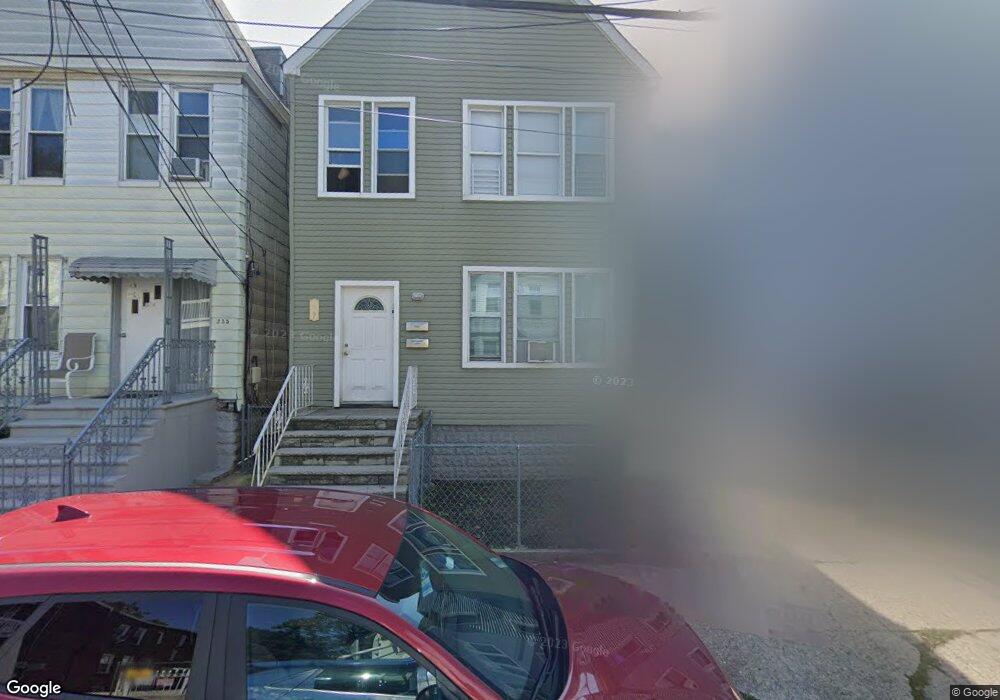

239 Grant Ave Unit 2nd Floor Jersey City, NJ 07305

West Side NeighborhoodEstimated Value: $769,000 - $920,000

3

Beds

1

Bath

2,974

Sq Ft

$276/Sq Ft

Est. Value

About This Home

This home is located at 239 Grant Ave Unit 2nd Floor, Jersey City, NJ 07305 and is currently estimated at $821,187, approximately $276 per square foot. 239 Grant Ave Unit 2nd Floor is a home located in Hudson County with nearby schools including James F. Murray School - P.S. 38, Henry Snyder High School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2021

Sold by

Rodriguez Emeterio and Rodriguez Sylvia

Bought by

Suarez Somjid and Suarez Albis

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$643,136

Outstanding Balance

$585,206

Interest Rate

2.8%

Mortgage Type

FHA

Estimated Equity

$235,981

Purchase Details

Closed on

Nov 8, 2020

Sold by

Rodriguez Silvia and Rodriguez Emeterio

Bought by

Rodriguez Emeterio and Rodriguez Sylvia

Purchase Details

Closed on

Mar 25, 2013

Sold by

Cartagena Inez and Werner Inez

Bought by

Rodriguez Emeterio and Rodriguez Sylvia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,362

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

May 12, 1999

Sold by

Cartagena Samuel and Cartagena Inez

Bought by

Cartagena Inez and Rodriguez Emeterio

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Suarez Somjid | $655,000 | Old Republic Natl Ttl Ins Co | |

| Rodriguez Emeterio | -- | All Ahead Title | |

| Rodriguez Emeterio | -- | All Ahead Title | |

| Rodriguez Emeterio | $52,872 | None Available | |

| Cartagena Inez | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Suarez Somjid | $643,136 | |

| Previous Owner | Rodriguez Emeterio | $137,362 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,460 | $558,000 | $94,000 | $464,000 |

| 2024 | $12,538 | $558,000 | $94,000 | $464,000 |

| 2023 | $12,538 | $558,000 | $94,000 | $464,000 |

| 2022 | $4,859 | $229,400 | $94,000 | $135,400 |

| 2021 | $3,680 | $229,400 | $94,000 | $135,400 |

| 2020 | $3,693 | $229,400 | $94,000 | $135,400 |

| 2019 | $4,925 | $319,800 | $94,000 | $225,800 |

| 2018 | $1,231 | $319,800 | $94,000 | $225,800 |

| 2017 | $6,451 | $82,700 | $12,000 | $70,700 |

| 2016 | $6,369 | $82,700 | $12,000 | $70,700 |

| 2015 | $5,938 | $82,700 | $12,000 | $70,700 |

| 2014 | $5,898 | $82,700 | $12,000 | $70,700 |

Source: Public Records

Map

Nearby Homes

- 205 Orient Ave

- 406 Westside Ave

- 224 Ege Ave

- 25 Morton Place

- 53 College St

- 149 Culver Ave

- 207 Virginia Ave

- 166 Grant Ave

- 164 Grant Ave

- 172 Culver Ave Unit 301

- 172 Culver Ave

- 172 Culver Ave Unit 204

- 172 Culver Ave Unit 206

- 28 Clarke Ave

- 299 Bergen Ave

- 297 Claremont Ave

- 249 Bergen Ave Unit 201

- 249 Bergen Ave Unit 302

- 249 Bergen Ave Unit 301

- 249 Bergen Ave Unit 101

- 239 Grant Ave

- 239 Grant Ave Unit 2

- 237 Grant Ave

- 235 Grant Ave

- 241 Grant Ave

- 233 Grant Ave

- 243 Grant Ave

- 231 Grant Ave

- 240 Grant Ave

- 240 Grant Ave Unit 2ND FL

- 238 Grant Ave

- 245 Grant Ave

- 245 Grant Ave Unit 1

- 245 Grant Ave Unit 2

- 234 Grant Ave

- 229 Grant Ave

- 229 Grant Ave Unit 2

- 232 Grant Ave

- 50 Broadman Pkwy

- 48 Broadman Pkwy