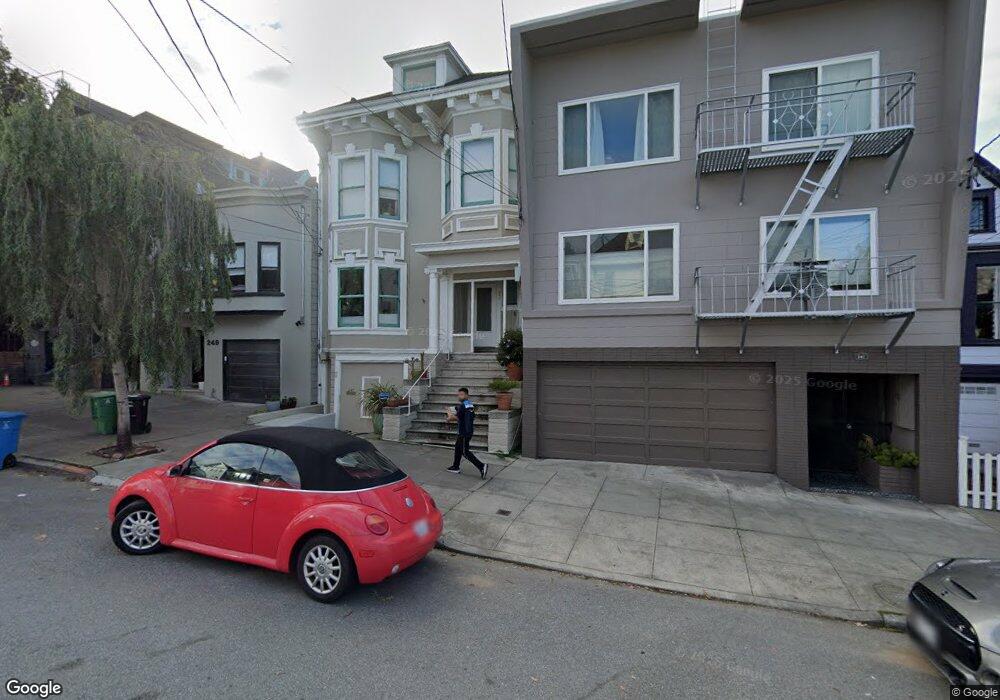

245 10th Ave Unit 247 San Francisco, CA 94118

Inner Richmond NeighborhoodEstimated Value: $1,789,000 - $3,140,436

5

Beds

2

Baths

2,940

Sq Ft

$761/Sq Ft

Est. Value

About This Home

This home is located at 245 10th Ave Unit 247, San Francisco, CA 94118 and is currently estimated at $2,236,109, approximately $760 per square foot. 245 10th Ave Unit 247 is a home located in San Francisco County with nearby schools including Sutro Elementary School, Roosevelt Middle School, and Stratford School - San Francisco 14th Avenue.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2002

Sold by

Egan Thomas A and Ryle Fiona

Bought by

Bank Benjamin M and Jersky Brian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$875,000

Outstanding Balance

$367,104

Interest Rate

6.17%

Mortgage Type

Commercial

Estimated Equity

$1,869,005

Purchase Details

Closed on

Jun 10, 1997

Sold by

Venetia Gingold

Bought by

Egan Thomas A and Ryle Fiona

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$344,000

Interest Rate

4.25%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bank Benjamin M | $1,175,000 | First American Title Company | |

| Egan Thomas A | $430,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bank Benjamin M | $875,000 | |

| Previous Owner | Egan Thomas A | $344,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $20,334 | $1,701,776 | $1,021,069 | $680,707 |

| 2024 | $20,334 | $1,668,409 | $1,001,049 | $667,360 |

| 2023 | $20,029 | $1,635,696 | $981,421 | $654,275 |

| 2022 | $19,651 | $1,603,625 | $962,178 | $641,447 |

| 2021 | $19,305 | $1,572,182 | $943,312 | $628,870 |

| 2020 | $19,439 | $1,556,062 | $933,640 | $622,422 |

| 2019 | $18,774 | $1,525,552 | $915,334 | $610,218 |

| 2018 | $18,138 | $1,495,640 | $897,387 | $598,253 |

| 2017 | $17,627 | $1,466,315 | $879,792 | $586,523 |

| 2016 | $17,344 | $1,437,565 | $862,542 | $575,023 |

| 2015 | $17,128 | $1,415,972 | $849,586 | $566,386 |

| 2014 | $16,676 | $1,388,236 | $832,944 | $555,292 |

Source: Public Records

Map

Nearby Homes