26 Chatham Manhattan Beach, CA 90266

Estimated Value: $3,076,000 - $3,763,949

3

Beds

3

Baths

2,729

Sq Ft

$1,240/Sq Ft

Est. Value

About This Home

This home is located at 26 Chatham, Manhattan Beach, CA 90266 and is currently estimated at $3,382,737, approximately $1,239 per square foot. 26 Chatham is a home located in Los Angeles County with nearby schools including Meadows Avenue Elementary School, Manhattan Beach Middle School, and Mira Costa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 16, 2007

Sold by

Lewis Ruth Lilian and The Morton & Ruth Lewis Living

Bought by

Chun David H and Chun Helen Y

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,466,500

Outstanding Balance

$850,169

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$2,532,568

Purchase Details

Closed on

May 11, 2000

Sold by

Gutzman Steven

Bought by

Lewis Morton and Lewis Ruth Lillian

Purchase Details

Closed on

Aug 15, 1996

Sold by

Morgan David F and The David F Morgan Trust

Bought by

Gutzman Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$526,000

Interest Rate

7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chun David H | $2,095,000 | Southland Title | |

| Lewis Morton | $940,000 | North American Title | |

| Gutzman Steven | $721,000 | Southland Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chun David H | $1,466,500 | |

| Previous Owner | Gutzman Steven | $526,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $32,851 | $2,924,386 | $2,143,659 | $780,727 |

| 2024 | $32,851 | $2,867,046 | $2,101,627 | $765,419 |

| 2023 | $31,119 | $2,742,333 | $2,060,419 | $681,914 |

| 2022 | $30,580 | $2,688,563 | $2,020,019 | $668,544 |

| 2021 | $30,013 | $2,635,847 | $1,980,411 | $655,436 |

| 2019 | $29,205 | $2,557,669 | $1,921,672 | $635,997 |

| 2018 | $28,412 | $2,493,240 | $1,883,993 | $609,247 |

| 2016 | $23,231 | $2,100,000 | $1,603,800 | $496,200 |

| 2015 | $23,088 | $2,100,000 | $1,603,800 | $496,200 |

| 2014 | $17,978 | $1,621,000 | $1,238,000 | $383,000 |

Source: Public Records

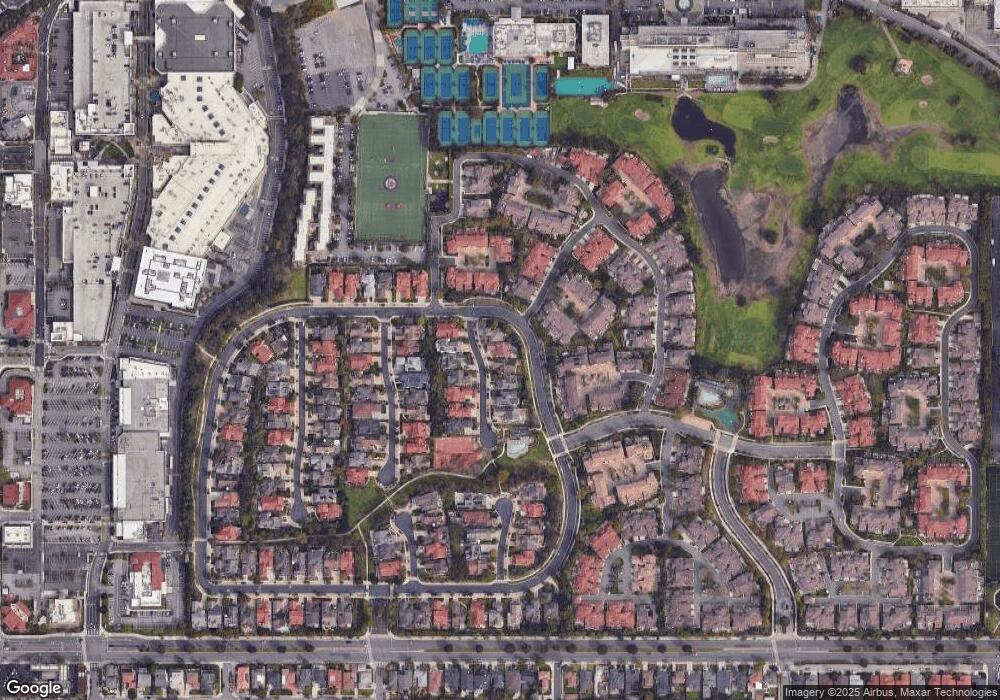

Map

Nearby Homes

- 28 Westport

- 11 Malaga Place W

- 18 Malaga Place E

- 2508 Pine Ave

- 1400 17th St

- 1612 Magnolia Ave

- 966 Rosecrans Ave

- 1728 Oak Ave

- 2917 N Poinsettia Ave

- 2921 N Poinsettia Ave

- 908 Rosecrans Ave

- 2100 Palm Ave

- 3508 Maple Ave

- 1450 Manhattan Beach Blvd

- 5512 W 149th Place

- 1431 10th St

- 947 Manhattan Beach

- 2623 Laurel Ave

- 1525 10th St

- 3604 Laurel Ave