2690 Raven Cir Corona, CA 92882

South Corona NeighborhoodEstimated Value: $773,000 - $930,000

4

Beds

3

Baths

2,363

Sq Ft

$357/Sq Ft

Est. Value

About This Home

This home is located at 2690 Raven Cir, Corona, CA 92882 and is currently estimated at $842,825, approximately $356 per square foot. 2690 Raven Cir is a home located in Riverside County with nearby schools including John Adams Elementary School, Letha Raney Intermediate School, and Corona High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 19, 1994

Sold by

Pmi Mtg Insurance Company

Bought by

Scott Gregg A and Scott Kathleen T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,600

Interest Rate

8.56%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 27, 1994

Sold by

City Svgs Fsb

Bought by

Pmi Mtg Insurance Company

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,600

Interest Rate

8.56%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 15, 1993

Sold by

Cal Western Reconveyance Corp

Bought by

City Svgs Fsb

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scott Gregg A | $160,000 | Chicago Title Company | |

| Pmi Mtg Insurance Company | $192,000 | Chicago Title Company | |

| City Svgs Fsb | $150,300 | Gateway Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Scott Gregg A | $143,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,571 | $271,230 | $93,461 | $177,769 |

| 2023 | $3,571 | $260,700 | $89,833 | $170,867 |

| 2022 | $3,475 | $255,589 | $88,072 | $167,517 |

| 2021 | $3,418 | $250,579 | $86,346 | $164,233 |

| 2020 | $3,387 | $248,010 | $85,461 | $162,549 |

| 2019 | $3,322 | $243,148 | $83,786 | $159,362 |

| 2018 | $3,249 | $238,382 | $82,145 | $156,237 |

| 2017 | $3,172 | $233,709 | $80,535 | $153,174 |

| 2016 | $3,134 | $229,127 | $78,956 | $150,171 |

| 2015 | $3,068 | $225,687 | $77,771 | $147,916 |

| 2014 | $2,970 | $221,268 | $76,249 | $145,019 |

Source: Public Records

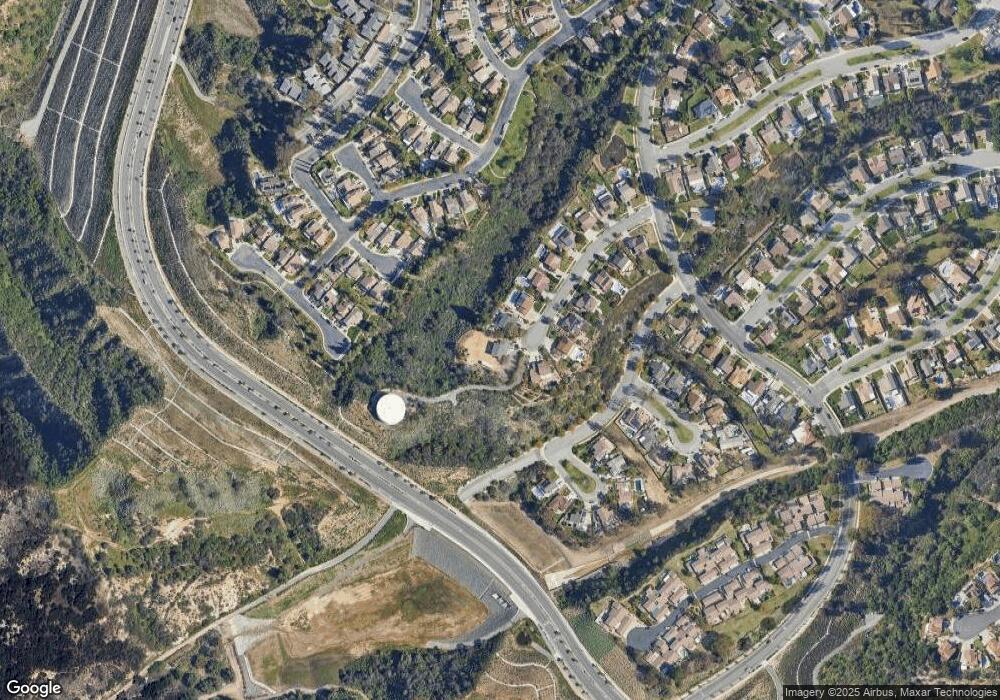

Map

Nearby Homes

- 2648 Condor Cir

- 2672 Condor Cir

- 2600 Avenida Del Vista Unit F203

- 1720 Sugar Pine Dr

- 2548 Avenida Del Vista Unit 103

- 2568 Avenida Del Vista Unit 201

- 2564 Independence Way

- 1925 Adobe Ave

- 1455 Deer Hollow Dr

- 1764 Coplen Cir

- 2400 Mabey Canyon Rd

- 2425 Centennial Way

- 1372 Old Trail Dr

- 2350 Centennial Way

- 3090 Mangular Ave

- 1336 Old Trail Dr

- 1552 Tilson Cir

- 2493 Sierra Bella Dr

- 1486 Baird St

- 2575 Sierra Bella Dr

- 2678 Raven Cir

- 2666 Raven Cir

- 2683 Raven Cir

- 2671 Raven Cir

- 2654 Raven Cir

- 2659 Raven Cir

- 2647 Raven Cir

- 2642 Raven Cir

- 1701 Vixen Trail Cir

- 1700 Vixen Trail Cir

- 2635 Raven Cir

- 2630 Raven Cir

- 2641 Misty Mountain Dr

- 2631 Misty Mountain Dr

- 1701 Chisholm Trail Cir

- 1711 Vixen Trail Cir

- 2621 Misty Mountain Dr

- 2613 Falcon Cir

- 2623 Raven Cir

- 2612 Falcon Cir