27 Raven Rd Saint Paul, MN 55127

Estimated Value: $1,227,000 - $1,358,000

6

Beds

5

Baths

2,692

Sq Ft

$481/Sq Ft

Est. Value

About This Home

This home is located at 27 Raven Rd, Saint Paul, MN 55127 and is currently estimated at $1,294,212, approximately $480 per square foot. 27 Raven Rd is a home located in Ramsey County with nearby schools including Turtle Lake Elementary School, Chippewa Middle School, and Mounds View Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2023

Sold by

Dean A Klein Trustee Of The Barbara K K

Bought by

Cossack Matthew and Cossack Sarah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$800,000

Outstanding Balance

$777,470

Interest Rate

6.32%

Mortgage Type

New Conventional

Estimated Equity

$516,742

Purchase Details

Closed on

Sep 23, 2016

Sold by

Klein Dean A and Klein Barbara K

Bought by

Klein Barbara K and Klein Dean A

Purchase Details

Closed on

Nov 17, 1997

Sold by

North Oaks Company Llc

Bought by

Klein Dean A and Klein Barbara K

Purchase Details

Closed on

Jun 10, 1996

Sold by

North Oaks Company Inc

Bought by

Klein Dean A and Klein Barbara K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cossack Matthew | $1,100,000 | -- | |

| Klein Barbara K | -- | Attorney | |

| Klein Dean A | $120,500 | -- | |

| Klein Dean A | $120,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cossack Matthew | $800,000 | |

| Closed | Klein Dean A | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,414 | $1,246,000 | $250,000 | $996,000 |

| 2023 | $13,414 | $1,126,900 | $250,000 | $876,900 |

| 2022 | $10,848 | $950,900 | $210,000 | $740,900 |

| 2021 | $10,874 | $837,600 | $210,000 | $627,600 |

| 2020 | $11,008 | $858,500 | $170,800 | $687,700 |

| 2019 | $10,154 | $808,100 | $170,800 | $637,300 |

| 2018 | $10,204 | $800,300 | $170,800 | $629,500 |

| 2017 | $10,982 | $782,900 | $170,800 | $612,100 |

| 2016 | $11,072 | $0 | $0 | $0 |

| 2015 | $11,146 | $815,100 | $146,600 | $668,500 |

| 2014 | $11,822 | $0 | $0 | $0 |

Source: Public Records

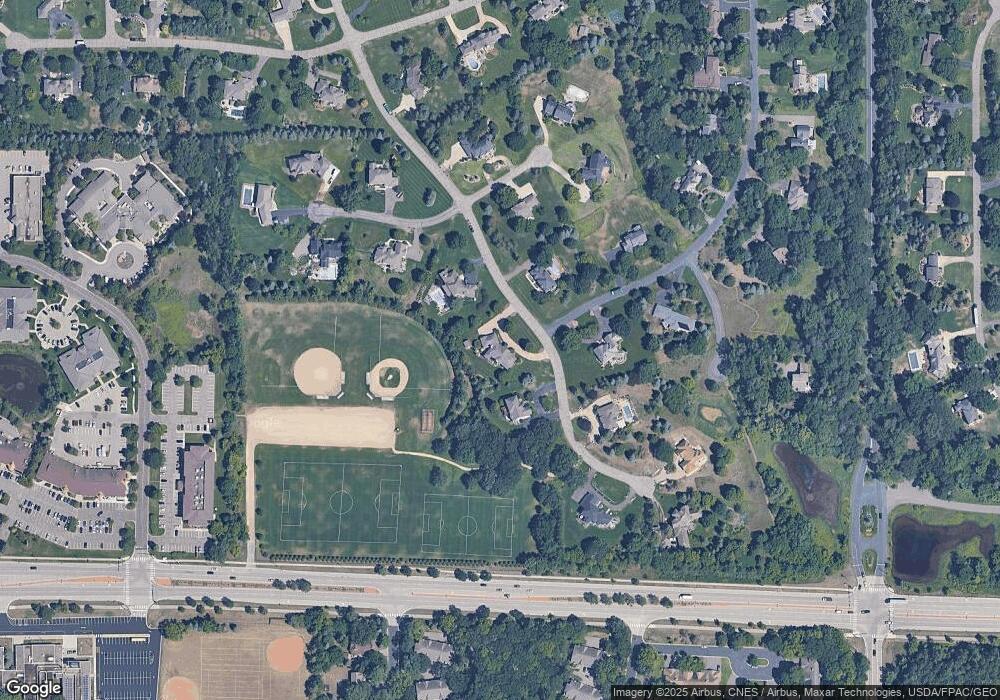

Map

Nearby Homes

- 217 Galtier Place

- 505 Chandler Ct

- 495 Harbor Ct

- 475 Tanglewood Dr

- 3 Hill Farm Cir

- 599 Harbor Ct

- 550 Harbor Ct

- 592 Harbor Ct

- 4715 Chandler Rd

- 276 Dawn Ave

- 23 Evergreen Rd

- 640 Highway 96 W

- 4706 Lorinda Dr

- 4825 Hodgson Connection

- 283 Timberline Trail

- 4151 Rice St

- 171 Red Oaks Dr

- 4268 Reiland Ln

- 4839 Larson Rd

- 240 Cottonwood Dr