2401 Cedar Dr Basalt, CO 81621

Estimated Value: $1,551,000 - $2,241,000

3

Beds

3

Baths

1,845

Sq Ft

$1,025/Sq Ft

Est. Value

About This Home

This home is located at 2401 Cedar Dr, Basalt, CO 81621 and is currently estimated at $1,890,834, approximately $1,024 per square foot. 2401 Cedar Dr is a home located in Eagle County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2018

Sold by

Behrens Richard Travis and Behrens Debra Diane

Bought by

Behrens Richard Travis and Behrens Debra Diane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Outstanding Balance

$126,335

Interest Rate

4.43%

Mortgage Type

New Conventional

Estimated Equity

$1,764,499

Purchase Details

Closed on

Jul 27, 2007

Sold by

Holstein Sara Laurel Cloud and Tesoro Scott

Bought by

Behrens Debra Diane and Behrens Richard Travis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

7.75%

Mortgage Type

Negative Amortization

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Behrens Richard Travis | -- | None Available | |

| Behrens Debra Diane | $475,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Behrens Richard Travis | $215,000 | |

| Previous Owner | Behrens Debra Diane | $250,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,014 | $67,360 | $33,830 | $33,530 |

| 2023 | $5,014 | $67,360 | $33,830 | $33,530 |

| 2022 | $3,603 | $44,830 | $17,200 | $27,630 |

| 2021 | $4,319 | $46,130 | $17,700 | $28,430 |

| 2020 | $4,143 | $46,130 | $17,700 | $28,430 |

| 2019 | $4,177 | $46,130 | $17,700 | $28,430 |

| 2018 | $3,545 | $37,590 | $13,370 | $24,220 |

| 2017 | $4,588 | $53,830 | $53,830 | $0 |

| 2016 | $4,520 | $51,980 | $51,980 | $0 |

Source: Public Records

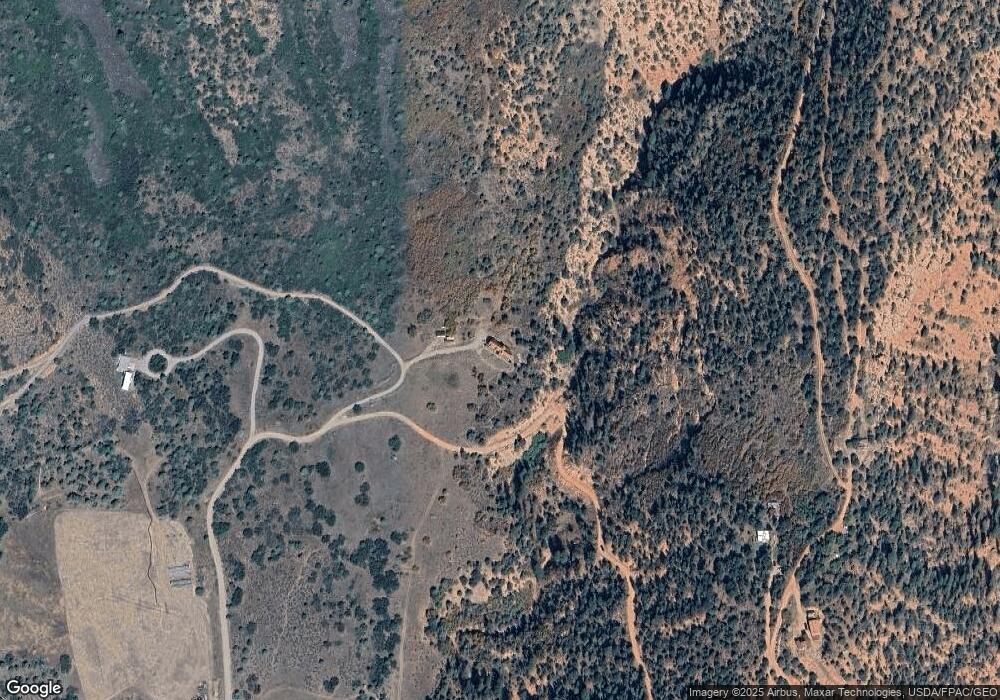

Map

Nearby Homes

- 679 Pinon Dr

- 400 Meadow Ln Unit 9

- 217 Longhorn Ln

- 262 Midland Ave

- 204 E Sopris Dr

- 175 Midland Ave Unit 10

- 165 Midland Ave

- 140 Basalt Center Cir Unit 202

- 140 Basalt Center Cir Unit 312

- 140 Basalt Center Cir Unit 215

- 140 Basalt Center Cir Unit 216

- 140 Basalt Center Cir Unit 231

- 140 Basalt Center Cir Unit 217

- 140 Basalt Center Cir Unit 209

- 140 Basalt Center Cir Unit 211

- 140 Basalt Center Cir Unit 317

- 140 Basalt Center Cir Unit 227

- 140 Basalt Center Cir Unit 220

- 140 Basalt Center Cir Unit 218

- 140 Basalt Center Cir Unit 213