2411 7th Ave SW Austin, MN 55912

Estimated Value: $312,080 - $343,000

3

Beds

3

Baths

1,902

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 2411 7th Ave SW, Austin, MN 55912 and is currently estimated at $326,520, approximately $171 per square foot. 2411 7th Ave SW is a home located in Mower County with nearby schools including Banfield Elementary School, Ellis Middle School, and I.J. Holton Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2021

Sold by

Graves Thomas A and Graves Paula K

Bought by

Kanyapue Boe and Kanyamaw Mary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$221,310

Outstanding Balance

$200,562

Interest Rate

3.1%

Mortgage Type

New Conventional

Estimated Equity

$125,958

Purchase Details

Closed on

Feb 28, 2020

Sold by

Seguin Penny

Bought by

Graves Thomas A and Graves Paula K

Purchase Details

Closed on

Jul 29, 2005

Sold by

Riles John Kenneth

Bought by

Seguin Penny

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.66%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kanyapue Boe | $245,900 | North American Title Co | |

| Graves Thomas A | $195,909 | Crestwood Hills 3Rd Add | |

| Seguin Penny | $145,000 | None Available | |

| Kanyapue Boe Boe | $245,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kanyapue Boe | $221,310 | |

| Previous Owner | Seguin Penny | $100,000 | |

| Closed | Kanyapue Boe Boe | $221,310 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,384 | $271,500 | $89,900 | $181,600 |

| 2024 | $3,384 | $270,900 | $89,900 | $181,000 |

| 2023 | $3,440 | $270,900 | $89,900 | $181,000 |

| 2022 | $2,992 | $269,800 | $86,600 | $183,200 |

| 2021 | $2,706 | $220,300 | $76,600 | $143,700 |

| 2020 | $2,902 | $197,200 | $66,600 | $130,600 |

| 2018 | $0 | $202,200 | $66,600 | $135,600 |

| 2017 | $1,868 | $0 | $0 | $0 |

| 2016 | $1,796 | $0 | $0 | $0 |

| 2015 | $2,028 | $0 | $0 | $0 |

| 2012 | $2,028 | $0 | $0 | $0 |

Source: Public Records

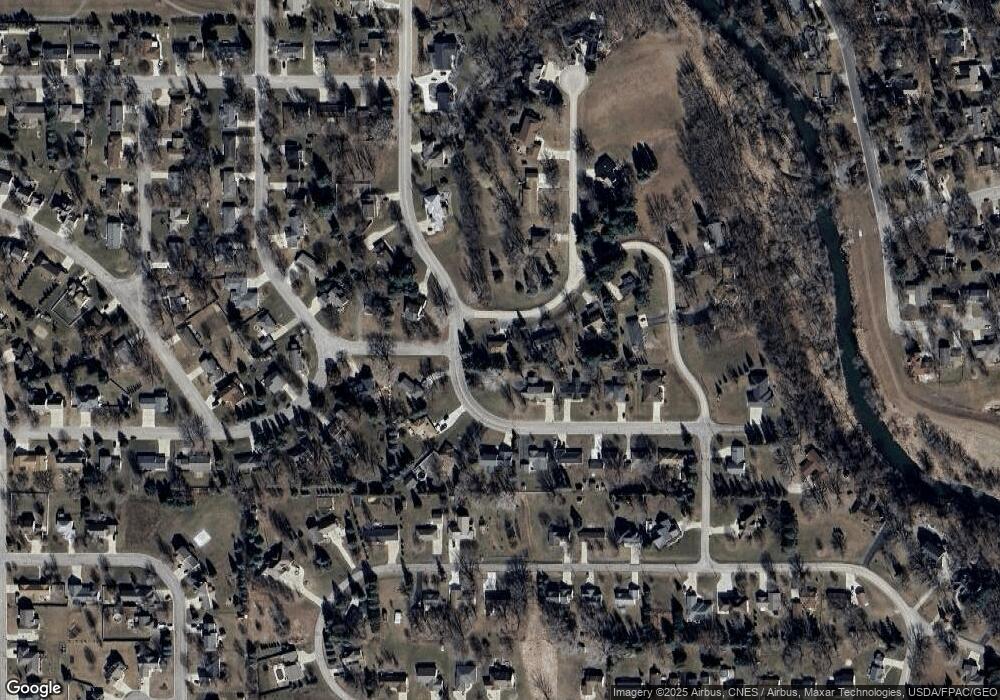

Map

Nearby Homes

- 2404 8th Ave SW

- 2424 9th Ave SW

- 707 26th St SW

- 401 21st St SW

- 2108 9th Place SW

- 1007 28th St SW

- 710 19th St SW

- 1301 28th St SW

- 2402 15th Ave SW

- 301 22nd St NW

- 1604 18th St SW

- 2402 16th Ave SW

- 1703D Carriage Home Dr SW

- 905 16th St SW

- 2100 16th Ave SW

- 2701 4th Ave NW

- 1405 17th Dr SW

- 1507 4th Ave SW

- 3007 15th Ave SW

- 2508 4th Ave NW

- 801 24th Ave NW

- 2409 7th Ave SW

- 2406 8th Ave SW

- 610 24th St SW

- 2417 8th Ave SW

- 2407 7th Ave SW

- 708 23rd St SW

- 2411 8th Ave SW

- 2415 8th Ave SW

- 2413 8th Ave SW

- 2411 8th Ave SW

- 2502 7th Ave SW

- 2409 8th Ave SW

- 2402 8th Ave SW

- 2407 8th Ave SW

- 607 24th St SW

- 2503 7th Ave SW

- 800 23rd St SW

- 706 23rd St SW

- 608 24th St SW