27005 Fortrose Unit 154 Mission Viejo, CA 92691

Estimated Value: $825,570 - $1,132,000

3

Beds

2

Baths

1,464

Sq Ft

$636/Sq Ft

Est. Value

About This Home

This home is located at 27005 Fortrose Unit 154, Mission Viejo, CA 92691 and is currently estimated at $930,393, approximately $635 per square foot. 27005 Fortrose Unit 154 is a home located in Orange County with nearby schools including Viejo Elementary School, Newhart Middle School, and Capistrano Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2020

Sold by

Hayden Kim A

Bought by

Hayden Kim A and The Tiajute Family Living Trus

Current Estimated Value

Purchase Details

Closed on

Oct 17, 2006

Sold by

Hayden Kim A

Bought by

Hayden Kim A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,000

Outstanding Balance

$219,931

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$710,462

Purchase Details

Closed on

Nov 1, 1999

Sold by

Donald Wile and Donald Pamela B

Bought by

Hayden Kim A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Interest Rate

6%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hayden Kim A | -- | None Available | |

| Hayden Kim A | -- | Ticor Title Company Of Ca | |

| Hayden Kim A | $200,000 | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hayden Kim A | $370,000 | |

| Previous Owner | Hayden Kim A | $170,000 | |

| Closed | Hayden Kim A | $20,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,993 | $307,387 | $141,070 | $166,317 |

| 2024 | $2,993 | $301,360 | $138,304 | $163,056 |

| 2023 | $2,929 | $295,451 | $135,592 | $159,859 |

| 2022 | $2,872 | $289,658 | $132,933 | $156,725 |

| 2021 | $2,815 | $283,979 | $130,327 | $153,652 |

| 2020 | $2,786 | $281,068 | $128,991 | $152,077 |

| 2019 | $2,730 | $275,557 | $126,461 | $149,096 |

| 2018 | $2,677 | $270,154 | $123,981 | $146,173 |

| 2017 | $2,623 | $264,857 | $121,550 | $143,307 |

| 2016 | $2,572 | $259,664 | $119,166 | $140,498 |

| 2015 | $2,532 | $255,764 | $117,376 | $138,388 |

| 2014 | $2,482 | $250,754 | $115,076 | $135,678 |

Source: Public Records

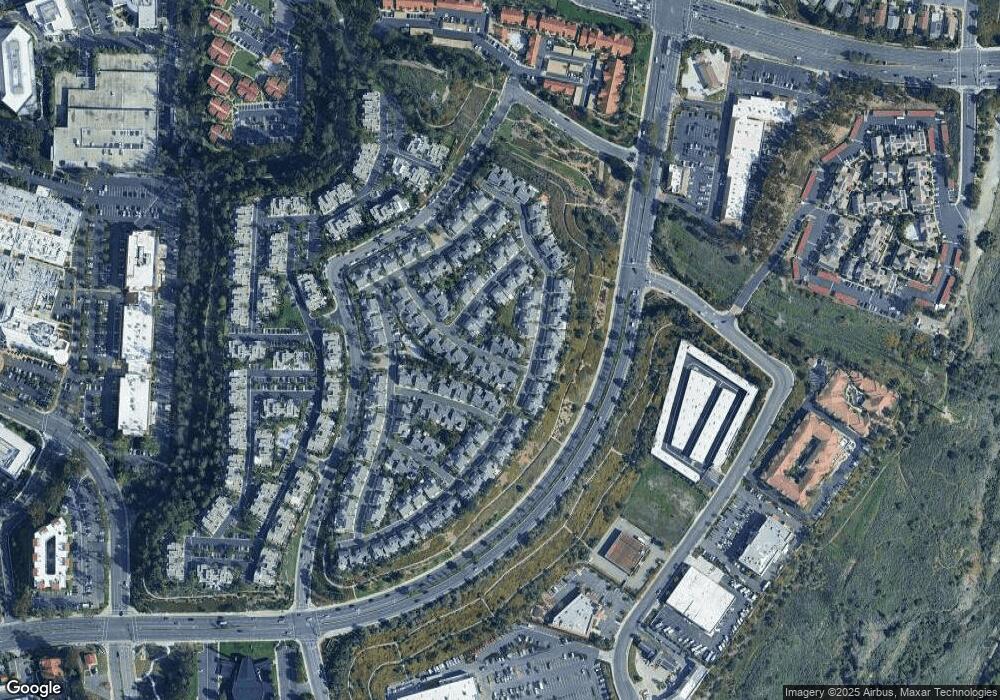

Map

Nearby Homes

- 26982 Stonehaven Unit 77

- 26914 Jasper Unit 254

- 27756 Emerald Unit 2

- 27854 Emerald

- 26848 Alexandrite

- 27657 Aquamarine Unit 157

- 26972 Venado Dr

- 27075 La Fuente

- 66 Garrison Loop

- 25 Garrison Loop

- 26516 El Mar Dr

- 26856 La Sierra Dr

- 42 Livingston Place

- 10 Martino

- 26848 Park Terrace Ln Unit 130

- 5176 Solance Dr

- 18811 Volta Rd

- 5192 Solance Dr

- 5169 Solance Dr

- 26732 Trasmiras

- 27011 Fortrose Unit 155

- 27011 Fortrose

- 27015 Fortrose Unit 156

- 26966 Fortrose

- 26976 Fortrose Unit 175

- 26976 Fortrose

- 26972 Fortrose

- 26955 Fortrose

- 27716 Argyll Unit 118

- 27001 Fortrose Unit 153

- 27012 Fortrose

- 27712 Argyll Unit 117

- 26951 Fortrose

- 26952 Fortrose

- 27706 Argyll Unit 116

- 26945 Fortrose Unit 187

- 26946 Fortrose Unit 181

- 26942 Fortrose

- 26941 Fortrose

- 27702 Argyll Unit 115