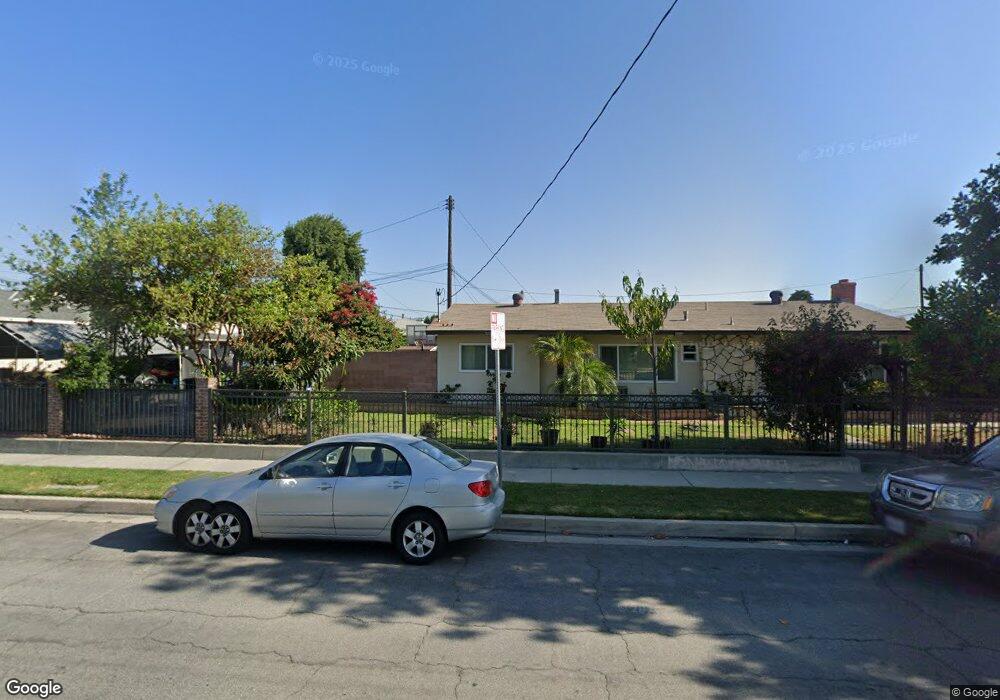

2615 Muscatel Ave Unit G Rosemead, CA 91770

Estimated Value: $1,397,000 - $1,553,000

8

Beds

4

Baths

3,824

Sq Ft

$388/Sq Ft

Est. Value

About This Home

This home is located at 2615 Muscatel Ave Unit G, Rosemead, CA 91770 and is currently estimated at $1,482,333, approximately $387 per square foot. 2615 Muscatel Ave Unit G is a home located in Los Angeles County with nearby schools including Sanchez (George I.) Elementary School, Temple (Roger W.) Intermediate School, and San Gabriel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2003

Sold by

Pasutharachati Sakorn and Lu Cheng Tong

Bought by

Tribeca Investment Co

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$800,000

Outstanding Balance

$338,069

Interest Rate

5.18%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,144,264

Purchase Details

Closed on

Apr 6, 2000

Sold by

Sun Peter C K and Sun Dorothy J

Bought by

Sun Peter C K and Sun Dorothy J

Purchase Details

Closed on

Feb 29, 2000

Sold by

Liu Lu Cheng Tong and Liu Lu Yu Chu

Bought by

Liu Lu Cheng Tong and Liu Lu Yu Chu

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tribeca Investment Co | -- | First American Title Co | |

| Sun Peter C K | -- | -- | |

| Sun Peter C K | -- | -- | |

| Liu Lu Cheng Tong | -- | -- | |

| Liu Lu Cheng Tong | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tribeca Investment Co | $800,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,717 | $619,880 | $278,661 | $341,219 |

| 2024 | $8,717 | $607,727 | $273,198 | $334,529 |

| 2023 | $8,419 | $595,812 | $267,842 | $327,970 |

| 2022 | $8,051 | $584,131 | $262,591 | $321,540 |

| 2021 | $8,002 | $572,679 | $257,443 | $315,236 |

| 2020 | $7,931 | $566,808 | $254,804 | $312,004 |

| 2019 | $7,723 | $555,695 | $249,808 | $305,887 |

| 2018 | $7,284 | $544,800 | $244,910 | $299,890 |

| 2016 | $6,674 | $523,646 | $235,400 | $288,246 |

| 2015 | $6,567 | $515,782 | $231,865 | $283,917 |

| 2014 | $6,501 | $505,680 | $227,324 | $278,356 |

Source: Public Records

Map

Nearby Homes

- 7229 7229 1/2 Tegner Dr

- 0 Leach Canyon Rd Unit DW25215715

- 1908 & 1910 Bailey Ave

- 9044 Garvey Ave Unit 21

- 3047 Sullivan Ave

- 8408 Garvey Ave

- 3242 Heglis Ave

- 2600 Charlotte Ave

- 2751 Charlotte Ave

- 2561 Troy Ave

- 3107 N San Gabriel Blvd

- Plan 2303 at Starlite - The Front Row at Astaire

- Plan 2090 at Starlite - The Front Row at Astaire

- Plan 1931 at Starlite - Harlow

- Plan 1781 Modeled at Starlite - Harlow

- Plan 1348 at Starlite - Harlow

- Plan 2026 Modeled at Starlite - Astaire

- Plan 1923 Modeled at Starlite - Astaire

- Plan 2088 Modeled at Starlite - Astaire

- 3107 San Gabriel Blvd Unit 6

- 2611 Muscatel Ave

- 2617 Muscatel Ave

- 2623 Muscatel Ave

- 8723 Fern Ave

- 8717 Fern Ave

- 2627 Muscatel Ave

- 2627 Muscatel Ave

- 2614 Bartlett Ave

- 8733 Fern Ave

- 2608 Bartlett Ave

- 2620 Bartlett Ave

- 2602 Bartlett Ave

- 2613 Muscatel Ave

- 2626 Bartlett Ave

- 2619 Muscatel Ave

- 2609 Muscatel Ave

- 2625 Muscatel Ave

- 2583 Dubonnet Ave

- 2630 Bartlett Ave

- 2558 Bartlett Ave