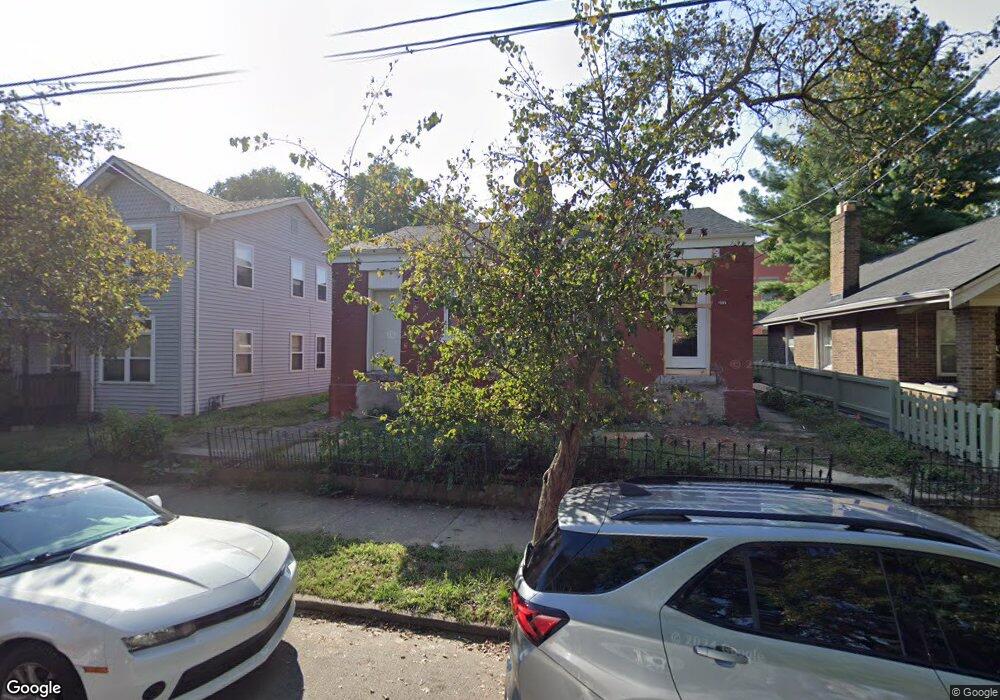

249 W 7th St Unit 251 Covington, KY 41011

Downtown Covington NeighborhoodEstimated Value: $178,728 - $248,000

2

Beds

1

Bath

1,118

Sq Ft

$190/Sq Ft

Est. Value

About This Home

This home is located at 249 W 7th St Unit 251, Covington, KY 41011 and is currently estimated at $212,682, approximately $190 per square foot. 249 W 7th St Unit 251 is a home located in Kenton County with nearby schools including Holmes High School, Prince of Peace School, and Saint Augustine Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2023

Sold by

Kenton County

Bought by

Hauck Drew W

Current Estimated Value

Purchase Details

Closed on

Jul 26, 2022

Sold by

Curb Development Limited Liability Compa

Bought by

Chantry Properties Llc

Purchase Details

Closed on

Apr 27, 2022

Sold by

Hauck Drew W and Hauck Valerie

Bought by

Curb Development Limited Liability Company

Purchase Details

Closed on

Nov 24, 2003

Sold by

Lawson Hauck Corp

Bought by

Hauck Drew W

Purchase Details

Closed on

Oct 6, 1995

Sold by

Filer Mary E

Bought by

Lawson Hauck Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hauck Drew W | $1,134 | None Listed On Document | |

| Ham Curtis | $1,134 | None Listed On Document | |

| Chantry Properties Llc | $130,000 | None Listed On Document | |

| Curb Development Limited Liability Company | $55,000 | None Listed On Document | |

| Hauck Drew W | -- | -- | |

| Lawson Hauck Corp | $24,000 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $861 | $65,000 | $5,000 | $60,000 |

| 2024 | $855 | $65,000 | $5,000 | $60,000 |

| 2023 | $866 | $65,000 | $5,000 | $60,000 |

| 2022 | $722 | $50,000 | $5,000 | $45,000 |

| 2021 | $449 | $25,000 | $5,000 | $20,000 |

| 2020 | $447 | $25,000 | $5,000 | $20,000 |

| 2019 | $451 | $25,000 | $5,000 | $20,000 |

| 2018 | $459 | $25,000 | $5,000 | $20,000 |

| 2017 | $465 | $25,000 | $5,000 | $20,000 |

| 2015 | $526 | $25,000 | $5,000 | $20,000 |

| 2014 | $560 | $25,000 | $5,000 | $20,000 |

Source: Public Records

Map

Nearby Homes

- 328 W 6th St

- 501 Johnson St

- 138 W Pike St

- 346 W 9th St

- 130 W 4th St

- 128 W 4th St

- 126 W 4th St

- 124 W 4th St

- 1025 Banklick St

- 1102 Lee St

- 1212-1234 W Pike St

- 656 W Pike St

- 664 W Pike St

- 100 W Rivercenter Blvd Unit PH3B

- 652 Western Ave

- 848 Western Ave Unit Lot 2

- 844 Western Ave Unit Lot 4

- 852 Western Ave Unit Lot 1

- 846 Western Ave Unit Lot 3

- 501 Western Ave