2438 Gird Rd Fallbrook, CA 92028

Estimated Value: $1,053,870 - $1,213,000

3

Beds

3

Baths

2,564

Sq Ft

$438/Sq Ft

Est. Value

About This Home

This home is located at 2438 Gird Rd, Fallbrook, CA 92028 and is currently estimated at $1,123,468, approximately $438 per square foot. 2438 Gird Rd is a home located in San Diego County with nearby schools including Live Oak Elementary School, James E. Potter Intermediate School, and Fallbrook High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2025

Sold by

Elzenga Brian and Elzenga Janice

Bought by

Brian J Elzenga And Janice M Elzenga Family T and Elzenga

Current Estimated Value

Purchase Details

Closed on

Nov 13, 2008

Sold by

Perry Dennis Alan and Perry Virginia Downing

Bought by

Elzenga Brian and Elzenga Janice

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$408,000

Interest Rate

6.04%

Mortgage Type

Unknown

Purchase Details

Closed on

Nov 27, 1995

Sold by

Young Chris W and Young Sharon K

Bought by

Perry Dennis Alan and Perry Virginia Downing

Purchase Details

Closed on

Jun 16, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brian J Elzenga And Janice M Elzenga Family T | -- | None Listed On Document | |

| Elzenga Brian | $510,000 | Land America Title Ins Co | |

| Perry Dennis Alan | -- | First American Title Co | |

| -- | $200,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Elzenga Brian | $408,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,492 | $800,893 | $300,563 | $500,330 |

| 2024 | $8,492 | $785,190 | $294,670 | $490,520 |

| 2023 | $8,227 | $715,486 | $283,229 | $432,257 |

| 2022 | $7,808 | $676,562 | $277,780 | $398,782 |

| 2021 | $7,282 | $676,562 | $277,780 | $398,782 |

| 2020 | $6,910 | $630,036 | $274,932 | $355,104 |

| 2019 | $6,668 | $607,880 | $259,738 | $348,142 |

| 2018 | $6,568 | $595,962 | $254,646 | $341,316 |

| 2017 | $750 | $584,277 | $249,653 | $334,624 |

| 2016 | $6,281 | $572,821 | $244,758 | $328,063 |

| 2015 | $6,183 | $564,218 | $241,082 | $323,136 |

| 2014 | $6,066 | $553,167 | $236,360 | $316,807 |

Source: Public Records

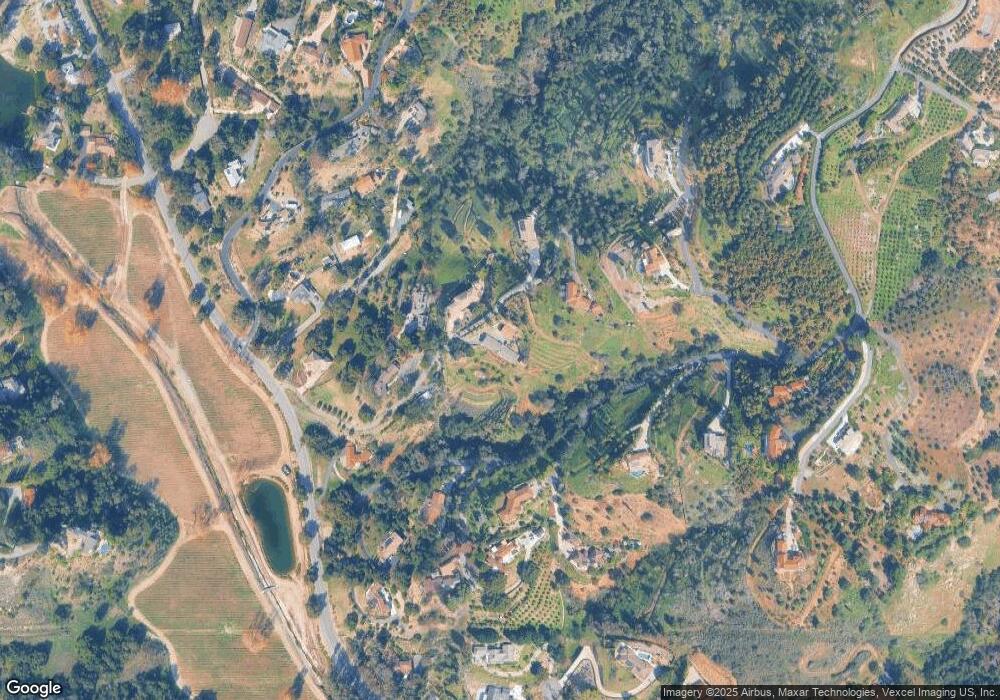

Map

Nearby Homes

- 2416 Gird Rd

- 0 Gird Rd Unit D6

- 3649 Laketree Dr

- 2719 Via Del Robles

- 2323 Wilt Rd

- 2635 Vista de Palomar

- 3655 Lupine Ln

- 0 Lupine Ln

- 3129 Reche Rd

- 2644 Dos Lomas

- 3770 Peony Dr Unit 20

- 2163 Gracey Ln

- 2328 Dos Lomas

- 1482 Wilt Rd

- 2869 Dos Lomas Place

- 3849 Pala Mesa Dr

- 3976 Lorita Ln

- 2691 Daisy Ln

- 2607 Alta Vista Dr

- 2975 Dos Lomas

- 0 Country Club Ln

- 2440 Gird Rd

- 2446 Gird Rd

- 2422 Gird Rd

- 2444 Gird Rd

- 2442 Gird Rd

- 2436 Gird Rd

- 3005 Via Del Cielo

- 3054 Via Del Cielo

- 2933 Via Del Cielo

- 2424 Gird Rd

- 3045 Via Del Cielo

- 00 Country Club Ln

- 2448 Gird Rd

- 3007 Via Del Cielo

- 2404 Gird Rd

- 2410 Gird Rd

- 3075 Via Del Cielo

- 3009 Via Del Cielo

- 2905 Via Del Cielo