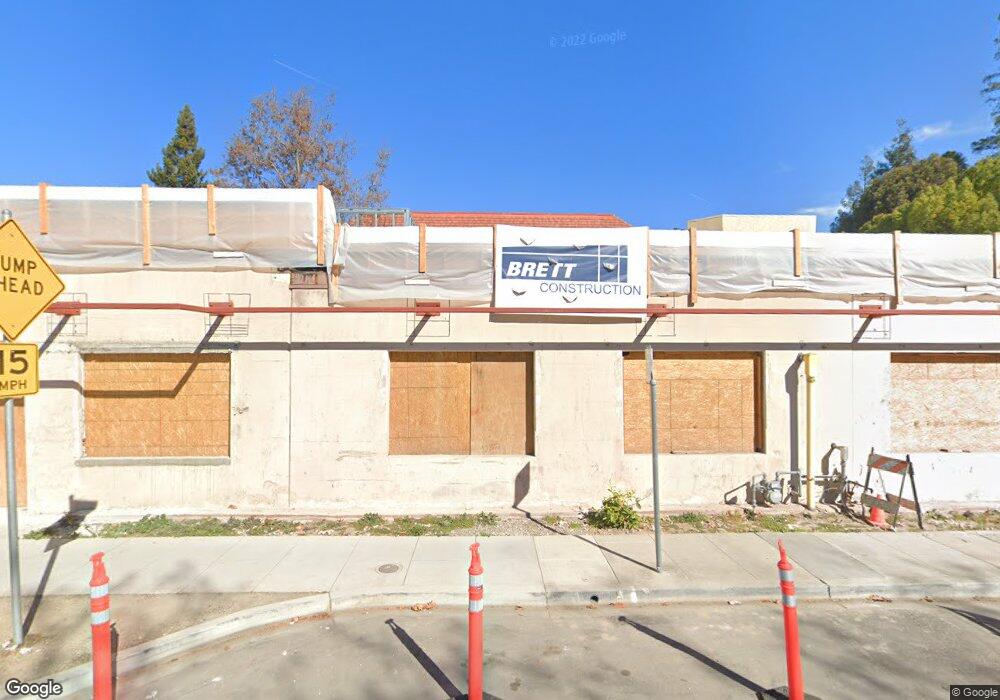

2581 Park Blvd Unit Y203 Palo Alto, CA 94306

Old Palo Alto NeighborhoodEstimated Value: $1,120,000 - $1,782,000

2

Beds

3

Baths

1,260

Sq Ft

$1,034/Sq Ft

Est. Value

About This Home

This home is located at 2581 Park Blvd Unit Y203, Palo Alto, CA 94306 and is currently estimated at $1,303,055, approximately $1,034 per square foot. 2581 Park Blvd Unit Y203 is a home located in Santa Clara County with nearby schools including Escondido Elementary School, Frank S. Greene Jr. Middle, and Palo Alto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 1999

Sold by

Westbrook Gregg A and Westbrook Mary H

Bought by

Thomas Gareth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,250

Outstanding Balance

$81,296

Interest Rate

7.05%

Mortgage Type

Stand Alone First

Estimated Equity

$1,221,759

Purchase Details

Closed on

Nov 29, 1994

Sold by

Summerhill Palo Alto Ii Inc

Bought by

Westbrook Gregg Anthony and Westbrook Mary Ellen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,150

Interest Rate

8.92%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thomas Gareth | $411,000 | North American Title Co | |

| Westbrook Gregg Anthony | $256,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thomas Gareth | $308,250 | |

| Previous Owner | Westbrook Gregg Anthony | $203,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,405 | $642,734 | $321,367 | $321,367 |

| 2024 | $7,405 | $630,132 | $315,066 | $315,066 |

| 2023 | $8,166 | $617,778 | $308,889 | $308,889 |

| 2022 | $8,064 | $605,666 | $302,833 | $302,833 |

| 2021 | $7,904 | $593,792 | $296,896 | $296,896 |

| 2020 | $7,754 | $587,704 | $293,852 | $293,852 |

| 2019 | $7,662 | $576,182 | $288,091 | $288,091 |

| 2018 | $7,467 | $564,886 | $282,443 | $282,443 |

| 2017 | $7,334 | $553,810 | $276,905 | $276,905 |

| 2016 | $7,136 | $542,952 | $271,476 | $271,476 |

| 2015 | $7,060 | $534,798 | $267,399 | $267,399 |

| 2014 | $6,840 | $524,324 | $262,162 | $262,162 |

Source: Public Records

Map

Nearby Homes

- 2573 Park Blvd Unit U204

- 200 Sheridan Ave Unit 304

- 200 Sheridan Ave Unit 303

- 200 Sheridan Ave Unit 103

- 200 Sheridan Ave Unit 307

- 151 Colorado Ave

- 410 Sheridan Ave Unit 446

- 2399 South Ct

- 5 Plan at Acacia

- 4X Plan at Acacia

- 4 Plan at Acacia

- 3 Plan at Acacia

- 2A Plan at Acacia

- 2 Plan at Acacia

- 1 Plan at Acacia

- 1932 Emerson St

- 184 Tennyson Ave

- 360 Fernando Ave

- 125 Lowell Ave

- 444 Tennyson Ave

- 2581 Park Blvd Unit Y211

- 2581 Park Blvd Unit Y209

- 2581 Park Blvd Unit Y207

- 2581 Park Blvd Unit Y205

- 2581 Park Blvd Unit Y201

- 2581 Park Blvd Unit Y103

- 2581 Park Blvd Unit Y101

- 2579 Park Blvd Unit X204

- 2579 Park Blvd Unit X202

- 2579 Park Blvd Unit X200

- 2579 Park Blvd Unit X102

- 2579 Park Blvd Unit X100

- 2585 Park Blvd Unit Z102

- 2585 Park Blvd Unit Z218

- 2585 Park Blvd Unit Z216

- 2585 Park Blvd Unit Z214

- 2585 Park Blvd Unit Z212

- 2585 Park Blvd Unit Z210

- 2585 Park Blvd Unit Z208

- 2585 Park Blvd Unit Z204