25611 Quail Run Unit 52 Dana Point, CA 92629

Del Obispo NeighborhoodEstimated Value: $524,914 - $567,000

1

Bed

1

Bath

650

Sq Ft

$838/Sq Ft

Est. Value

About This Home

This home is located at 25611 Quail Run Unit 52, Dana Point, CA 92629 and is currently estimated at $544,729, approximately $838 per square foot. 25611 Quail Run Unit 52 is a home located in Orange County with nearby schools including Del Obispo Elementary School, Marco Forster Middle School, and Dana Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2012

Sold by

Cantrell Edd B and Cantrell Donna J

Bought by

Cantrell Edd B and Cantrell Donna J

Current Estimated Value

Purchase Details

Closed on

Nov 3, 2011

Sold by

Ferdinand Justin

Bought by

Cantrell Edd B and Cantrell Donna J

Purchase Details

Closed on

Apr 17, 2006

Sold by

Powell Christopher

Bought by

Ferdinand Justin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

6.3%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Dec 27, 2002

Sold by

Calderon Armando and Calderon Rita

Bought by

Powell Christopher

Purchase Details

Closed on

Oct 8, 1999

Sold by

Margaret Neil Margaret O and Margaret Krista

Bought by

Calderon Armando and Calderon Rita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,450

Interest Rate

7.96%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cantrell Edd B | -- | Accommodation | |

| Cantrell Edd B | $160,000 | North American Title Co Inc | |

| Ferdinand Justin | $265,000 | Ati | |

| Powell Christopher | $177,000 | American Title Co | |

| Calderon Armando | $107,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ferdinand Justin | $140,000 | |

| Previous Owner | Calderon Armando | $104,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,577 | $200,964 | $146,868 | $54,096 |

| 2024 | $2,577 | $197,024 | $143,988 | $53,036 |

| 2023 | $2,474 | $193,161 | $141,164 | $51,997 |

| 2022 | $2,383 | $189,374 | $138,396 | $50,978 |

| 2021 | $2,318 | $185,661 | $135,682 | $49,979 |

| 2020 | $2,328 | $183,758 | $134,291 | $49,467 |

| 2019 | $2,278 | $180,155 | $131,657 | $48,498 |

| 2018 | $2,218 | $176,623 | $129,075 | $47,548 |

| 2017 | $2,156 | $173,160 | $126,544 | $46,616 |

| 2016 | $2,094 | $169,765 | $124,063 | $45,702 |

| 2015 | $1,940 | $167,215 | $122,199 | $45,016 |

| 2014 | $1,907 | $163,940 | $119,805 | $44,135 |

Source: Public Records

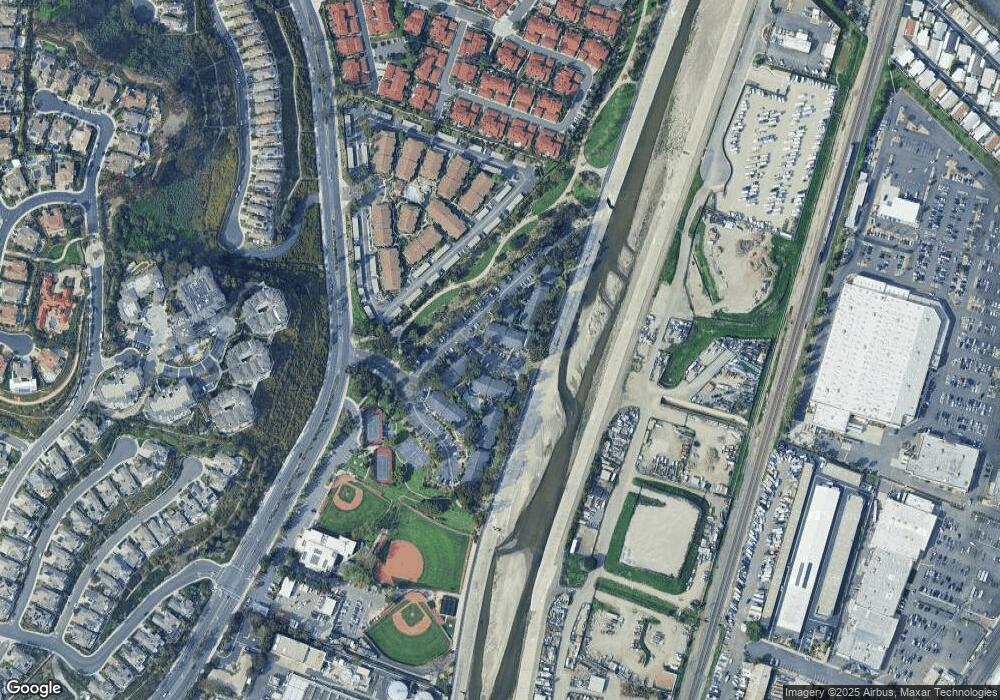

Map

Nearby Homes

- 33852 Del Obispo St Unit 70

- 33852 Del Obispo St Unit 2

- 33852 Del Obispo St Unit 135

- 25382 Sea Bluffs Dr Unit 8107

- 25432 Sea Bluffs Dr Unit 302

- 33772 Bayside Ln Unit 240

- 2148 Doheny Way

- 3321 Doheny Way

- 33651 Surfside Dr Unit 41

- 985 Doheny Way

- 33831 Camino Capistrano Unit 50

- 33831 Camino Capistrano Unit 19

- 0 Stonehill Dr Unit OC25264877

- 34052 Doheny Park Rd Unit 75

- 34052 Doheny Park Rd

- 34052 Doheny Park Rd Unit 17

- 34052 Doheny Park Rd Unit 133

- 34056 Pequito Dr

- 33856 Pequito Dr

- 3327 Doheny Way

- 25611 Quail Run

- 25611 Quail Run Unit 2

- 25611 Quail Run Unit 74

- 25611 Quail Run

- 25611 Quail Run Unit 38

- 25611 Quail Run Unit 2

- 25611 Quail Run Unit 23

- 25611 Quail Run Unit 125

- 25611 Quail Run Unit 4

- 25611 Quail Run Unit 127

- 25611 Quail Run Unit 117

- 25611 Quail Run Unit 27

- 25611 Quail Run Unit 90

- 25611 Quail Run Unit 31

- 25611 Quail Run Unit 46

- 25611 Quail Run Unit 89

- 25611 Quail Run Unit 61

- 25611 Quail Run Unit 91

- 25611 Quail Run Unit 70

- 25611 Quail Run Unit 92