$392,850

Outstanding Balance

$327,089

Interest Rate

4.23%

Mortgage Type

New Conventional

Estimated Equity

$213,040

Purchase Details

Closed on

Apr 24, 2017

Sold by

Hammonds Leila M and Condley Cali P

Bought by

Joyce Gloria V

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$392,850

Outstanding Balance

$327,089

Interest Rate

4.23%

Mortgage Type

New Conventional

Estimated Equity

$213,040

Purchase Details

Closed on

Dec 10, 2014

Sold by

Burns Myra S

Bought by

Hammonds Leila M and Condley Cali P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,500

Interest Rate

4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 5, 2004

Sold by

Burns Rowena

Bought by

Burns Rowena

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Joyce Gloria V | -- | Placer Title Company | |

| Joyce Gloria V | $405,000 | Placer Title Company | |

| Hammonds Leila M | $250,000 | First American Title Company | |

| Burns Rowena | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Joyce Gloria V | $392,850 | |

| Previous Owner | Hammonds Leila M | $237,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,111 | $470,031 | $232,114 | $237,917 |

| 2024 | $6,888 | $460,815 | $227,563 | $233,252 |

| 2023 | $6,888 | $451,780 | $223,101 | $228,679 |

| 2022 | $6,756 | $442,923 | $218,727 | $224,196 |

| 2021 | $6,629 | $434,239 | $214,439 | $219,800 |

| 2019 | $6,469 | $421,362 | $208,080 | $213,282 |

| 2018 | $6,293 | $413,100 | $204,000 | $209,100 |

| 2017 | $4,389 | $258,887 | $165,688 | $93,199 |

| 2016 | $4,032 | $253,812 | $162,440 | $91,372 |

| 2015 | $3,998 | $250,000 | $160,000 | $90,000 |

| 2014 | $1,496 | $28,550 | $15,375 | $13,175 |

Source: Public Records

Map

Nearby Homes

- 229 Lake Ave

- 201 Lake Ave

- 215 4th St

- 343 Rodeo Ave

- 1012 Rock Harbor Point

- 715 Mariposa Ave

- 220 Vaqueros Ave

- 60 Railroad Ave

- 1027 3rd St

- 601 Napa Ave

- 1334 7th St

- 919 Elm Dr

- 836 Hawthorne Dr

- 909 Seascape Cir

- 834 Coral Ridge Cir

- 943 Coral Ridge Cir

- 801 Dover

- 704 Windsor Unit 704

- 120 Bonita Ct

- 405 Weymouth

- 243 Garretson Ave

- 247 Garretson Ave

- 251 Garretson Ave

- 233 Garretson Ave

- 223 Garretson Ave

- 234 Lake Ave

- 240 Lake Ave

- 226 Lake Ave

- 215 Garretson Ave

- 252 Lake Ave

- 248 Garretson Ave

- 240 Garretson Ave

- 301 Garretson Ave

- 232 Garretson Ave

- 226 Garretson Ave

- 305 Garretson Ave

- 222 3rd St

- 218 Garretson Ave

- 311 Garretson Ave

- 333 3rd St