24030 Basham Ln Anamosa, IA 52205

Estimated Value: $412,000 - $509,000

3

Beds

2

Baths

1,852

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 24030 Basham Ln, Anamosa, IA 52205 and is currently estimated at $465,372, approximately $251 per square foot. 24030 Basham Ln is a home located in Jones County with nearby schools including Strawberry Hill Elementary School, Anamosa Middle School, and Anamosa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 9, 2021

Sold by

Maash Lawrence Dewitt and Maash Janet Sue

Bought by

Maas Family Revocable Living Trust and Maahs

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$290,874

Interest Rate

2.7%

Mortgage Type

VA

Purchase Details

Closed on

Oct 18, 2016

Sold by

Maahs Lawrence Dewitt and Maahs Janet Sue

Bought by

Maahs Lwarence Dewitt and Maahs Janet Sue

Purchase Details

Closed on

Mar 11, 2014

Sold by

Gombert Pierre L and Gombert Lois V

Bought by

Maahs Lawrence D and Maahs Janet S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$329,797

Interest Rate

4.24%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maas Family Revocable Living Trust | -- | None Listed On Document | |

| Maahs Lawrence Dewitt | -- | None Listed On Document | |

| Maahs Lwarence Dewitt | -- | None Available | |

| Maahs Lawrence D | $325,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Maahs Lawrence Dewitt | $290,874 | |

| Previous Owner | Maahs Lawrence D | $329,797 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,898 | $407,480 | $45,180 | $362,300 |

| 2024 | $4,898 | $395,840 | $45,180 | $350,660 |

| 2023 | $4,764 | $395,840 | $45,180 | $350,660 |

| 2022 | $4,340 | $316,750 | $42,170 | $274,580 |

| 2021 | $4,340 | $316,750 | $42,170 | $274,580 |

| 2020 | $3,952 | $280,930 | $42,170 | $238,760 |

| 2019 | $3,958 | $280,930 | $42,170 | $238,760 |

| 2018 | $3,748 | $271,830 | $29,820 | $242,010 |

| 2017 | $3,590 | $271,830 | $29,820 | $242,010 |

| 2016 | $3,514 | $257,800 | $29,820 | $227,980 |

| 2015 | $3,514 | $257,800 | $29,820 | $227,980 |

| 2014 | $3,490 | $148,970 | $0 | $0 |

| 2013 | $2,138 | $148,970 | $27,280 | $121,690 |

Source: Public Records

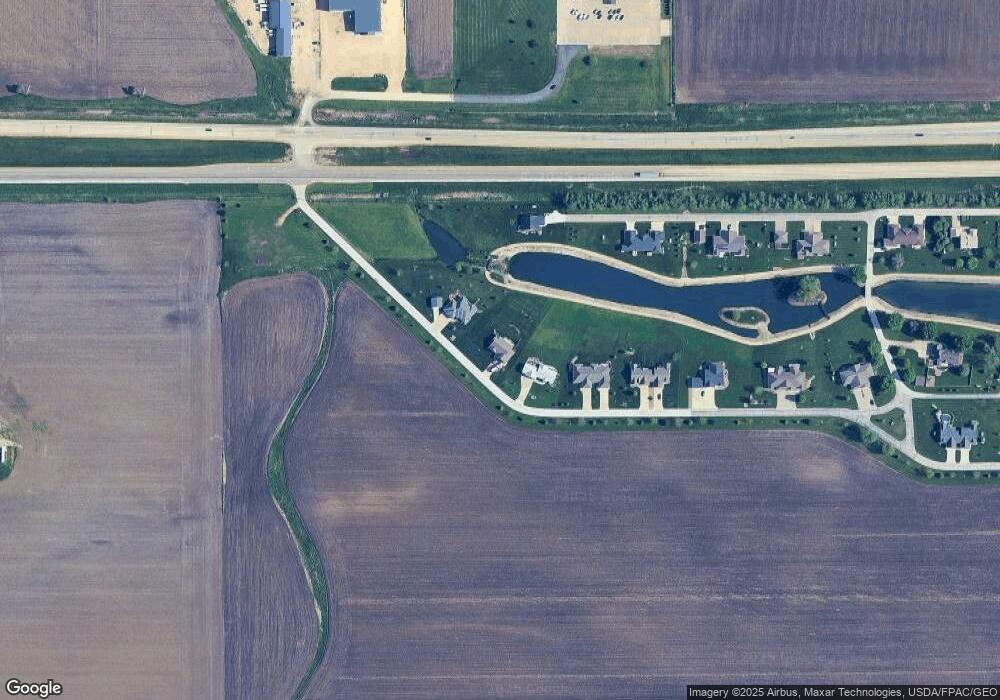

Map

Nearby Homes

- 23700 Gombert Dr

- 23672 Gombert Dr

- 23005 Antler Trail

- 22980 105th St

- 8063 218th Ave

- 231 Prairie Chapel Rd

- 7936 217 Ave

- 260 Prairie Chapel Rd

- 9071 207th Ave

- 9174 207th Ave

- 23083 County Road E34 Unit Lot 1

- 915226002 Parcel, Lot 4 Wapsi Ridge

- 417 South St

- 200 Hubbell St

- 213 Hubbell St

- 211 E Kohl St

- 608 S Garnavillo St

- 500 E Hickory St

- 605 W Main St

- 108 E 5th St

- 24002 Basham Ln

- 24050 Basham Ln

- 24000 Basham Ln

- 23992 Basham Ln

- 23962 Owen Place

- 23960 Owen Place

- 23960 Owen Place

- 23990 Basham Ln

- 23950 Basham Ln

- 23942 Owen Place Unit 23940

- 23940 Owen Place

- 23932 Basham Ln

- 23930 Basham Ln

- 23924 Owen Place

- 23928 Basham Ln

- 23920 Owen Place

- 23926 Basham Ln

- 9527 Highway 151

- 23892 Gombert Dr

- 23934 Basham Ln