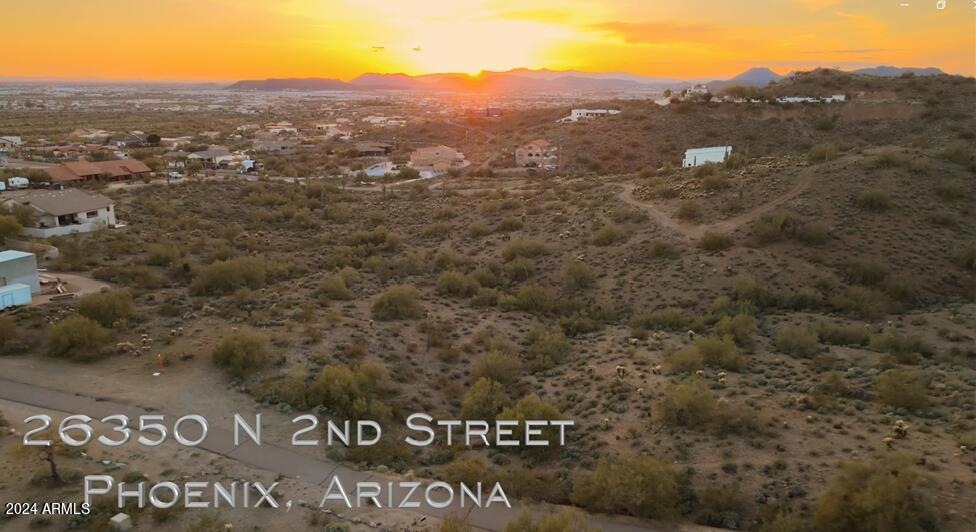

26350 N 2nd St Unit 1.13 Acres Phoenix, AZ 85085

Happy Valley NeighborhoodEstimated payment $1,978/month

Total Views

10,657

1.13

Acres

$309,735

Price per Acre

49,223

Sq Ft Lot

Highlights

- Horses Allowed On Property

- 1.13 Acre Lot

- No HOA

About This Lot

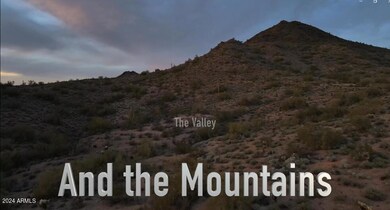

Less than 100 yards from the Phoenix Sonoran Mountain Preserve . . . Romantic Sunsets . . . Panoramic City Lights . . . Breathtaking Mountain Views . . . Custom Homesite on 1.13 acres in the heart of North Phoenix . . . Quiet and Secluded . . . Yet mere minutes from all amenities, the 101 and I17. No HOA. Easy Build.

Property Details

Property Type

- Land

Est. Annual Taxes

- $728

Additional Features

- 1.13 Acre Lot

- Horses Allowed On Property

Community Details

- No Home Owners Association

- Views! Less Than 100 Yards From Phoenix Sonoran Mountain Preserve. No Hoa. Subdivision

Listing and Financial Details

- Tax Lot 1.13 Acres

- Assessor Parcel Number 210-14-004-E

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $735 | $9,030 | $9,030 | -- |

| 2024 | $728 | $8,600 | $8,600 | -- |

| 2023 | $728 | $19,485 | $19,485 | $0 |

| 2022 | $705 | $15,795 | $15,795 | $0 |

| 2021 | $735 | $13,800 | $13,800 | $0 |

| 2020 | $726 | $13,050 | $13,050 | $0 |

| 2019 | $708 | $12,135 | $12,135 | $0 |

| 2018 | $688 | $11,175 | $11,175 | $0 |

| 2017 | $666 | $12,090 | $12,090 | $0 |

| 2016 | $631 | $10,965 | $10,965 | $0 |

| 2015 | $616 | $11,936 | $11,936 | $0 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 07/14/2025 07/14/25 | Price Changed | $350,000 | +16.7% | -- |

| 01/08/2025 01/08/25 | Price Changed | $299,900 | -24.6% | -- |

| 08/16/2024 08/16/24 | For Sale | $397,777 | -- | -- |

Source: Arizona Regional Multiple Listing Service (ARMLS)

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $169,000 | Security Title Agency | |

| Cash Sale Deed | $100,000 | Pioneer Title Agency Inc | |

| Trustee Deed | $83,000 | None Available | |

| Warranty Deed | $350,000 | Grand Canyon Title Agency In |

Source: Public Records

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $60,000 | Unknown | |

| Previous Owner | $297,500 | New Conventional |

Source: Public Records

Source: Arizona Regional Multiple Listing Service (ARMLS)

MLS Number: 6744607

APN: 210-14-004E

Nearby Homes

- 15 E Briles Rd

- 301 E Jomax Rd

- 12 E Quartz Rock Rd

- 33506 N 5th St

- 300 W Quartz Rock Rd

- 26112 N 7th Ave

- 101 W Briles Rd

- 1322 W Spur Dr

- 1535 W Quail Track Dr

- 27721 N 15th Dr

- 1653 W Straight Arrow Ln

- 1806 W Fetlock Trail

- 1732 W Gambit Trail

- 1909 W Lariat Ln

- 25919 N 19th Dr

- 1860 W Buckhorn Trail

- 1864 W Buckhorn Trail

- 1854 W Fetlock Trail

- 1948 W Rowel Rd

- 25909 N 19th Ln

- 227 W Jomax Rd

- 412 E Yearling Rd

- 26712 N 14th Ln

- 1634 W Red Bird Rd

- 1722 W Straight Arrow Ln

- 1717 W Happy Valley Rd

- 27617 N 18th Dr

- 1928 W Spur Dr

- 25255 N 19th Ave

- 2009 W Trotter Trail

- 1977 W Kinfield Trail

- 26417 N 22nd Dr

- 28000 N North Valley Pkwy

- 25400 N 21st Ave

- 2310 W Spur Dr

- 2205 W Gambit Trail

- 25300 N 22nd Ln

- 26711 N 24th Ave

- 27623 N 23rd Dr

- 2434 W Rowel Rd